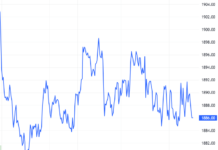

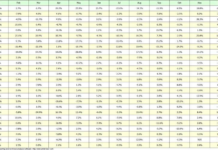

Berkshire’s investment position in Apple took a significant hit in Q2 2024, dropping by over $50 billion to $84.2 billion. Apple has been one of the largest and core holdings in Berkshire’s portfolio since the company started buying in 2016.

This isn’t the first quarter that Berkshire has unloaded Apple shares. The company began trimming its Apple position last year and accelerated the pace at the beginning of this year. In Q1 2024, Berkshire’s Apple investment stood at $135.4 billion, down from $174.3 billion at the end of 2023.

According to calculations by the Financial Times, the legendary investor’s company has sold nearly 390 million Apple shares, offloading 50% of its Apple holdings.

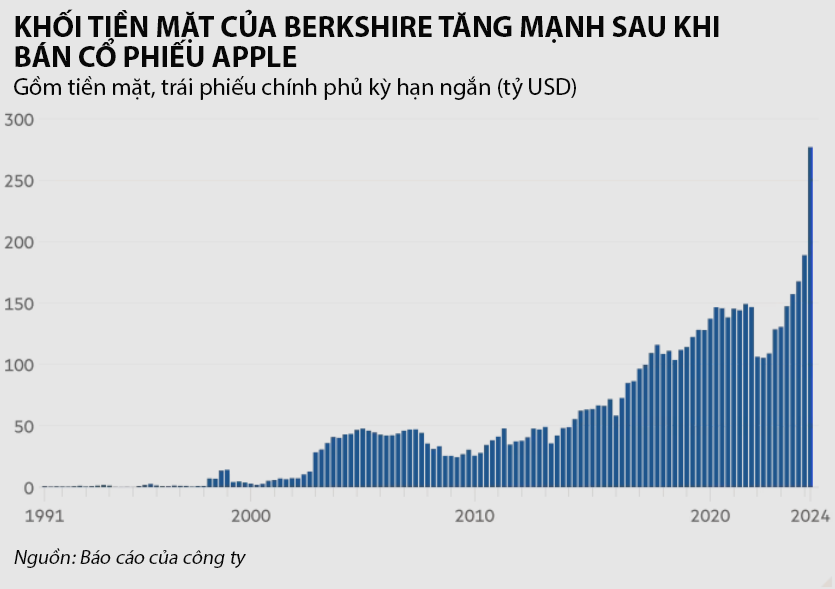

The sale of Apple shares, along with some other stock holdings in Q2, netted Berkshire a post-tax gain of $47.2 billion. The stock sales also boosted Berkshire’s cash pile to a record $277 billion, an increase of $88 billion from Q1.

In parallel with the stock sales, Berkshire has been buying short-term US government bonds.

At Berkshire’s shareholder meeting in May, Buffett emphasized that Apple remains one of the largest holdings in the company’s portfolio, alongside long-term investments in Coca-Cola and American Express.

“Unless something very unusual happens, and it would have to be very unusual, it is going to be a large investment of ours. But in terms of the market, I think I’ve sort of moved to the sidelines. At the present time, I’m looking for operations that we would buy, and we would buy them either in the stock market or we would buy them as an entire company, but we’re looking around the world,” Buffett said at the meeting.

In recent years, Apple has been one of Berkshire’s most important stock investments, as tech stocks have been a significant driver of the US stock market’s growth.

Buffett and his late partner, Charlie Munger, were once wary of investing in tech companies, as Berkshire had not fared well with tech investments in the past, notably with IBM in 2011. However, their investment strategy shifted in 2016 when Berkshire started investing heavily in Apple. According to the Financial Times, Berkshire has spent nearly $40 billion on Apple stock since then. This investment has yielded a total profit of nearly 800% to date.

“The sale of Apple shares signals that Buffett always puts a premium on valuation in his investment decisions,” said Christopher Rossbach, investment manager at J Stern & Co, and also a Berkshire shareholder. “The question now is what he will do with the cash and whether he can find other investment opportunities in the stock market or will return it to Berkshire shareholders through a buyback program.”

Jim Shanahan, an analyst at Edward Jones, noted that Buffett has mentioned one of the main reasons Berkshire is selling is the potential for higher investment profits taxes in the coming years.

In addition to the regulatory filings, Berkshire also disclosed that it continued to trim some of its other investment positions in Q3.

In recent weeks, the company sold $3.8 billion worth of Bank of America stock over 12 consecutive trading sessions. As a result, Berkshire’s ownership stake in Bank of America dropped by one percentage point to 12.1%.

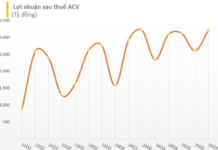

Over the past two years, Berkshire’s US government bond portfolio has generated substantial profits due to high-interest rates in the US, earning $8 billion last year and $2.6 billion in Q2 this year. In contrast, the company made only $5.4 billion in dividends from its $285 billion stock investment portfolio in 2023.

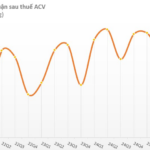

Berkshire’s operating profit for Q2 2024 rose 15% year-over-year to $11.6 billion, thanks to a rebound in its insurance business.

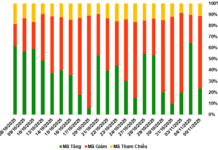

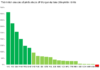

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.

Vietnam’s Largest Deep-water Port Town is Set to Become a Thriving City with Investments from Korean Chaebols: Latest Project Involves Nearly 10 Trillion VND for Fuel

Previously, this chaebol has invested $3.5 billion in projects in various major cities such as Hanoi, Ho Chi Minh City, Dong Nai, and Ba Ria – Vung Tau.