A notable shift in foreign investor group ownership has occurred regarding one of Vietnam’s leading corporations, Hoa Sen Group Joint Stock Company (HSG-HOSE).

On July 30, investment funds associated with Dragon Capital offloaded 600,000 HSG shares, reducing their collective holdings. The sale involved Wareham Group Limited, causing the group’s ownership to dip from 49.455 million shares (8.03%) to 48.85 million shares (7.93%) of the company’s charter capital.

In the market, HSG shares reached a peak of VND 25,350 per share on July 8, the highest in the past year. However, by August 1, the share price had declined by 17.7% to VND 20,850. Fortunately, the stock rebounded on August 2, closing at VND 21,450 per share, a gain of VND 600.

In terms of financial performance, HSG recently released its Q3 financial statements for the 2023-2024 fiscal year, reporting impressive results. The company’s revenue reached VND 10,840 billion, a 25.3% increase compared to the same period last year. Gross profit surged by nearly 50%, amounting to VND 1,337 billion after deducting cost of goods sold.

HSG’s financial income witnessed a remarkable 136% jump, reaching VND 30.6 billion, and the company experienced an increase in overall expenses. Among these, selling expenses were the most significant, rising from VND 720.4 billion to VND 901 billion. Nevertheless, HSG announced a substantial pre-tax profit of VND 287 billion, a 23.5-fold increase compared to the previous year, with a post-tax profit of VND 273 billion, reflecting a staggering 1,900% year-on-year growth.

For the first nine months of the 2023-2024 fiscal year, HSG’s cumulative performance showed continued improvement. The company recorded a 24% year-on-year increase in net revenue, reaching VND 29,163 billion, alongside a remarkable turnaround in post-tax profit, which stood at VND 696 billion compared to a loss of VND 410 billion in the previous year. This turnaround can be attributed to a VND 5,619 billion increase in net revenue and a VND 1,419 billion rise in gross profit, representing a 71% increase.

As of June 30, HSG’s total assets exceeded VND 19,723 billion, reflecting a 14% increase from the beginning of the fiscal year (VND 17,365 billion). Notably, inventories accounted for over VND 10,157 billion of this amount. The company’s equity stood at VND 11,108 billion, including undistributed post-tax profits of VND 4,714 billion.

On the liabilities side, HSG’s total liabilities amounted to over VND 8,614 billion, a substantial 31% increase from the start of the fiscal year (October 1, 2023). The majority of this amount comprised loans totaling more than VND 5,944 billion, marking a remarkable 102% increase since the beginning of the fiscal year. This significant surge in short-term bank debt is worth noting.

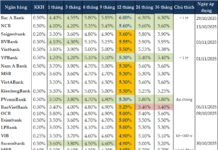

Among HSG’s lenders, Vietcombank – Nam Binh Duong Branch stands out with the highest lending amount of nearly VND 2,772 billion, reflecting a 152% increase from the beginning of the fiscal year. Vietinbank – Binh Duong Industrial Zone Branch follows closely with loans exceeding VND 1,743 billion.

Additionally, BIDV – Branch of Transaction Office 2 has extended a loan of nearly VND 795 billion to HSG, while United Overseas Bank (Vietnam) Limited has provided over VND 340 billion in financing.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.