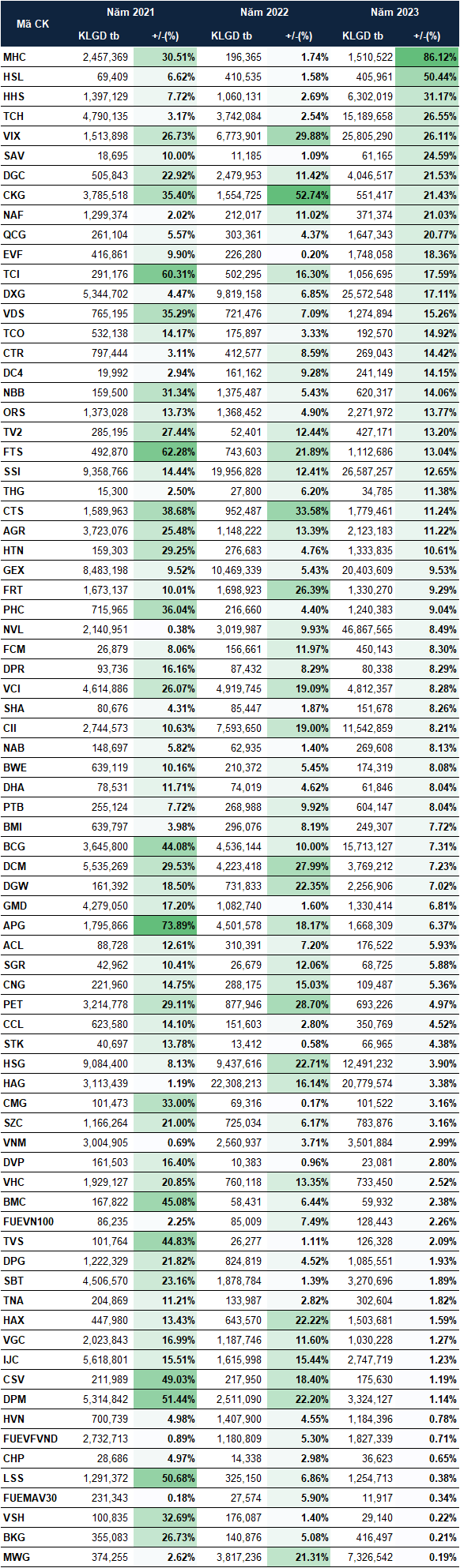

According to statistics from VietstockFinance, during the month of August over the past three consecutive years (2021-2023), the HOSE exchange witnessed 77 stocks that consistently recorded gains during this period. This included leading stocks such as: DGC, DCM, and DPM from the chemicals and fertilizers sector; HVN from the aviation industry; DGW and MWG in retail; GMD in transportation; real estate stocks NVL, CII, and DXG; VNM in the food industry; and HSG in the metal coating sector, among others.

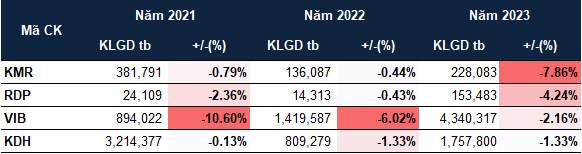

On the other hand, only four stocks experienced consistent declines during this month: KMR, RDP, VIB, and KDH.

|

Stocks on the HOSE that increased in price every August from 2021-2023

Source: VietstockFinance

|

|

Stocks on the HOSE that decreased in price every August from 2021-2023

Source: VietstockFinance

|

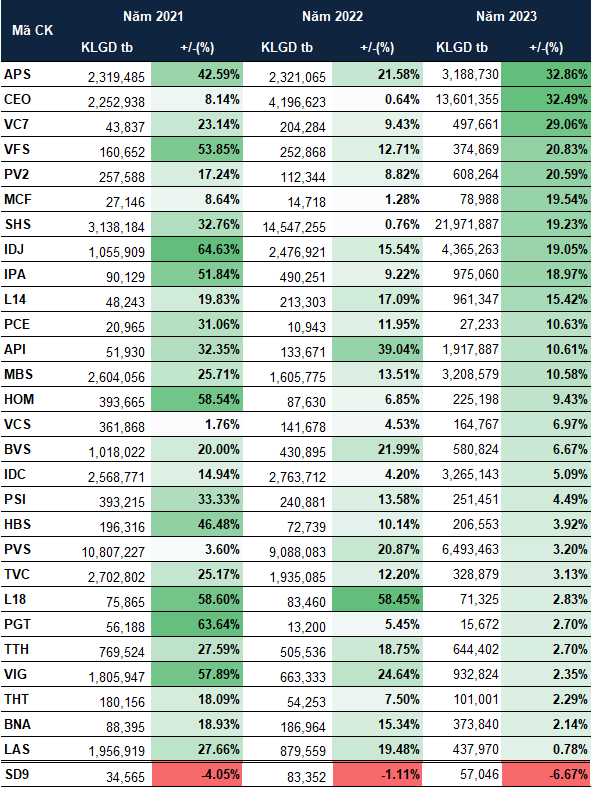

A similar trend was observed on the HNX exchange, with a dominant performance from stocks that consistently increased in price, totaling 28. Notable stocks on the exchange, such as CEO, SHS, MBS, VCS, and IDC, were among this group. In contrast, only one stock, SD9, consistently declined during this period.

|

Stocks on the HNX that increased/decreased in price every August from 2021-2023

Source: VietstockFinance

|

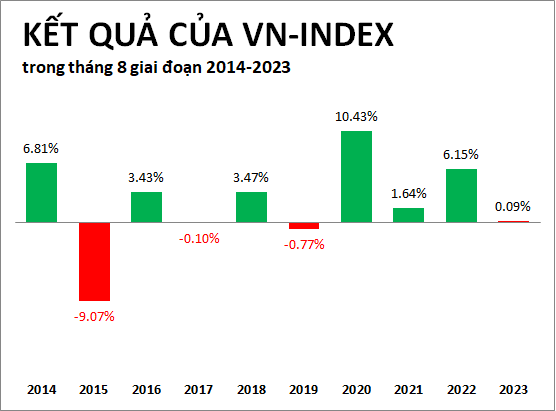

Additionally, when considering a broader timeframe of the past ten years (2014-2023), the VN-Index has ended in positive territory during the month of August for seven out of those ten years. The last time the index recorded a decline during this month was in 2019.

Source: VietstockFinance

|

With the recent conclusion of the second-quarter financial statement announcements by listed companies, investors now have additional insights into the performance of various sectors and specific businesses they are interested in.

During the Livestream Radar Investment session held on July 31st, Mr. Cao Minh Hoang, Hanoi Senior Client Director at DNSE Securities Joint Stock Company, shared his perspective. He suggested that at the current valuation levels, investors can consider investing in companies with a minimum growth rate of 20% per year. Alternatively, they can choose to wait for lower valuations before purchasing, but this may require a longer period of patience. Therefore, investors may consider a strategy of dividing their investments into two parts: one for immediate investment in solid companies and the other for investing at lower valuations in the future. However, this latter approach may require a waiting period of two to four years.

At the present time, sectors such as banking offer attractive growth prospects.

Secondly, investors can consider the port and maritime transportation sector. When the economies of major powers are on relatively equal footing, geopolitical developments can lead to disruptions in supply, causing freight rates to soar.

The third sector to consider is public investment, along with the oil and gas industry, which is expected to have a substantial workload in the next three to four years. However, investing in this sector requires a long-term perspective, and the results may take one to three years to materialize.