Buy GEX with a target price of VND 28,500/share

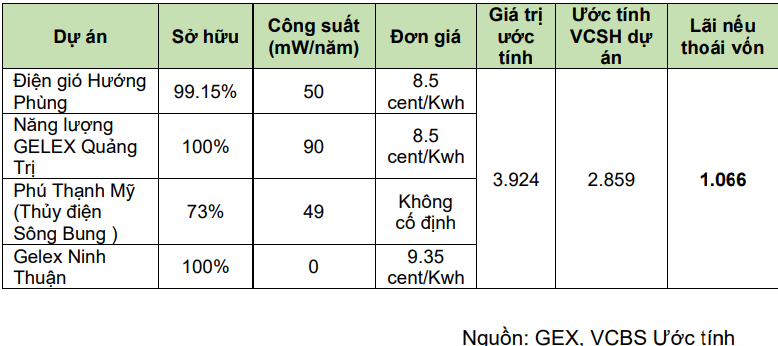

Vietcombank Securities (VCBS) states that currently, Gelex Group Joint Stock Company (HOSE: GEX) is managing and implementing the divestment of four main energy projects with a total designed capacity of 245 mW/year to Sembcorp. The estimated value after GEX’s divestment could bring about VND 3,924 billion, and the estimated profit recorded is about VND 1,066 billion.

According to the Company’s management, the project is completing the final steps to recognize profit calculation in Q2/2024. After divesting the existing projects, Viglacera Corporation – Joint Stock Company (HOSE: VGC), a subsidiary of GEX, will cooperate with foreign partners to develop mega renewable energy projects with a capacity of 3,500-3,900 MW, opening up great potential in the future.

|

4 GEX energy projects expected to divest

|

By the end of 2023, VGC still had about 848 ha of industrial land available for lease, of which 90ha was ready for rent. According to VCBS’s estimates, Yen My and Thuan Thanh industrial parks have about 80ha and 177ha available for lease, respectively, with rental prices of $130/m2/cycle and $140/m2/cycle, respectively. With an estimated gross profit margin of 45-50%, this will be a great incentive to boost VGC’s industrial park segment, as large industrial parks like Yen Phong MR and Yen Phong II-C have run out of land.

Some remaining industrial parks, such as Phu Ha, Phong Dien, and Tien Hai, have large land funds but slow rental rates and not-so-high gross profit margins. In 2024, VGC continues to promote the search for new industrial parks, including the successful approval of Doc Da Trang Industrial Park with a total investment of VND 1,807 billion and 296 ha, and Song Cong II Industrial Park with an investment of VND 3,985 billion.

VCBS estimates that GEX recorded a profit from securities investment of about VND 90 billion (36% after-tax profit) in Q1/2024. GEX maintains a financial investment balance of VND 2,455 billion, including a stock investment portfolio of VND 1,765 billion and bonds of VND 590 billion. VCBS believes that this investment activity supports GEX’s profit when the market is more favorable.

Based on the two valuation methods of FCFF and SOTP with a 50:50 ratio, VCBS recommends buying GEX with a target price of VND 28,500/share.

Read more here

VHC looks promising with a target price of VND 88,000/share

According to SSI Research, in Q2/2024, Vinh Hoan Corporation (HOSE: VHC) announced revenue and net profit of VND 3.2 trillion (up 17.3% over the same period and 12% over the previous quarter) and VND 336 billion (down 26.4% and up 78% over the previous quarter), respectively. While revenue exceeded SSI Research’s expectations thanks to a strong recovery in sales volume (up 26% and 10% over the previous quarter, according to SSI Research estimates), net profit met estimates as Q2/2023 had a high baseline profit due to high average tra fish prices.

SSI Research notes that VHC’s performance was outstanding compared to its peers, while Vietnam’s tra fish export turnover increased by only 6% in Q2/2024. For example, Nam Viet Corporation (HOSE: ANV) announced a 11% increase in revenue but a 134% decrease in net profit. In the first half of 2024, VHC recorded revenue and net profit of VND 6 trillion (up 22.4%) and VND 525 billion (down 23.1%), completing 57% and 66% of the revenue and net profit plan for 2024, respectively, which is an encouraging sign for the full-year 2024 business results.

Fillet tra fish revenue reached VND 2.2 trillion (up 17% over the same period and 18% over the previous quarter), of which export revenue to the US market (accounting for 56% of tra fish revenue) reached VND 1 trillion (up 13% over the same period and 45% over the previous quarter). SSI Research notes that the average selling price of tra fish fillets in the US market decreased by 17% year-on-year but increased by 7% compared to the previous quarter. This explains the recovery in consumption volume in the US market by 30% year-on-year and 38% over the previous quarter. SSI Research observes that buyers have accumulated a large amount of tra fish to take advantage of the current low prices, expecting a recovery in consumption in the second half of 2024. In addition, the price of Chinese tilapia (a direct substitute for tra fish) increased sharply to $3.9/kg (up 14%) in the first half of 2024 due to tight supply, leading to a decrease in tilapia imports and an increase in tra fish imports into the US market.

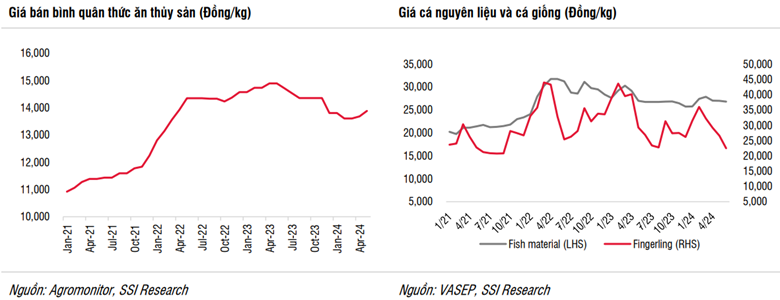

The overall gross profit margin reached 14.4%, down 690 basis points year-on-year, while improving by 510 basis points compared to the previous quarter. This is in line with the movement of the average selling price of tra fish fillets (down 17% year-on-year and up 7% compared to the previous quarter). In terms of costs, the cost of aquaculture feed and raw material fish also decreased by 7% and 3% year-on-year, respectively.

While export prices remain low, VHC has actively boosted domestic market revenue with key products such as aquaculture feed (from FeedOne factory), tra fish, and by-products. Domestic market revenue increased by 10% in Q2/2024, contributing 25% to VHC’s total revenue in the first half of 2024. Revenue from wellness products recovered by 30%, indicating a recovery in demand and an increase in consumer confidence.

In the second half of 2024, SSI Research expects sales volume to continue to grow, as the period from August to November is the peak season for tra fish exports, along with the expected recovery in consumption in the US market. SSI Research expects the average selling price to improve by 10% compared to the first half of 2024 (up 15%), while the decrease in aquaculture feed costs will help improve the gross profit margin. SSI Research notes that the prices of soybean meal, corn, and wheat have decreased by 19%, 16%, and 17%, respectively, since the beginning of the year, which will reduce the cost of aquaculture feed in the second half of 2024. Therefore, SSI Research expects the gross profit margin to improve by 700 basis points in the second half of 2024.

For the full year 2024, SSI Research expects VHC to achieve revenue and NPATMI of VND 12.1 trillion and VND 1.24 trillion, up 20.4% and 34% year-on-year, respectively, with revenue and NPATMI in the second half of 2024 expected to increase by 18.4% and 215%, respectively. Q4/2023 was the period when tra fish prices hit rock bottom.

For 2025, SSI Research forecasts revenue and NPATMI of VND 13.7 trillion and VND 1.6 trillion, up 13% and 29%, respectively, assuming a 7% increase in tra fish sales volume and an average selling price of $3.45/kg (up from $3.2/kg) in 2024.

With the above expectations, SSI Research recommends VHC as promising with a target price of VND 88,000/share.

Read more here

DGC looks promising with a target price of VND 122,000/share

Vietcap Securities lowers its forecast for IPC sales volume in 2024 (in terms of phosphorus content) to 60,166 tons, up 5%, down from the previous forecast of a 13% increase, due to slightly lower-than-expected business results in the first half of 2024. Vietcap believes that this is because Duc Giang Chemical Group Joint Stock Company (HOSE: DGC) is hesitant to sell P4 to Indian customers at low prices, as in the past. In Q2/2024, Vietcap estimates that the price of P4 for East Asian and American customers remains at $4,200/ton, while the price for Indian customers decreases slightly from the previous quarter to $3,650/ton.

In the first six months of 2024, WPA sales volume decreased by 10% year-on-year, while fertilizer and feed additive volumes increased by 40% and 42%, respectively, according to Vietcap estimates. DGC plans to reduce WPA revenue by 87% but double agricultural product revenue in Q3/2024. DGC is flexible in adjusting the proportion of agricultural products to WPA. Specifically, DGC will sell WPA when prices are favorable and process it into agricultural products with geographical advantages in the domestic market when the WPA export market is unfavorable.

According to DGC’s management, the ethanol plant will be operational in Q4/2024. This timeline is later than Vietcap Securities’ previous expectation of Q3/2024. Therefore, the company adjusts its ethanol revenue forecast down to VND 320 billion in 2024 from VND 640 billion in the previous forecast. In 2025, Vietcap maintains its revenue forecast at VND 1.5 trillion, including 64,000 m3 of ethanol (100% capacity) sold at VND 20 million/m3 and VND 200 billion from by-products.

DGC plans to start constructing the caustic soda-chlorine plant in Q4/2024, in line with Vietcap Securities’ expectations. Vietcap maintains its forecast that this project will be operational in Q4/2025, contributing VND 50 billion to after-tax profit in 2025.

With the above forecast, Vietcap Securities recommends DGC as promising with a target price of VND 122,000/share.

Read more here