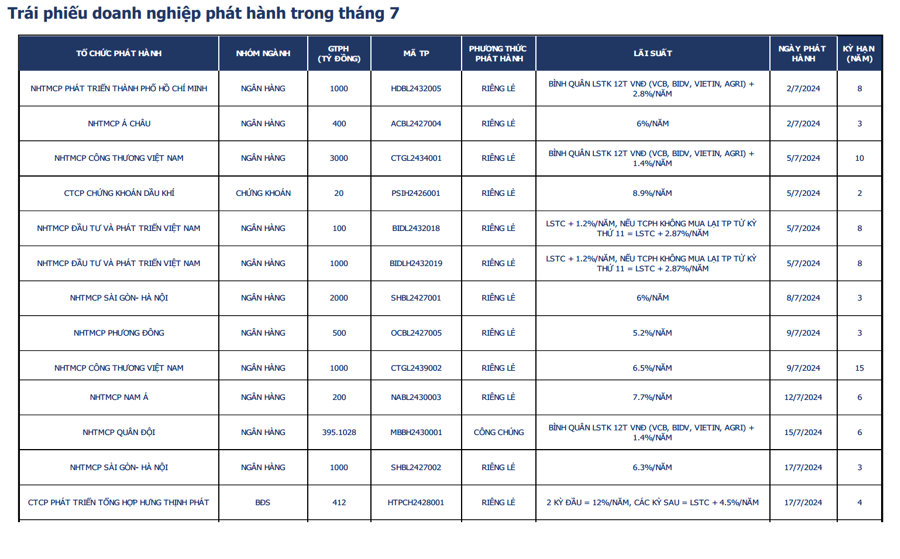

On August 5, regarding the corporate bond market situation, the Ministry of Finance reported that in July 2024 (from July 1 to July 26), there were 56 successful private corporate bond issuances, totaling approximately VND 45,000 billion. This represents a 15% decrease compared to June 2024 but a significant 57% increase from the same period in 2023.

After a subdued first quarter, the second quarter of 2024 saw a strong recovery in private corporate bond issuances, particularly from banks. Continuing this momentum, in July 2024, credit institutions accounted for the majority of issuances, with 78% of the volume and a value of VND 35,100 billion.

Banks issued bonds to increase their medium and long-term capital mobilization ratio to comply with the State Bank’s regulations on the maximum ratio of short-term capital mobilization for medium and long-term lending.

Real estate companies followed with issuances totaling VND 5,500 billion (12.1%). Enterprises in other sectors issued approximately VND 4,400 billion (9.9%).

According to the Ministry of Finance, of the total issuances, VND 6,300 billion of bonds were backed by assets, accounting for 14% of the volume. Among these, real estate companies’ bonds with guarantee clauses accounted for 86.5%, while credit institutions’ bonds were unsecured.

“In the first seven months of 2024, there were 174 successful private corporate bond issuances, totaling VND 161,500 billion, a 2.6-fold increase compared to the same period in 2023.”

Report from the Ministry of Finance

Overall, in the first seven months of the year, credit institutions dominated the issuance landscape, with more than VND 109,000 billion in issuances, accounting for 67.5% of the total volume. Real estate companies, on the other hand, issued nearly VND 38,700 billion, making up 24% of the total volume. Prior to the crisis, these two sectors were neck-and-neck in terms of bond issuance volume.

Real estate companies continue to offer some of the highest interest rates in the market, with an average of 12%/year for short-term bonds.

In the same period, enterprises in other sectors issued bonds totaling VND 13,800 billion, accounting for 8.5% of the total volume.

Regarding secured bonds, the Ministry of Finance reported that approximately VND 24,000 billion of bonds were issued with guarantee clauses, representing 14.9% of the total volume. Real estate companies’ bonds with guarantee clauses accounted for 84.4% of this figure, while credit institutions’ bonds were unsecured.

The Ministry of Finance also reported that the volume of early bond repurchases was VND 88,800 billion, a 36% decrease compared to the same period in 2023.

In terms of the secondary market, the Ministry of Finance shared that in the first seven months of 2024, the total trading value reached VND 566,857 billion, with an average trading value of approximately VND 4,049 billion per session.

The liquidity of the private corporate bond market has improved significantly since the launch of the private corporate bond trading system one year ago (July 19, 2023). The average trading value in the first month of the system’s operation was VND 250.6 billion per session, increasing to VND 1,880.6 billion per session by the end of 2023. By the end of June 2024, the average trading value of private corporate bonds had reached VND 4,092.9 billion per session.

The private corporate bond trading system has been operating smoothly and securely, and the market size has regained its growth trajectory. At the launch of the system, the market included 19 private corporate bond codes from 3 issuing organizations, with a total registered trading value of VND 9,060 billion.

By the end of 2023, the system had 887 bond codes from 249 issuing organizations, with a registered trading value of VND 617,610.1 billion. By the end of the second quarter of 2024, the market size had grown to 997 bond codes from 259 issuing organizations, with a registered trading value of nearly VND 706,236.3 billion.

Concurrently, the number of trading members in the private corporate bond market has also increased rapidly. Starting with 5 trading members at the launch, the market had 36 trading members by the end of 2023. As of the second quarter of 2024, there are 48 trading members, including 44 securities companies and 4 commercial banks. Among them, 45 out of 48 members have traded on the Hanoi Stock Exchange (HNX) system.

Statistics on private corporate bond trading from the system’s launch to June 30, 2024, show that the most traded bonds were those issued by credit institutions, accounting for 45.71% of the total market value, equivalent to a trading value of VND 324,246 billion. Bonds issued by real estate companies accounted for approximately 30% of the market’s trading value, equivalent to a trading value of VND 212,577 billion.

The development of the secondary market has also facilitated enterprises’ capital mobilization in the primary market, contributing to the healthy and sustainable development of the primary market.

Bond Market: Investing in “Gold Bonds” despite interest rates lower than 0.5 – 1%

Positive actions from the issuing organization and policies from regulatory agencies have indicated that the most difficult period for the corporate bond market has passed. Despite challenges, the corporate bond market is reemerging as a highly promising investment product.