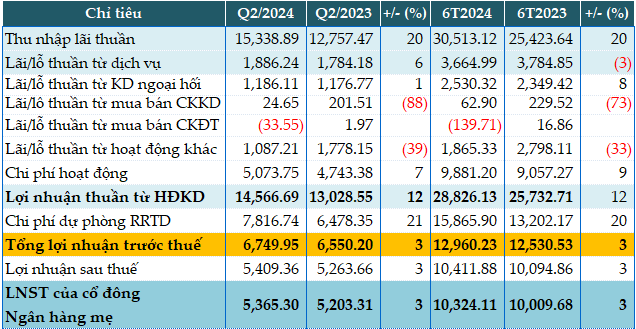

Core business activities of CTG in Q2 witnessed a 20% surge, yielding VND 15,339 billion in net interest income. Non-interest income, however, took a dip, with investment security trading profits plunging by 88% and other business activities dipping by 39%, resulting in losses in investment security trading.

Consequently, the profit from business operations climbed by 12%, touching VND 14,567 billion. The bank bolstered its credit risk reserve by 21%, reaching VND 7,817 billion, leaving a pre-tax profit of VND 6,750 billion, marking a 3% year-over-year increase.

For the first six months of the year, the bank’s pre-tax profit surpassed VND 12,960 billion, reflecting a 3% climb compared to the same period last year.

|

CTG’s Q2/2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

The bank’s total assets as of the end of Q2 witnessed a 6% climb from the beginning of the year, surpassing VND 2.16 quadrillion. Notably, the bank’s deposits at the State Bank decreased by 29% (VND 28,980 billion), while deposits with other credit institutions rose by 29% (VND 334,405 billion), and loans to customers increased by 7% (VND 1.57 quadrillion)

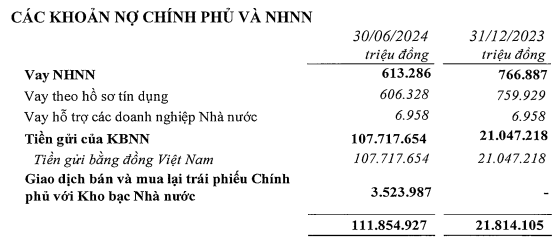

On the funding front, customer deposits climbed by 4% from the start of the year to nearly VND 1.47 quadrillion. Notably, the Treasury’s deposits increased fivefold from the beginning of the year (VND 107,717 billion). Additionally, the end of Q2 witnessed a transaction of VND 3,523 billion in the purchase and resale of government bonds with the Treasury.

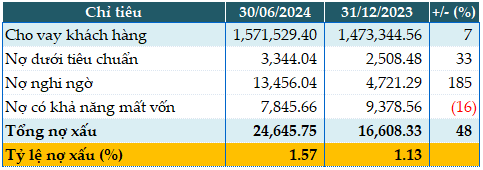

As of June 30, 2024, CTG’s total non-performing loans (NPLs) stood at VND 24,645 billion, marking a 48% increase from the beginning of the year. Consequently, the NPL ratio climbed from 1.13% at the start of the year to 1.57%.

|

CTG’s Loan Quality as of June 30, 2024. Unit: Billion VND

Source: VietstockFinance

|