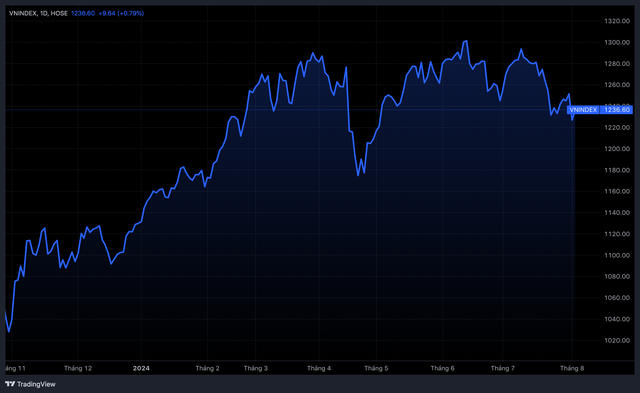

The Vietnamese stock market experienced a volatile trading week from July 29 to August 2, with cautious investors. Sellers dominated the last two trading sessions, causing a significant correction in the index, dipping as low as just over 9 points above the 1,200-point mark.

At the week’s close, the VN-Index dropped 5.51 points (-0.44%) compared to the previous week, settling at 1,236.6 points. For the entire month of July, the VN-Index edged up 6 points (+0.5%) compared to June.

As the second-quarter earnings season draws to a close, investors are curious about the upcoming developments. We had the opportunity to discuss the market outlook with financial experts:

VN-Index Bottom Not Confirmed Yet

Mr. To Quoc Bao – Head of Market Strategy, PSI Securities Joint Stock Company

In the short term, the Vietnamese stock market is facing pressures as the VN-Index has lost its short-to-medium-term support trend and failed to recover to retest the resistance/support zone of 1,255-1,260 points, corresponding to the long-term moving average MA100.

According to Mr. Bao, recent news about geopolitical instability and rising savings interest rates may make investors more cautious. Additionally, August 5, 2024, is the last day for ETFs tracking VN30, VNFinlead, and VNMidcap to finalize their portfolios according to the new constituents announced in the July review, leading to significant trades that could impact the index amid the current “drying up” liquidity.

Market liquidity has declined sharply, and bearish sentiment has caused individual investors to turn to net selling in the latest sessions. “Currently, it is challenging to confirm whether the market has bottomed out. If the index fails to hold this short-term support zone in the coming sessions, the VN-Index is likely to face further downside risks and correct towards the strong psychological support level of 1,200 points, which is the average price for the past year,” the expert asserted.

On a positive note, foreign net selling has slowed, with net selling value in July halving compared to the previous month. This selling trend may soon end as the State Bank of Vietnam has taken steps to stabilize exchange rates, and the Fed is expected to cut interest rates by the end of the year.

Following the second-quarter earnings season, the stock market enters August with a relatively negative short-term outlook. This period also lacks corporate news, so the market will heavily depend on macroeconomic growth prospects and other market factors.

Vietnam’s economy has shown signs of improvement in recent months due to increased domestic and international demand. Vietnamese enterprises have increased imports of raw materials and means of production to meet orders. The monetary and foreign exchange markets have also stabilized, creating a favorable macroeconomic environment for economic development.

The PSI expert believes that the macroeconomic situation will remain stable in the second half of this year. Additionally, most investors anticipate that the US Federal Reserve (Fed) and the European Central Bank (ECB) will cut interest rates in September. When the Fed cuts rates, emerging markets, including Vietnam, are expected to regain the attention of large foreign investment inflows.

Regarding strategy, Mr. Bao recommends that short-to-medium-term investors maintain a safe portfolio allocation with above-average buying power. They can consider reducing the proportion of stocks that underperformed in the second quarter and adhere to stop-loss principles if necessary, as forced selling pressure may increase.

However, investors should not panic and sell off during intra-session fluctuations when the VN-Index approaches the strong psychological support level of 1,200 points. This level is relatively attractive and has good buying power.

For new investment positions, investors can consider taking advantage of intra-session corrections to invest in leading companies with solid fundamentals, based on second-quarter growth and expected to perform well in the last months of the year.

VN-Index May Dip Below 1,200 Points But Will Recover

Mr. Bui Van Huy – Branch Director, DSC Securities

Commenting on the VN-Index’s decline last week, Mr. Huy said that with the earnings season over, the market entered an information vacuum and lacked new stories. The heaviest selling session of the week coincided with many enterprises’ final announcements, completing the earnings picture.

Regarding the global context, many stock markets plummeted, especially the Japanese market, which fell by nearly -6% on the last trading day of the week, impacting domestic investor sentiment. On July 31, Japan decided to raise its policy rate to around 0.25% and reduce its government bond purchases to 3,000 billion yen, marking a clear shift in its long-term stance after decades of easing.

However, since the beginning of the year, as global indices have taken turns reaching new highs, the Vietnamese stock market has barely moved in tandem. So, the recent sharp corrections in major global markets are not overly concerning.

According to Mr. Huy, foreign investors have withdrawn significant capital, with net selling of up to nearly VND 60,000 billion in the first seven months. “The selling peak has passed, so Vietnam’s stock market is likely to become less volatile due to negative external factors unless they affect the domestic situation. We can see that foreigners and proprietary traders remain net buyers in the latest sessions, despite sharp corrections in regional stock markets,” the DSC expert noted.

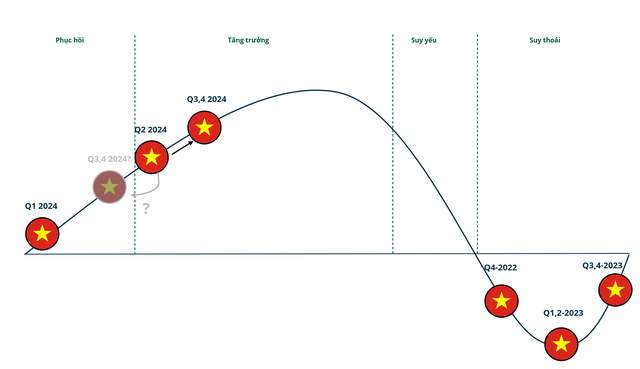

Additionally, the domestic context shows several bright spots in the economy and the dissipation of uncertainties. Macroeconomic data still indicates a positive and robust economic recovery. Regardless of short-term sentiment and liquidity, a solid economic recovery always lays an essential foundation for the market.

Regarding market breadth, Mr. Huy said that over 50% of the stocks on the Ho Chi Minh Stock Exchange (HoSE) have maintained their 200-day moving average (MA200). Large-cap stocks have performed even better and have barely corrected.

Typically, the expert observed that during periods when the VN-Index pierced the MA200, major global stock markets also broke their MA200. Currently, the US, Chinese, and European stock markets are relatively far from their MA200. Except for the Japanese market, which has its unique story and has broken the MA200, it appears that the MA200 can be sustained in this correction.

Based on these observations, Mr. Huy assessed that the possibility of the VN-Index breaking the MA200 (around the 1,200-point mark) is quite low: “The market may retest the MA200 around 1,200 points but will hold and recover, as seen last week. We can’t expect excitement, but we shouldn’t be pessimistic.”

While the second-quarter earnings season is over, it provides a good reference for predicting the recovery of corporate profits in the latter part of the year. Therefore, this is the time to think long-term.

The expert emphasized three significant stories that would impact the market in the second half: (1) Economic policy easing, (2) Economic recovery momentum, and (3) The story of market upgrade. Among these, economic recovery momentum and the prospect of market upgrade will become clearer.

Investors are advised to focus on leading, high-quality stocks to capture profit recovery momentum. Sectors that benefit from economic recovery include Banking, Financial Services, Consumer, Construction Materials, Basic Resources, and Retail… while avoiding fundamentally weak stocks.

VN-Index to Soon Resume Short-Term Uptrend

Mr. Tran Truong Manh Hieu – Head of Analysis, KIS Securities

The market’s previous uptrend was based on expectations, and second-quarter earnings have been reflected in stock prices. It is understandable that investors chose to take profits on August 1. Additionally, investors are cautious and tend to stay on the sidelines, awaiting crucial information such as exchange rate movements, inflation, and the Fed’s decisions… leading to the current “silent” period.

According to the KIS expert, a double-top pattern has been confirmed on the VN-Index, with a price target of 1,180-1,200 points. After reaching this target, the market may form an important bottom in the 1,180-1,200-point range and rebound. Thus, this correction should be considered a technical adjustment rather than the start of a new trend.

Liquidity often reflects investor sentiment, and low liquidity indicates their caution about the market recovery. Although selling pressure may increase, the expert believes that money remains in the market, waiting for the right time to re-enter.

“The likelihood of money shifting from the stock market to other investment channels is very low. After a hot period, the gold market has stabilized without significant fluctuations. Real estate has not recovered, and deposit interest rates remain low, so these channels are still unattractive to large capital flows from the stock market,” Mr. Hieu assessed.

While acknowledging the market’s decline in July 2024, he pointed out that it is still in an uptrend since the end of 2024. This trend is supported by enterprises’ positive business results amid the economic recovery.

Although cautious about the short-term market outlook, the KIS expert believes that the current correction will end soon, and the market will return to its long-term uptrend as the economy remains robust.

Regarding short-term investment strategy, Mr. Hieu recommends that investors maintain a safe stock proportion and wait for clear bottom-forming signals. When there is an appropriate entry point, they can open mid-to-long-term investment positions.