Exactly 24 years ago, on July 28, 2000, Vietnam’s stock market held its first trading session with two stock codes, REE of REE Corporation and SAM of SAM Holdings. This historic event marked a turning point, ushering in a new era for the development of Vietnam’s economy in general and its stock market in particular.

In fact, Vietnam’s stock market had taken its first tentative steps four years earlier with the establishment of the State Securities Commission of Vietnam on November 28, 1996. The Ho Chi Minh City Securities Trading Center, the predecessor of the Ho Chi Minh Stock Exchange (HoSE), was founded in 1998 and officially inaugurated on July 20, 2000.

Over nearly three decades, Vietnam’s stock market has grown exponentially from its infancy. With a wave of enterprises listing and trading their shares on the stock exchange, the market has expanded from the initial two stock codes to 729 stock codes and fund certificates listed on HoSE and HNX, along with 878 stocks registered for trading on UPCoM as of now.

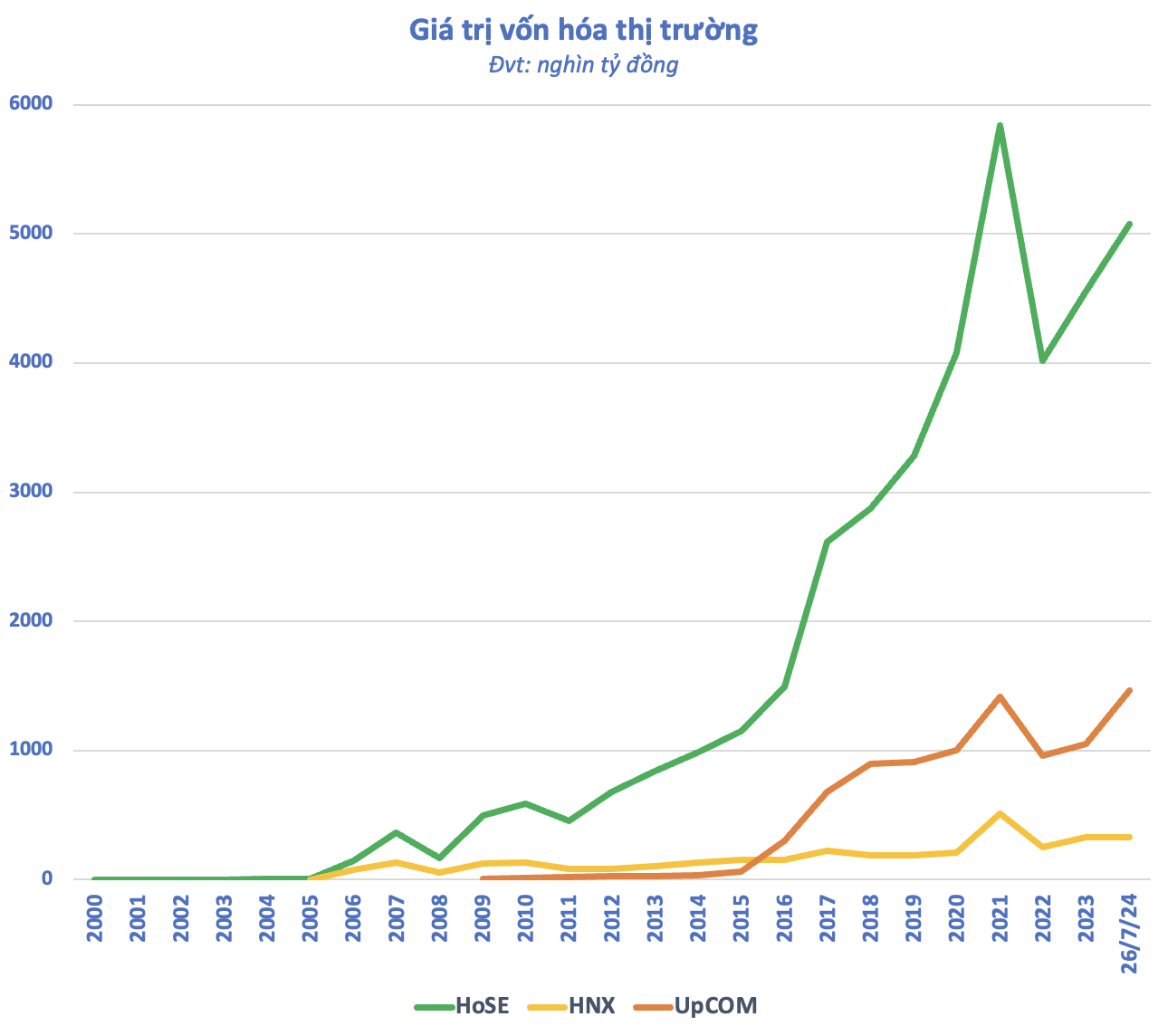

At present, the total value of listed and registered stocks for trading is approximately VND 2,280 quadrillion, equivalent to 22% of GDP in 2023. The total market capitalization of enterprises on the three exchanges, HoSE, HNX, and UPCoM, amounts to VND 6,900 quadrillion (USD 270 billion), a 16% increase since the beginning of 2024 and equivalent to 67% of GDP in 2023. Among these enterprises, there are 49 billion-dollar companies, along with hundreds of names with a capitalization of over VND 10 trillion.

However, the journey has not been without its challenges. Vietnam’s stock market has gone through many ups and downs since its inception 24 years ago. Starting from the baseline of 100 points, the VN-Index experienced periods of dramatic increases (2005-2007) but also witnessed sharp declines, especially in its early years when the market was still nascent and the operating mechanisms were not yet fully developed.

Following the global financial crisis of 2008-2009, Vietnam’s stock market became more stable. The VN-Index climbed steadily and, for the first time in over a decade, returned to the 1,200-point peak in early 2018. Subsequently, the market experienced a significant downturn before being hit by the Covid-19 shock, plunging to a long-term low in March 2020.

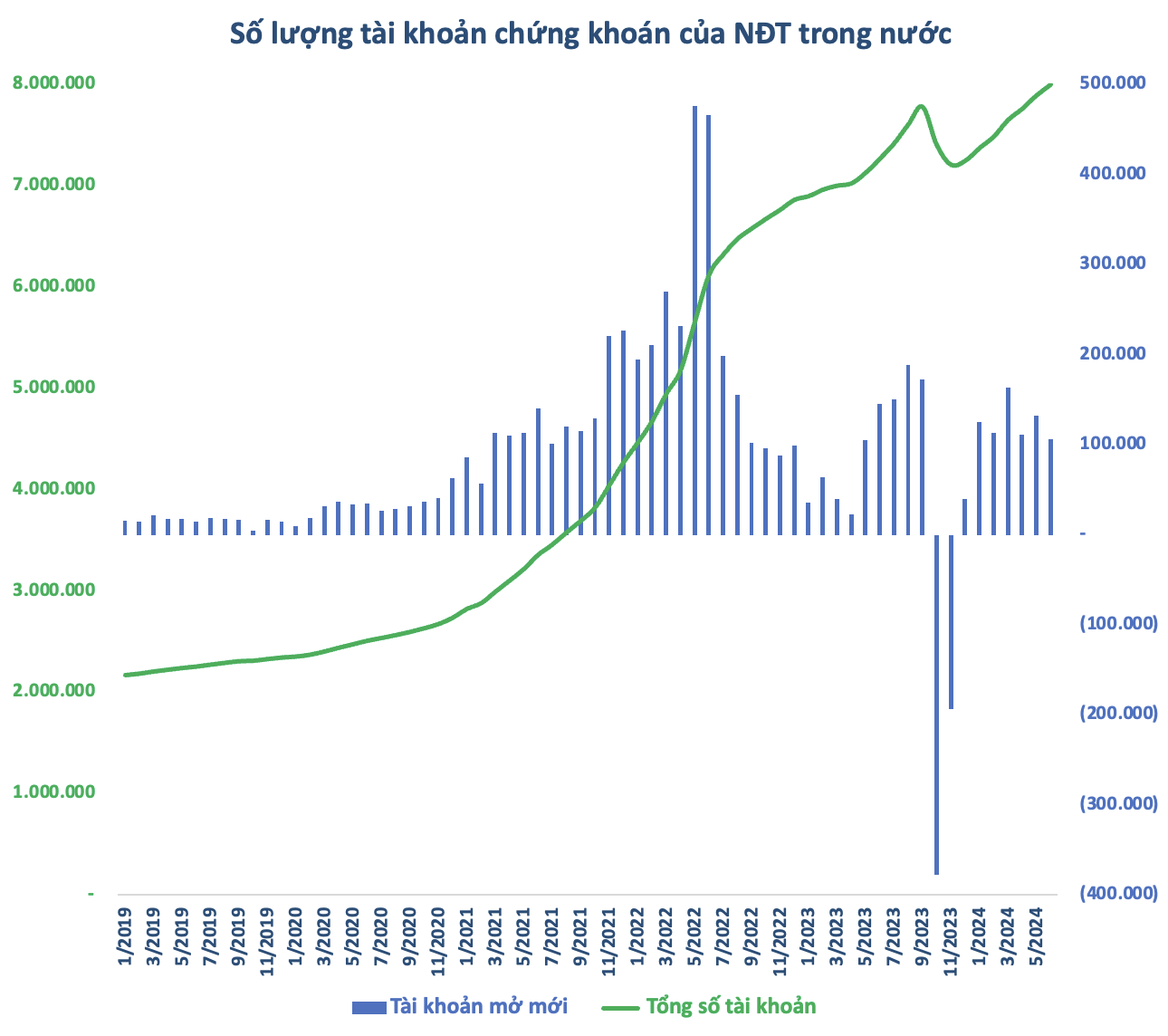

From there, a new chapter began for Vietnam’s stock market with a wave of new investors joining en masse amid an era of cheap money due to the loose monetary policy implemented to support the economy. Domestic investors continuously poured money into the market, driving liquidity to unprecedented levels, with trading volume surpassing USD 2 billion in a single session at its peak. This influx of cash propelled the VN-Index to break through milestones never seen before, crossing the 1,300, 1,400, and even reaching the 1,500 mark in late 2021 and early 2022.

After the period of overheating in both the stock and bond markets, the tightening measures implemented by the regulatory authorities brought Vietnam’s stock market back on a path of stable and sustainable growth. Trading activities remain vibrant, and while liquidity is no longer at its peak, it still surpasses pre-Covid levels.

The achievements of Vietnam’s stock market today are underpinned by several important milestones. One notable example is the increase in the number of trading sessions from three to five days a week starting in 2002, which created a consistent and regular market rhythm, contributing to the growing popularity of stocks among the public.

A year later, in 2003, the foreign ownership limit in listed companies was raised from 20% to 30% and subsequently increased to 49% in 2005. This crucial decision helped the stock market capture the wave of foreign investment as Vietnam officially joined the World Trade Organization (WTO) in 2007.

Also, in 2005, the Hanoi Securities Trading Center (the predecessor of HNX), operating as an over-the-counter (OTC) market, was established to organize a secondary market for unlisted securities through a matching mechanism. Additionally, the Vietnam Securities Depository (VSD) was founded in 2006.

In 2007, the continuous matching method was introduced, providing a significant boost to the market and attracting more investment capital. Subsequently, online trading and margin trading were successively implemented in 2009 and 2011. In 2012, the VN30 index was launched, and the MP market order was applied, with the trading session extended to the afternoon.

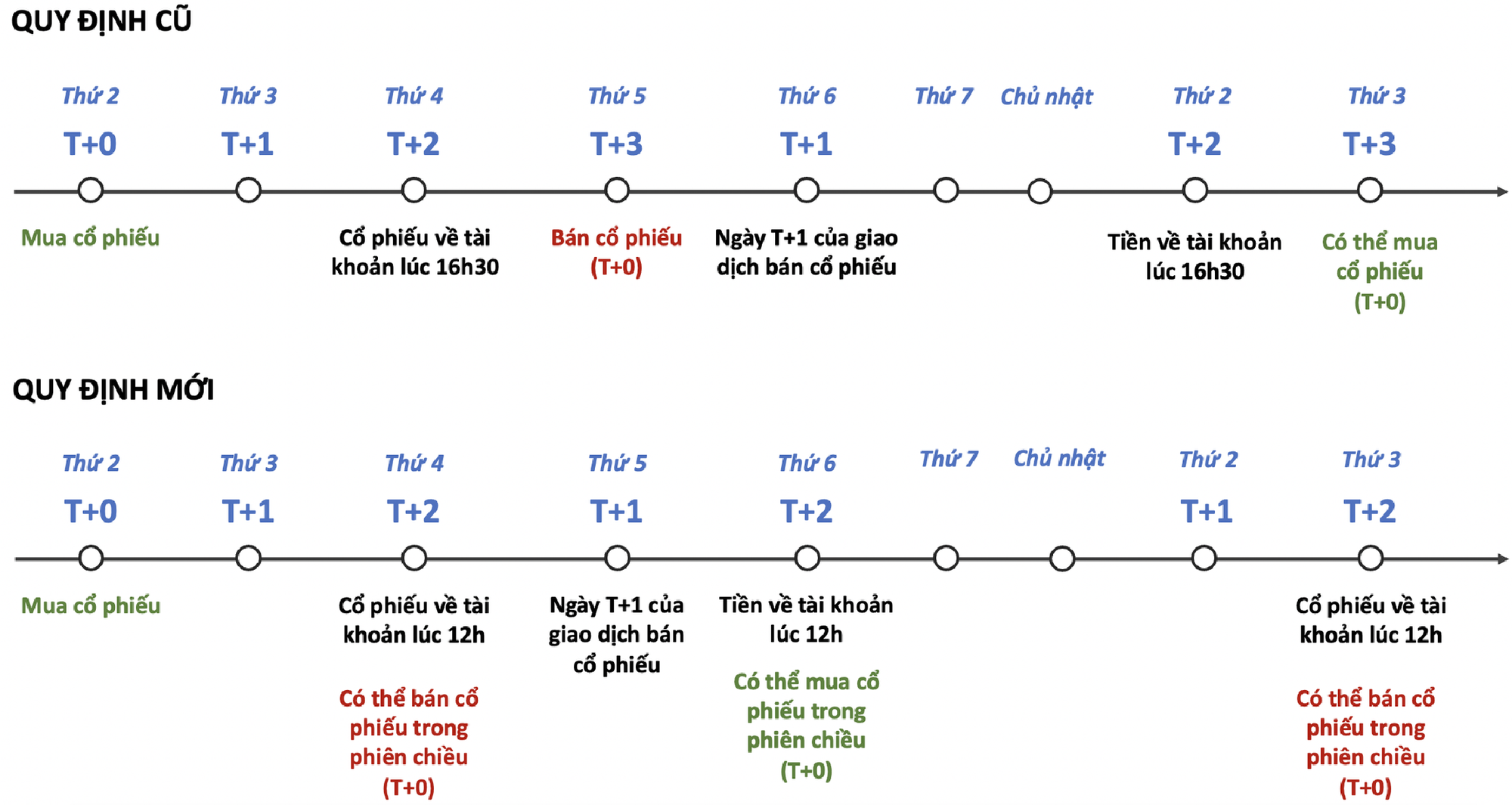

The following year, HoSE increased the daily trading band from 5% to 7%, as it remains today. In 2016, the T+2 settlement cycle was adopted. Six years later, in 2022, the trading cycle was further shortened from T+3 to T+1.5, enhancing flexibility in stock investing.

As the market evolved, investment products also became increasingly diversified. In 2003, Vietnam Fund Management (VFM) was established, marking the entry of the first professional domestic institutional investor and introducing a new form of collective investment in the market.

After two decades of development, the total assets under management (AUM) of investment funds in Vietnam soared to VND 639 trillion by the end of 2023. The number of investment funds also witnessed a significant jump to 107, encompassing diverse types such as bond funds, balanced funds, stock funds, ETF funds, and retirement funds.

In 2014, the first exchange-traded fund (ETF) certificate was listed and traded (E1VFVN30 – DCVFM VN30 ETF), marking a memorable milestone for the fund certificate market. Subsequently, various fund certificates such as DCVFM VNDiamond ETF (FUEVFVND), SSIAM VNFinLead ETF (FUESSVFL), and Kim Growth FinSelect ETF (FUEKIVFS) were also listed, providing investors with more options.

In 2017, the derivatives market was launched, further diversifying the investment portfolio and providing risk management tools, enhancing the investor base, particularly institutional investors, and boosting liquidity in the underlying stock market. The introduction of derivatives has been a game-changer for Vietnam’s stock market.

Two years later, in 2019, HoSE inaugurated the launch of covered warrants (CW), bringing a fresh breeze to investors with their flexible characteristics and mechanisms. In addition to offering investors the opportunity for two-way profits, CWs also help reduce the pressure on companies to increase foreign ownership limits to meet the investment demands of foreign investors.

A conducive development environment is underpinned by a robust legal framework. The enactment of the first Securities Law in 2006, which took effect on July 1, 2007, laid the foundation for the rapid and stable growth of the stock market, safeguarding the legitimate interests of investors, facilitating deep integration with international capital markets, and fulfilling Vietnam’s commitments in its journey of international economic integration.

The 2006 Securities Law established a relatively comprehensive and synchronized legal framework, comprehensively regulating the stock market to enhance the effectiveness of state management, ensure the transparent and public operations of listed companies, and contribute to the transparency of the economy. However, over time, certain shortcomings became evident, especially in the face of the market’s rapid development.

To address the limitations in the management, supervision, and governance processes and keep pace with the evolving stock market, the Securities Law was amended and supplemented in 2010. Most recently, the new Securities Law No. 62/2019/QH14 came into force on January 1, 2021, introducing breakthrough changes to replace the previous law.

Along with the Law, the system of legal documents at the decree and circular levels has also been amended and supplemented, contributing to the continuous improvement of the legal framework for securities and the stock market. Consequently, the stock market has increasingly become an essential channel for attracting long-term investment capital for the economy and enhancing social investment capital.

In terms of content, the Law focuses on amending fundamental issues such as raising the conditions for becoming a public company, clarifying the conditions for initial public offerings (IPOs) and additional public offerings, expanding certain definitions, and moving towards the Vietnam Stock Exchange, among other matters. These new provisions are expected to foster a healthy and transparent investment environment, providing incentives for market development and attracting more domestic and foreign investors.

As the stock market continues to evolve and mature, it attracts an increasing number of new investors. Beyond its role as a capital mobilization channel for the economy, stocks have transformed from a relatively obscure investment avenue to a prevalent choice for millions of investors, with 8 million securities accounts as of the end of June. Among these, individual investors hold more than 7.98 million accounts, equivalent to approximately 8% of Vietnam’s population.

According to the Strategy for Developing the Securities Market by 2030, Vietnam aims to reach 9 million securities trading accounts on the stock market by 2025 and 11 million accounts by 2030. The government emphasizes focusing on developing institutional investors, professional investors, and attracting the participation of foreign investors.

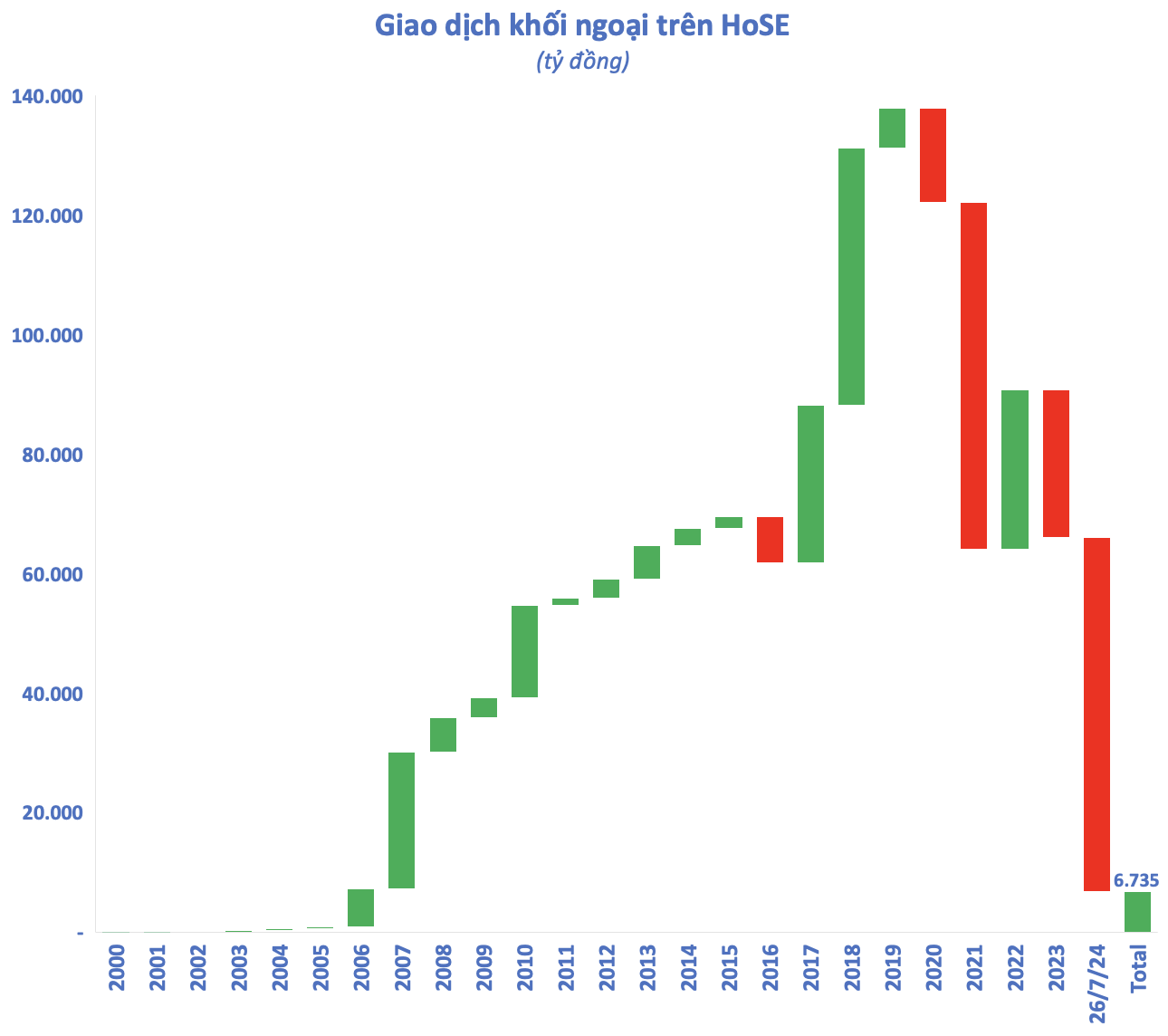

In reality, foreign capital once poured into Vietnam’s stock market but has reversed course in recent years, turning to net selling. Since the beginning of 2024, foreign investors have net sold nearly VND 60 trillion on HoSE, surpassing the record level of 2021. This figure has pushed the cumulative net buying value since the stock market’s inception in 2000 to approximately VND 6,700 billion.

To attract foreign capital back into the market, one crucial task is to fulfill the criteria for upgrading the market from frontier to emerging status. In the past, the government, regulatory agencies, and market members have made significant efforts to address critical bottlenecks, bringing Vietnam closer to achieving this upgrade.

BSC Securities Company forecasts that FTSE will conduct a review in September 2024, and there is a possibility that the Vietnamese stock market will be considered for an official upgrade this time. Regarding MSCI, the analytics department expects the Vietnamese stock market to be placed on the watchlist for potential reclassification in the near future, possibly in June 2025.

If the market is successfully upgraded, Vietnam will have the opportunity to attract a substantial amount of capital from investment funds that use the MSCI Emerging Market Index as a reference, and the market will be re-evaluated with a higher P/E ratio. According to estimates, the market capitalization of the MSCI Vietnam Investable Market Index (MSCI Vietnam IMI) stood at USD 32 billion as of May 31, 2024, while the MSCI Emerging IMI’s capitalization reached a substantial USD 7,239 billion.