Truong Thanh Wood, once dubbed the “Wood King,” was a leading exporter of wood products, but its poor business performance, coupled with stagnant stock prices, has left investors increasingly disappointed.

Truong Thanh Wood’s consolidated financial report for the second quarter of 2024 recorded a quarterly revenue of VND 372.94 billion, a slight decrease from the same period last year. However, after deducting expenses, the company incurred a net loss of VND 3.99 billion, compared to a net profit of over VND 11.5 billion in the previous quarter.

Truong Thanh Wood attributed the lower loss in the second quarter of 2024 compared to the same period last year (a loss of VND 41.58 billion) to their effective cost control measures and improved recovery of provisions for doubtful accounts receivable. Additionally, the company’s financial revenue increased due to favorable exchange rate differences.

Truong Thanh is a leading exporter of wood products

For the first six months of the year, Truong Thanh Wood achieved a revenue of VND 696 billion, with a net profit of over VND 7.5 billion, thanks to stable production and business operations and successful overcoming of previous challenges. This profit figure is a positive development compared to the loss of nearly VND 40 billion in the same period last year. However, TTF stock has continued to plummet in recent months.

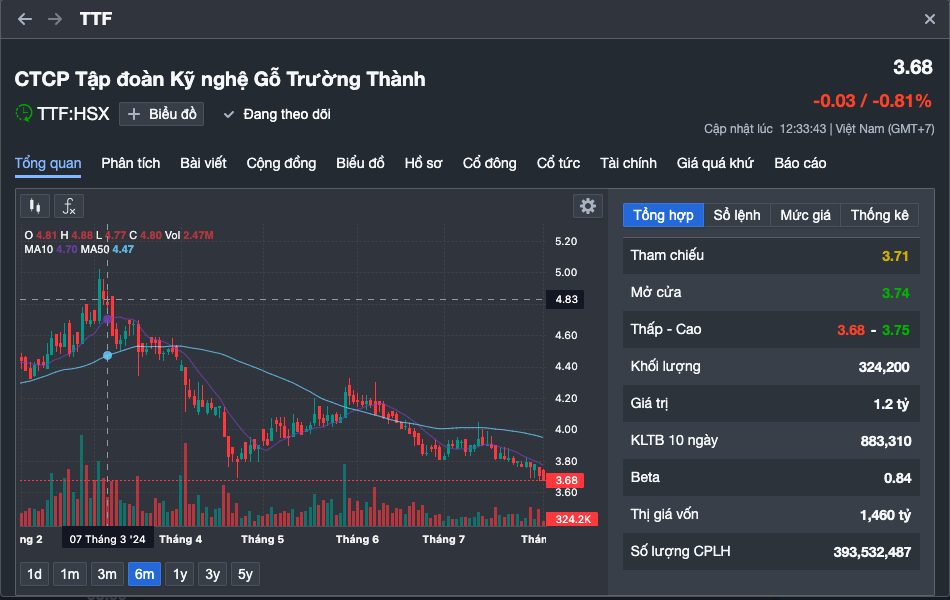

As of the end of the trading session on August 1, 2024, TTF stock price fell by 0.81% to VND 3,680, a decline of about 26% from its peak this year of over VND 5,000.

Many investors have shared their disappointment, having held on to TTF stock since the VN-Index peak of over 1,500 points, facing losses of nearly 80%. At that time, TTF stock price reached a multi-year high of over VND 17,000, attracting a slew of investors who anticipated further price increases to VND 20,000, and even some securities companies predicted a rise to VND 30,000.

Currently, TTF stock price hovers below VND 4,000, not even enough to buy a glass of iced tea, and it is on the warning list of the Ho Chi Minh City Stock Exchange. Investors are frustrated, unsure whether to cut their losses or hold on, as they don’t know where the bottom is.

In their explanation report on measures and roadmap to overcome the warning status of securities in the second quarter of 2024, Truong Thanh Wood’s management acknowledged the challenging market conditions and their efforts to maintain relationships with partners and customers, both domestic and international, ensuring independence from any specific market.

Declining stock prices have left investors disappointed. Source: Fireant

“Despite the increasingly stringent international market standards and regulations on product quality and origin, all of the company’s export products to these markets meet the requirements; expansion of export markets. This year, the company will continue to implement measures and roadmap to overcome the warning status of securities,” Truong Thanh Wood stated in their report.

The company has addressed issues related to tax arrears from 2012 to 2022, which hindered the VAT refund process and the enjoyment of other legitimate benefits for an extended period. As of now, the company’s VAT refund process has returned to normal, significantly improving cash flow for production and business operations, and reducing inventory.

According to Truong Thanh Wood, their production and business operations are expected to yield positive results in the coming period, gradually reducing and eliminating accumulated losses and addressing the reasons for the warning status of their securities.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.