Hyundai Elevator Co., Ltd. recently reported the sale of 5 million HBC shares of Hoa Binh Construction Group Joint Stock Company. The transaction took place during the July 31 session, which saw HBC shares fall to their daily limit. As there were no matching trades for HBC shares on the same day, it is likely that all 5 million shares were sold through matched orders on the exchange. Based on the closing price of VND 5,850 per share, the company earned approximately VND 29 billion from this transaction.

Following this sale, Hyundai Elevator still holds over 23 million HBC shares, representing a 6.64% stake in the company.

Hyundai Elevator, a subsidiary of Hyundai Group, is a 40-year-old company from South Korea that specializes in escalators and elevators, as well as their maintenance. They hold a significant market share in the installation of new elevators in the Korean market.

The South Korean company became a major shareholder in Hoa Binh Construction Group following a strategic cooperation deal in 2019, where they purchased 25 million HBC shares worth VND 575 billion, equivalent to VND 23,000 per share. As part of this partnership, the two companies also agreed to collaborate on four types of projects: those where Hoa Binh is the general contractor, those where Hoa Binh is responsible for design and construction (D&B), those where Hoa Binh is a subcontractor, and those where Hoa Binh is the investor.

Since then, Hyundai Elevator has not engaged in any further transactions, and their ownership of HBC shares has only increased due to dividend payments in the form of shares. The company has also received cash dividends of VND 16 billion for the years 2019 and 2021. This means that after five years of holding HBC shares, Hyundai Elevator has incurred a loss of approximately 70% compared to their initial investment.

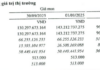

This divestment by the foreign shareholder comes at a time when HBC shares are facing mandatory delisting from the Ho Chi Minh City Stock Exchange (HoSE) due to their 2023 audited consolidated financial statements showing accumulated undistributed post-tax profits as of December 31, 2023, at a loss of VND 3,240 billion, exceeding the company’s actual paid-up capital of VND 2,741 billion.

In a subsequent statement, HBC announced that they would transfer nearly 347.2 million shares to UpCOM and committed to continue fulfilling their information disclosure obligations to ensure transparency and protect shareholder interests. The transfer to the new exchange is expected to be completed in August 2024.

HBC then issued another statement to HoSE, expressing their disagreement with the exchange’s grounds for considering mandatory delisting of HBC shares.

“The Company’s management is aware of the extremely serious consequences of delisting the Company’s shares. This will directly affect more than 39,000 shareholders and thousands of employees whose livelihoods depend on the Company, as well as over 1,400 suppliers and subcontractors, each with hundreds of thousands of employees,” the statement from Hoa Binh read.

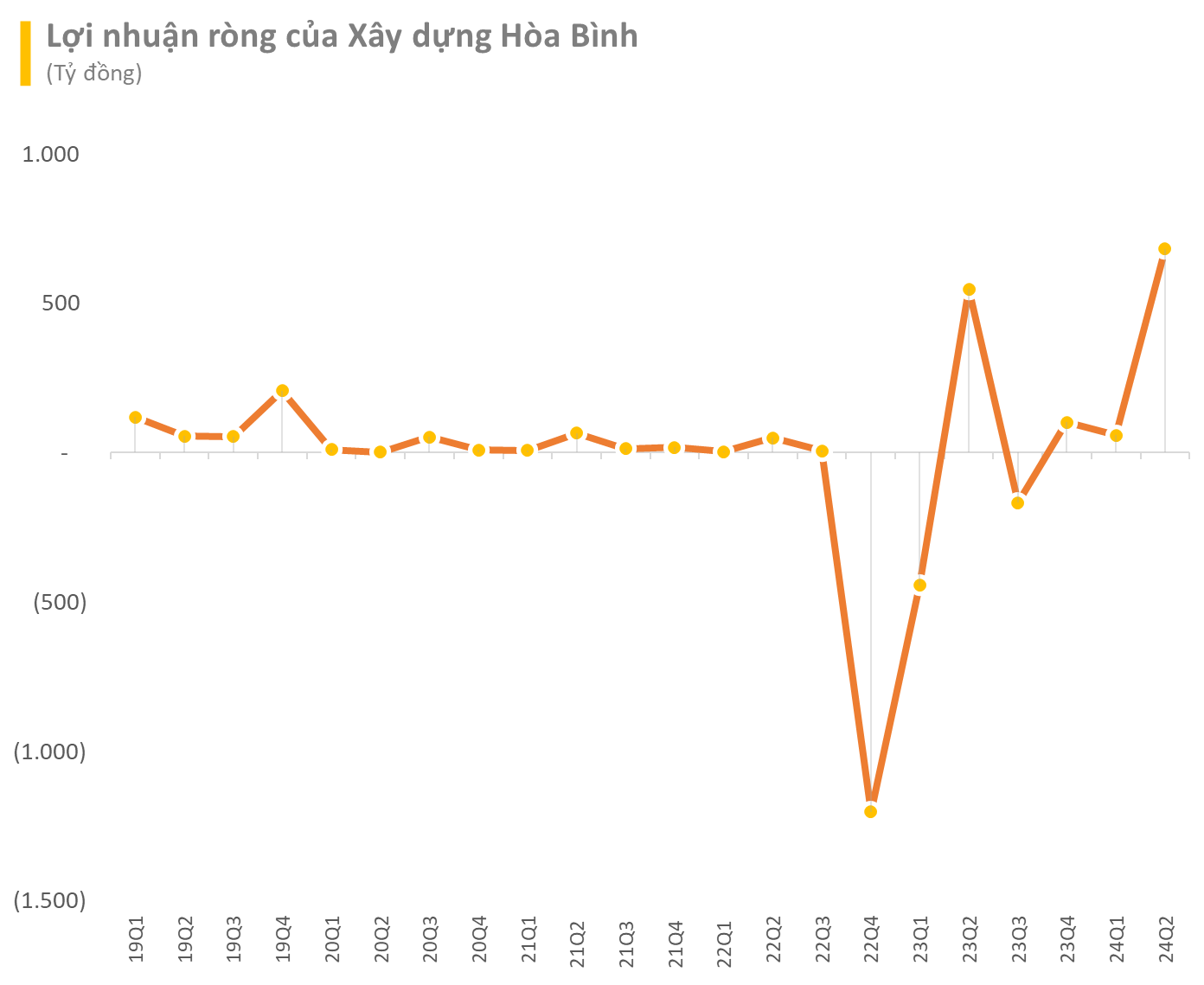

In terms of business performance, in the second quarter of 2024, the construction company reported an after-tax profit of VND 684 billion, a significant improvement from the loss of over VND 268 billion in the same period in 2023. The after-tax profit of the parent company reached over VND 682 billion, the highest quarterly profit ever achieved by the company since its inception.

For the first six months of 2024, HBC recorded a revenue of VND 3,811 billion, a 10% decrease from the previous year. However, their after-tax profit surged to VND 741 billion (compared to a loss of VND 713 billion in the same period last year). With these results, HBC has already surpassed 71% of their profit target for the entire year of 2024.