|

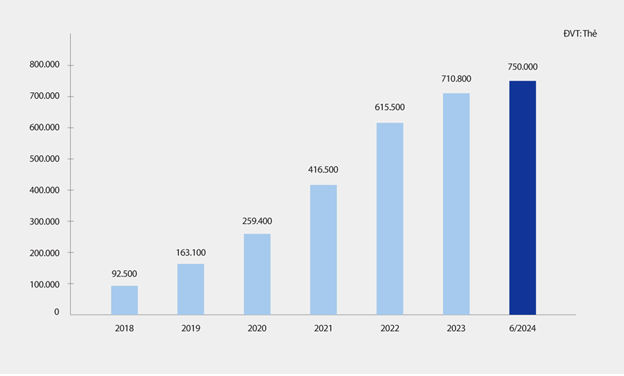

VIB Reaches 750,000 Card Milestone in June 2024

|

The 750,000 card milestone and the numbers that speak for themselves

In November 2018, VIB launched its new personalized credit card lines with specialized card types, marking a turning point in its card business strategy, with a customer-centric approach. Positioning itself as a leader in card trends, VIB has crafted a story of innovation, contributing to the shaping of a cashless payment market in Vietnam.

|

VIB Credit Card Growth Over More Than 6 Years

|

After more than 6 years, VIB has consecutively achieved significant milestones. In July 2022, the bank recorded the issuance of 500,000 credit cards. By June 2024, VIB reached the 750,000 card milestone. Compared to 2018, when it first embarked on the restructuring of its card business, VIB‘s credit card scale has grown more than eightfold.

Ms. Tuong Nguyen, Director of VIB Card Center, shared that as a bank “Leading the Card Trend”, VIB‘s greatest motivation to continuously develop and improve its products and services is the satisfaction of each customer when making payments with VIB credit cards, thereby fostering a modern lifestyle with smart spending habits and effective financial management skills.

“We set this goal years ago, and today we are reaping the rewards with a diverse ecosystem of 10 card lines featuring specialized functions that cater to different financial needs, offering advanced technology, and being the top choice for card users,” said Ms. Tuong Nguyen.

VIB‘s pioneering strategy of personalizing user experiences has contributed to changing customers’ perceptions of credit cards. VIB emphasizes that credit cards are not just a product for spending now and paying later but, more importantly, a companion in life that makes payments more convenient and enables better financial management.

By closely understanding customers’ spending needs and creating quality, superior benefit card products, VIB has consistently led the market in card issuance. In the first half of 2024, spending on VIB cards reached nearly VND 59,000 billion (over USD 2.3 billion), equivalent to an average monthly spending of nearly VND 10,000 billion by VIB cardholders.

Additionally, the number of transactions on VIB cards reached nearly 18 million, a 22% increase compared to the first six months of 2023.

VIB is the leading bank in terms of growth rate in the first half of 2024. Total spending on VIB cards in the first months of the year increased by 42.85% compared to the same period in 2023. Notably, domestic spending on VIB cards witnessed an impressive growth of 45.2%, resulting from the bank’s focus on designing features, benefits, and promotions for cardholders.

Specifically, in the first half of 2024, average spending on VIB – Mastercard cards reached USD 4,200 per card, equivalent to over VND 107 million per card, surpassing the market average.

Both direct and online spending on VIB cards increased significantly. Direct spending (via POS and contactless payments) grew by 48.3%, while online spending increased by 24.6% compared to the previous year.

These remarkable numbers stem from VIB‘s systematic investment in its credit card ecosystem over the years, aiming to deliver products that lead in technology, benefits, and user experience.

Technology shapes card trends

VIB commenced its new card strategy in 2018, coinciding with the explosion of Industry 4.0 in Vietnam. From the outset, the bank determined that its card products must incorporate advanced technology, modernity, and bring numerous benefits to users.

Every touchpoint in the VIB card journey with customers bears the imprint of technology, from the card application process to debt repayment, changing cashback and reward point categories, selecting automatic payment ratios and statement dates, enrolling in installment plans, and card locking and unlocking…

|

VIB Cards are favored for the benefits they bring to users

|

Five to seven years ago, when credit cards were not yet popular in Vietnam, the application process required extensive information and lengthy approval times of up to several weeks.

Today, with VIB‘s pioneering efforts, the card application process has been shortened and digitized, giving the bank a distinct advantage. In 2020, VIB was the first bank in Vietnam to implement the fully online issuance of credit cards, significantly reducing approval times and providing convenience to customers.

VIB is also a leader in virtual card technology, offering digital credit cards issued and managed entirely through the MyVIB mobile application. Customers can make payments anytime, anywhere, without the need for a physical card. Virtual cards have quickly gained popularity due to their high security, convenience, and ease of transaction history management and monitoring.

Additionally, VIB integrates cutting-edge technologies such as Artificial Intelligence (AI), Machine Learning, and hyper-realistic 3D simulation into Vie, Vietnam’s first virtual financial expert launched in July 2022, and applies Vie to the QR code on the back of VIB credit cards to assist customers at all times.

At the Vietnam Business Messaging Awards 2023, Vie, the virtual financial expert, was recognized by Meta as the most innovative solution in harnessing the power of conversational marketing.

|

Vie – Virtual Financial Expert

|

“We apply Virtual Reality (VR) and Augmented Reality (AR) technologies to bring our card lines to life, making them more unique and relatable to users. By simply scanning the QR code on the card, customers can receive instant advice from Vie on usage, payments, and discovering promotions in a quick and intuitive manner,” said Ms. Tuong.

VIB is also one of the first banks in Vietnam to implement contactless payment solutions such as Google Pay, Apple Pay, Garmin Pay, and Samsung Pay. With just a phone or a smart watch, VIB cardholders can easily make payments at contactless-enabled merchants.

|

VIB Contactless Payment Ecosystem

|

Comprehensive benefits – The more you spend, the more you save

Pursuing a personalized customer experience, VIB‘s 10 credit card lines in the market today cater to diverse needs, regardless of income, age, and consumer habits.

Many of VIB‘s card lines offer cashback, reward points, and gifts to customers, including those with the highest cashback rates in the market. Cardholders can also earn unlimited bonuses of up to VND 1.2 million per card when referring friends to successfully open a card.

Moreover, VIB collaborates with 150 strategic partners to meet all spending needs across five main categories: travel (VIB Travel), dining (VIB Dine), shopping (VIB Shop), transportation (VIB Move), and other benefits (VIB More).

Elevating every user experience

Users have increasingly higher expectations of credit cards, prioritizing personalized products that offer seamless and smooth experiences. That is why, in addition to its leading position in card technology and benefits, VIB continuously enhances user experiences in various other aspects, which may seem minor but positively contribute to elevating the power of a credit card.

VIB cards help customers maximize spending benefits by allowing them to choose between reward points or cashback and change spending categories at any time. Users can also manage their personal finances by selecting and changing statement dates or minimum payment ratios, choosing card numbers that hold special meaning to them, and setting spending limits for different types of domestic and international transactions through the MyVIB app.

First introduced with the Super Card, these personalization features will be expanded to the remaining card lines in the VIB ecosystem. This move is considered a significant step towards enhancing user experiences and further solidifying VIB‘s position as a technology leader in the card market.

|

VIB Cards Meet the Spending Needs of Users of All Ages

|

Throughout the journey of using VIB credit cards, the bank closely observes every user touchpoint and meticulously fine-tunes each detail. For example, cardholders participating in the Mastercard Travel Rewards program can enjoy discounts and cashback of up to 20% at thousands of duty-free shops, receive preferential foreign exchange transaction rates based on the State Bank’s rates, or become Vietnam Airlines Gold or Platinum members through the “Unlock Privileges 4.0” program.

Additionally, lounge access and fast-track services at airports in Vietnam and over 800 airports worldwide are offered to all VIB cardholders to make their journeys more comfortable and convenient.

Furthermore, the bank is committed to listening to customers’ feedback and continuously improving its products and services to accompany customers on their journey of efficient spending and enjoying life to the fullest.

Credit card debt with Eximbank of 8.5 million, payment due of 8.8 billion: Both parties commence negotiations

This morning, on March 19, the representative of Mr. H.A. from Quang Ninh province had a meeting with Eximbank regarding a credit card loan of 8.5 million, requiring a repayment of 8.8 billion after 11 years.

How VIB Family Link credit card reduces fees, increases rewards from April 27th?

Starting from April 27, VIB Family Link cardholders will enjoy remarkable changes, including a 50% reduction in annual fees, a shift from the Smile rewards feature to a cashback points system offering up to 10% cashback, complimentary insurance packages for cardholders, and support for children’s education expenses.