Illustrative image

Asia Commercial Joint Stock Bank (ACB) has just applied a new deposit interest rate schedule effective today (July 31). This is the first time ACB has increased deposit interest rates in July.

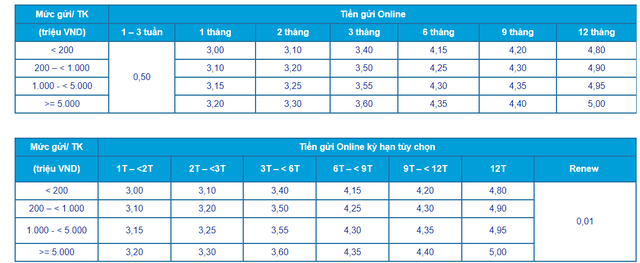

According to the online savings product with maturity payout for individual customers – the product with the highest interest rate, ACB divides the interest rate schedule according to the amount deposited, respectively: below VND 200 million, from VND 200 million to below VND 1 billion, from VND 1 billion to below 5 billion, and from VND 5 billion and above.

Among these, the interest rate for a 1-month term has increased by 0.2% per year, now ranging between 3.0% and 3.2% per year depending on the deposit amount.

The 2-month term has also increased by 0.2% per year, now ranging from 3.1% to 3.3% per year.

For the 3-month term, the interest rate has gone up by 0.3% per year, now fluctuating between 3.4% and 3.6% per year.

The 6-month term deposit interest rate has increased by 0.25% per year, now reaching approximately 4.5% to 4.35% per year.

ACB has raised the interest rate for the 9-month term by 0.2% per year, which now ranges between 4.2% and 4.4% per year.

For the 12-month term, ACB has increased the interest rate by 0.1% per year compared to before, now ranging from 4.8% to 5.0% per year.

Consequently, the highest deposit interest rate currently offered by ACB according to their online deposit interest rate schedule is 5.0% per year, applicable to accounts with deposits of VND 5 billion and above for the 12-month term. For accounts with smaller deposit amounts, the highest interest rate offered ranges from 4.8% to 4.95% per year.

ACB is the latest major private bank to join the deposit interest rate race in July. Previously, SHB, MB, VPBank, and Sacombank had made similar moves. Most recently, SHB increased deposit interest rates for short-term deposits ranging from 1 to 5 months by 0.2% per year starting yesterday, July 30.

After dropping to historical lows, deposit interest rates have started to climb back up since the end of March, with a broader increase observed in April, May, and June.

Entering July, around 20 banks have adjusted their deposit interest rates upward, including NCB, Eximbank, SeABank, VIB, BaoViet Bank, Saigonbank, VietBank, MB, BVBank, KienLong Bank, VPBank, PVCombank, PGBank, Sacombank, BIDV, ABBank, Bac A Bank, SHB, ACB, and Cake by VPBank. Notably, many banks have increased deposit interest rates two to three times.

According to analysts, the low growth in deposits from individuals and businesses in the first months of the year, coupled with the recovery in credit growth, has prompted many banks to raise deposit interest rates to ensure a balance in capital sources. Additionally, the State Bank of Vietnam’s (SBV) interventions through open market operations and foreign currency sales have impacted the Vietnamese Dong liquidity of banks.

Experts from Rong Viet Securities Company (VDSC) believe that the rebound in deposit interest rates is a suitable scenario based on expectations of exchange rate movements and interest rate policies.

In reality, since the beginning of the second quarter, the VND interest rate level has been on an upward trend, and by mid-year, the VND deposit interest rate offered by banks had increased by about 0.5% to 1% for various terms. Interbank money market interest rates have also risen, and the SBV has adjusted upward the interest rates for market intervention tools such as the open market operation (OMO) rate and the rate for issuing bills.

However, the current deposit interest rates remain lower than those in the pre-pandemic years. VDSC forecasts that VND interest rates in the second half of the year may continue to rise slightly by 0.25% to 0.75%.

KB Securities Vietnam (KBSV) also predicts: “Deposit interest rates will continue to increase by 50 basis points from now until the end of the year, reaching the level around the COVID-19 trough in 2020-2021.”

According to KBSV experts, the key factors influencing deposit interest rates from now until the end of the year include:

First, exchange rates in the third quarter of 2024 will still fluctuate, although the risk of a sharp increase is no longer a major concern. Accordingly, the SBV will maintain its orientation to keep interbank interest rates sufficiently high to limit carry trade, along with foreign currency sales to meet the needs of businesses as imports are expected to continue to increase in the coming time. These factors will directly affect the system’s liquidity and push up deposit interest rates in the formal economy, especially in small and medium-sized private joint-stock commercial banks with less flexible sources of mobilization and banks with strong credit growth.

Second, the expected recovery in credit demand will drive capital mobilization needs, leading to a continued increase in deposit interest rates towards the end of the year. Specifically, credit growth is forecast to recover more markedly in the second half of 2024, driven by a warming up of the economy, with key factors including: (i) Strong import turnover in recent months indicates positive prospects for the production sector and export activities in the coming time; (ii) the impact of monetary and fiscal policy stimuli on improving domestic demand; (iii) a revival in the real estate market. In fact, credit in the second quarter of 2024 has shown improvement, reaching 6% as of June 30 (specifically, credit increased by 4.6 percentage points in the second quarter of 2024), mainly driven by real estate and infrastructure development lending.

Along with the upward trend in deposit interest rates, experts also forecast that lending rates have bottomed out and are expected to remain stable or inch slightly higher by the end of the year. In reality, lending rates have decreased to relatively low levels compared to the peak at the end of 2022, in line with the government and SBV’s policy to lower interest rates to support economic development. However, with the upward movement in funding costs, KBSV experts believe that lending rates have hit bottom and are likely to stabilize or edge slightly higher by the year-end.

Nevertheless, KBSV argues that the specific increase will depend on each bank. State-owned banks, with their role in supporting the economy, will maintain relatively low lending rates, while private banks tend to raise lending rates to adjust to the increase in input costs. Moreover, non-performing loans remain a concern as banks’ buffers have been significantly reduced, and Circular 02 will expire at the end of 2024, potentially causing many customers to be reclassified, necessitating adjustments in lending rates to balance customer risk.