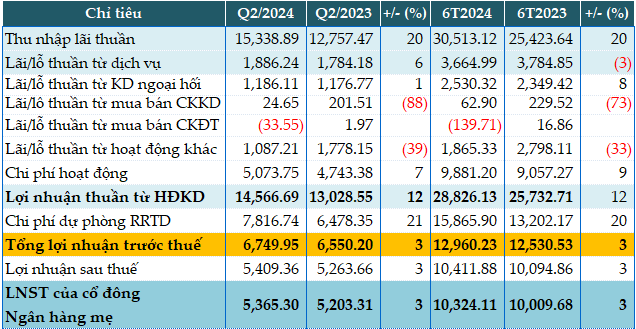

Core business activities of CTG in Q2 witnessed a 20% surge, yielding VND 15,339 billion in net interest income. Non-interest income, however, took a dip, with investment security trading profits plunging by 88% and other business activities shrinking by 39%, resulting in losses in investment security trading.

Consequently, the profit from business operations climbed by 12%, touching VND 14,567 billion. The bank bolstered its credit risk reserve by 21%, reaching VND 7,817 billion, which left a pre-tax profit of VND 6,750 billion, marking a 3% year-over-year increase.

For the first six months of the year, the bank’s pre-tax profit exceeded VND 12,960 billion, reflecting a 3% rise compared to the same period last year.

|

CTG’s Q2/2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

As of the quarter’s end, the bank’s total assets had expanded by 6% since the year’s start, surpassing VND 2.16 quadrillion. Notably, the bank’s deposits at the State Bank of Vietnam decreased by 29% to VND 28,980 billion, while deposits at other credit institutions climbed by 29% to VND 334,405 billion. Customer lending also experienced a 7% boost to VND 1.57 quadrillion.

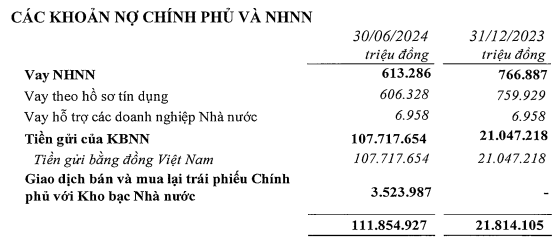

On the liability side, customer deposits climbed by 4% from the year’s beginning to nearly VND 1.47 quadrillion. Notably, deposits from the State Treasury witnessed a fivefold increase from the start of the year, reaching VND 107,717 billion. Additionally, the quarter witnessed a transaction of VND 3,523 billion in buying and selling government bonds with the State Treasury.

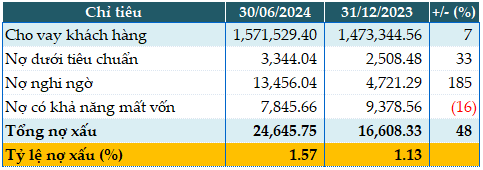

As of June 30, 2024, CTG’s total non-performing loans (NPLs) stood at VND 24,645 billion, reflecting a 48% increase since the year’s beginning. Consequently, the NPL ratio climbed from 1.13% at the start of the year to 1.57%.

|

CTG’s Loan Quality as of June 30, 2024. Unit: Billion VND

Source: VietstockFinance

|

SHB achieves excellent cost control with a CIR of only 23% in 2023, with profits exceeding 9,200 billion VND.

Saigon – Hanoi Bank (SHB) has recently released its consolidated financial report for the year 2023, showcasing stable business growth and strong safety indicators amidst a challenging market.