Domestic securities in the last week of July and the first week of August 2024 experienced some sharp declines before rebounding, helping many investors regain their calm. However, the global stock market plunge last weekend due to concerns about a US economic recession and rising geopolitical tensions has unnerved domestic investors.

Unable to Confirm the Trend

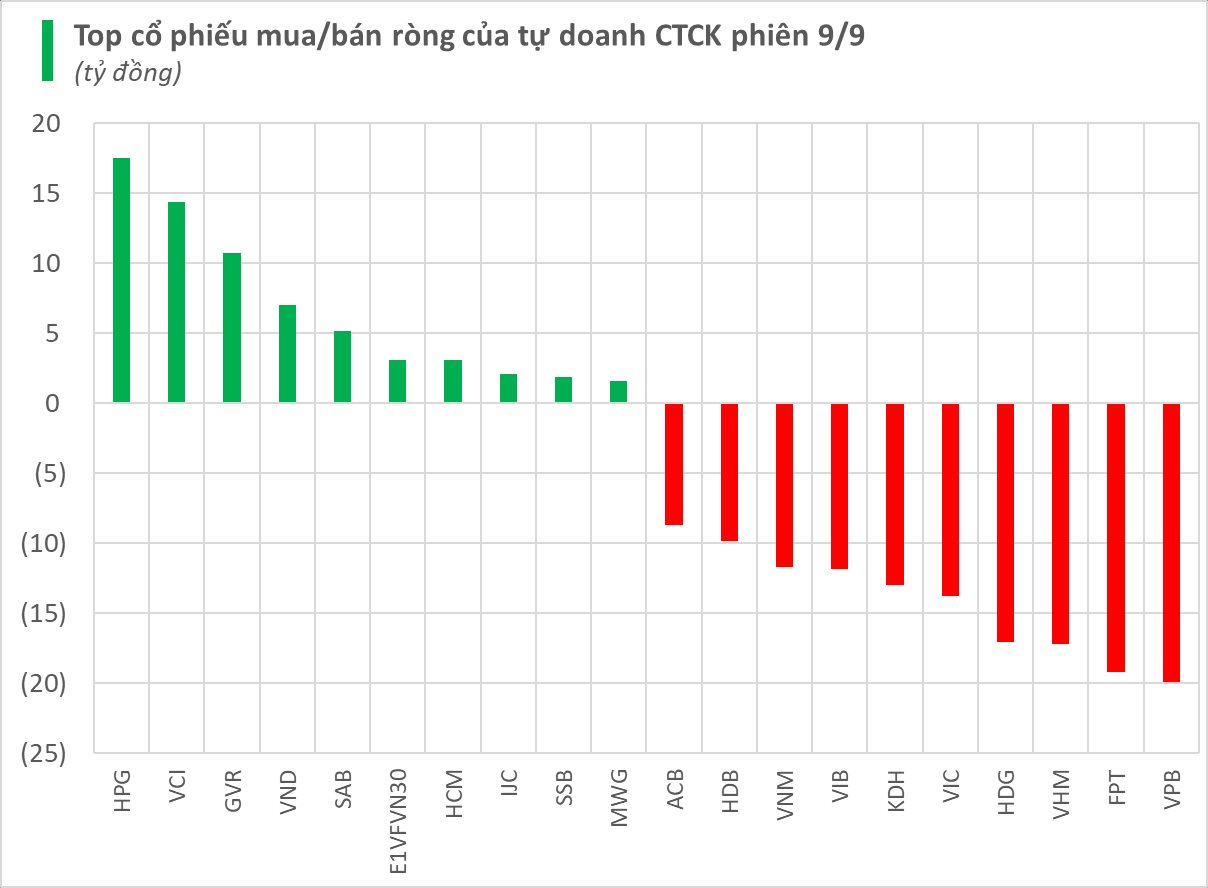

Referring to the domestic stock market performance last week, Mr. Do Bao Ngoc, Deputy General Director of CSI Securities Joint Stock Company, said that August 2 was the last day of the 9 ETE funds referenced by the VN-Diamond and VNFIN Lead indexes to finalize their July 2024 structures. These funds heavily purchased banking and securities stocks, which significantly influenced the overall market.

“This was one of the reasons behind the strong recovery of the VN-Index towards the end of the session, while stocks in other sectors did not witness similar gains. Therefore, we must closely monitor the market’s movements in the upcoming sessions, especially observing the supply and demand dynamics driven by investor capital,” said Mr. Do Bao Ngoc.

According to Mr. Phan Dung Khanh, Investment Advisory Director of Maybank Securities Joint Stock Company, the market’s performance last week does not allow for a definitive conclusion about the upcoming trend. This is because an essential factor for the market at this point is liquidity, which remains weak, and foreign investors persistently net sell.

“The pressure from rising deposit interest rates, surging gold prices, and record-high lending balances of securities companies also impact the VN-Index. Currently, the 1,180 – 1,200-point range is considered a mid-term support zone for the market,” said Mr. Phan Dung Khanh.

Regarding the sharp declines in many global stock markets during the last two sessions of last week and their potential impact on the VN-Index at the beginning of this week, Dr. Ho Quoc Tuan from the University of Bristol (UK) stated that it is reasonable for major stock markets, including the US market, to undergo corrections of 5%-10% after significant gains, as there is limited room for further growth. Other investment channels, such as gold, USD, and oil, are attracting more capital.

According to Dr. Ho Quoc Tuan, the overall decline in many international financial markets compared to the previous month is not overly negative, except for the Japanese market. “If the US economy weakens, capital inflows into emerging markets, including Vietnam, will also be affected. This is because Vietnam has a highly open economy. Global geopolitical instability will negatively impact Vietnam due to a slowdown in trade growth,” assessed Dr. Ho Quoc Tuan.

The green color in Vietnam’s stock market on August 2 helped investors regain their calm after the previous plunge. Photo: Le Tinh

Struggling at the 1,200-point Level

Many investors are puzzled as to why the stock market continues to decline despite positive factors in the domestic economy (economic data for the first seven months, Q2 and H1 2024 business results of many listed companies…). Moreover, the final obstacle to Vietnam’s stock market being upgraded to emerging market status is gradually being removed as the regulatory authority is about to eliminate the pre-funding requirement for foreign investors.

According to experts, these pieces of information have already been reflected in the previous stock price increases. In reality, numerous penny and midcap stocks on the Upcom exchange with weak fundamentals witnessed surges of 50%-100%, or even 200%, in a short period last July, hence the recent plunge is understandable. This situation has triggered forced cross-margin selling pressure from sources outside securities companies, causing the VN-Index to plunge.

Regarding the VN-Index’s ups and downs and its lingering around the 1,200-point level for many years, Mr. Do Bao Ngoc analyzed that, in the past years, the Vietnamese economy has been negatively affected by various issues, including the COVID-19 pandemic, economic downturns, a frozen real estate market, and difficulties faced by domestic enterprises. These factors have hindered the recovery of Vietnamese enterprises, resulting in the sluggish performance of the domestic stock market.

Mr. Ngoc remarked, “The nature of the stock market during this period has been predominantly speculative, with minimal investment elements. Consequently, in the past 2-3 years, the Government and state management agencies have been resolute in cleansing the stock market.”

According to Mr. Ngoc, numerous stocks of businesses listed on the HNX and UpCoM exchanges are akin to “junk stocks” due to their weak fundamentals, lack of professionalism in business operations, and, in some cases, the utilization of raised capital for speculative purposes. Over time, this has led to a loss of trust, causing many individuals to refrain from long-term investments in the stock market and instead engage in speculative or short-term trading…

“Therefore, it is necessary to enhance the quality of goods, products, etc., of listed companies on the exchanges and, most importantly, to purify the stock market so that efficiently operating enterprises can attract capital and restore investor confidence,” said Mr. Ngoc.

Return on Investment Remains Attractive

Mr. Nguyen The Minh, Director of Analysis at Yuanta Vietnam Securities Joint Stock Company, stated that, from a technical perspective, the VN-Index has entered the oversold zone. After significant corrections, the market’s P/E (valuation) has dropped to 13.5 times, the April low. The projected P/E for 2024 has also decreased to 11.5 times, indicating a high return on equity of 9%-10% for the stock market.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.