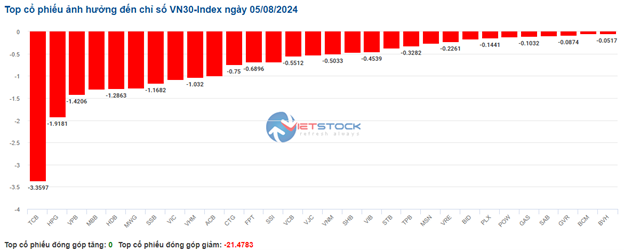

Stocks in the VN30 basket were all in the red as they faced strong selling pressure, resulting in a loss of over 21 points from the overall index. Notably, four bank codes TCB, HPG, VPB, and MBB witnessed respective decreases of 3.36 points, 1.92 points, 1.42 points, and 1.3 points.

Source: VietstockFinance

|

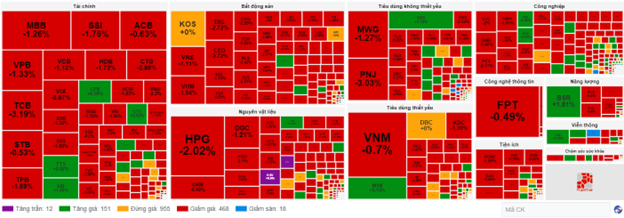

Funds continued to flow out of the real estate sector, causing most stocks in this industry to plummet. Specifically, VHM dropped by 1.81%, VRE by 1.11%, DIG by 2.93%, and CEO by 3.4%.

Following suit was the financial sector, with leading banking and securities stocks such as SSI decreasing by 1.92%, VND by 2.3%, VIX by 2.7%, MBB by 1.89%, TCB by 2.98%, and VPB by 1.6%. In contrast, a handful of stocks, including FTS, EIB, and LPB, managed to stay in the green, posting gains of 1.48%, 1.11%, and 0.35%, respectively.

Regarding FTS, from a technical perspective during the morning session of August 5, 2024, this stock continued its upward trajectory while forming a Piercing Pattern candlestick pattern. The trading volume is expected to surpass the 20-day average by the session’s end. Additionally, the Stochastic Oscillator has signaled a buy and emerged from the oversold region after a Bullish Divergence, further bolstering the case for FTS‘s recovery in upcoming sessions.

Source: https://stockchart.vietstock.vn/

|

Compared to the opening, sellers maintained their dominance. There were 468 declining stocks versus 151 advancing ones.

Source: VietstockFinance

|

Opening: Broad-based decline, VN-Index loses over 15 points at the start

The morning session commenced on a negative note, with red dominating most sectors. The VN30 index had the most adverse effect, as the majority of its constituent stocks witnessed declines.

Numerous VN30 stocks experienced significant drops, including SSB (-2.43%), POW (-1.45%), TCB (-3.19%), VIC (-2.62%), CTG (-2.85%), SSI (-2.08%), VIB (-2.37%), HDB (-3.45%), and GVR (-1.08%)…

The real estate sector also exerted a considerable negative influence, with stocks like VHM falling by 2.36%, NVL by 1.74%, VRE by 1.39%, VIC by 2.62%, HDG by 2.55%, DXG by 1.91%, and NLG by 3.04%.

Following closely was the non-essential consumer goods sector, with leading stocks across the board dipping into the red territory. These included MWG, which fell by 1.75%, PNJ by 1.62%, FRT by 2.47%, TNG by 2.79%, DGW by 1.73%, and PLX by 2.53%…