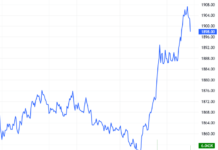

The VN-Index closed the morning session (August 5) down more than 24 points (2%) to 1,211 points. Since the previous peak, the index has corrected by almost 100 points.

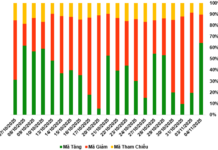

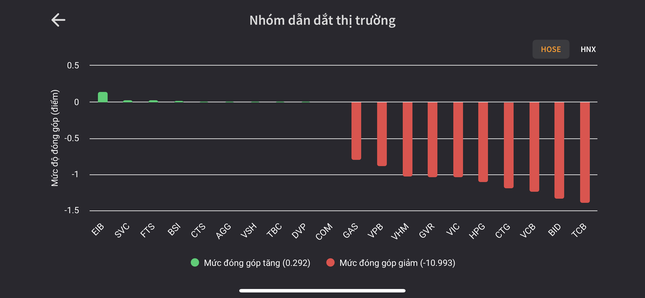

The market was painted red as all VN30 stocks witnessed price declines. The banking group caused the VN-Index to lose the most points, with TCB, BID, VCB, and CTG among the top negatively traded stocks.

Banking group caused the VN-Index to lose the most points.

Heavy selling pressure swept across most sectors, with trading value on HoSE exceeding VND6,300 billion. The market faced additional headwinds as foreign investors net sold over VND500 billion. Although there was no widespread panic selling as seen in previous sharp declines, the adjustment pressure remained significant as large-cap stocks and pillars extended their downward momentum.

The banking, real estate, securities, and steel sectors, which have a significant influence on the market, experienced strong selling pressure simultaneously. Vingroup’s stocks, including VIC, VHM, and VRE, fell by more than 2%. Except for EIB, all banking stocks listed on HoSE witnessed price declines.

The domestic market backdrop mirrored the performance of global stock markets as investors digested the newly released data showing that US jobless claims hit their highest level in nearly a year. This heightened concerns about the state of the world’s largest economy. The US Nasdaq Index has dropped by over 10% since its mid-July peak.

In Asian markets, Japan’s Topix index fell nearly 6% on August 2. South Korea’s Kospi index also dropped by more than 6%. The major indices in the Chinese market were not immune to the downward trend, with Hong Kong’s Hang Seng Index and the Shanghai Composite Index undergoing adjustments.