Illustrative image

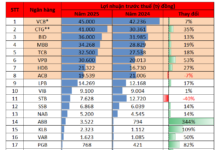

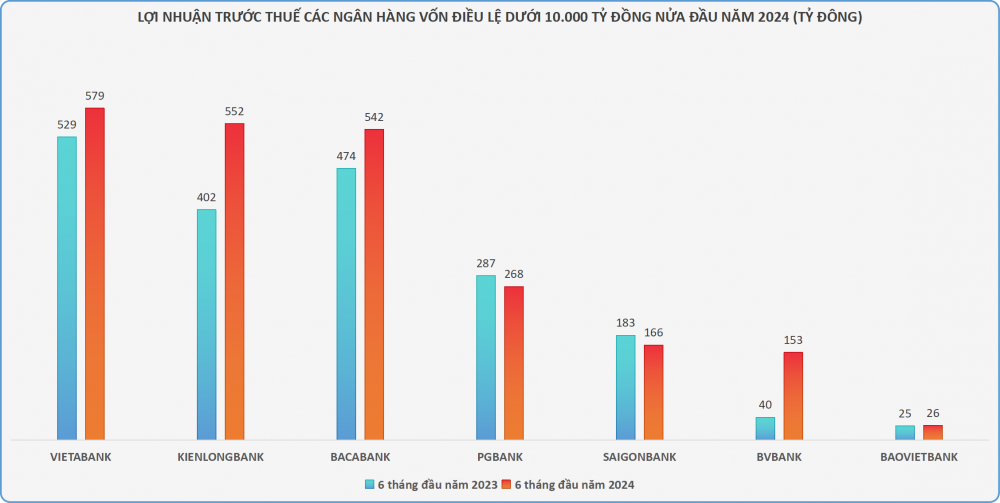

The financial reports of 28 listed banks showed positive results for the first half of 2024. While some banks boasted impressive pre-tax profits, such as Vietcombank (20,835 billion VND), Techcombank (15,628 billion VND), BIDV (15,549 billion VND), MB (13,428 billion VND), VietinBank (12,960 billion VND), and ACB (10,490 billion VND), there were also 10 banks with pre-tax profits below 600 billion VND. This group primarily consisted of smaller banks with chartered capital below 10 trillion VND.

One such bank is the Vietnam Commercial Joint Stock Bank (BVBank), which earned nearly 1.2 trillion VND in total operating income in the first six months of this year, a 46% increase compared to the same period last year. BVBank’s main growth driver remains its core lending business, with net interest income increasing by 57% to over 1 trillion VND. Similarly, its foreign exchange business thrived with a 65% increase thanks to a significant rise in foreign exchange transactions.

However, a nearly threefold increase in credit risk provisions significantly eroded BVBank’s profits for the first half of the year. Overall, BVBank reported a pre-tax profit of 153 billion VND for the six-month period, 3.8 times higher than the low base of the previous year.

The bank’s total non-performing loans (NPLs) as of the end of Q2/2024 stood at 2,249 billion VND, a 17% increase from the beginning of the year. Consequently, the NPL ratio increased from 3.31% at the start of the year to 3.77%.

Similarly, Kienlong Commercial Joint Stock Bank (KienlongBank) recorded a 72% increase in profits compared to the same period, reaching 552 billion VND and completing 69% of the plan approved by the Annual General Meeting of Shareholders. In Q2 alone, KienlongBank’s net interest income reached 919 billion VND, more than double that of the same period last year.

Service income for the quarter was 121 billion VND, a 28.37% increase. However, KienlongBank recorded a loss of 6.1 billion VND in foreign exchange trading, compared to a profit of 17.6 billion VND in the previous year. Additionally, income from investing in securities decreased by half to 3.5 billion VND in Q2/2024.

Notably, KienlongBank also had to increase its credit risk provisions by 23.9 times compared to the same period last year, reaching 244.3 billion VND. For the six-month period, the bank’s total provisions amounted to 355.9 billion VND, 3.6 times higher than the previous year.

As of June 30, 2024, KienlongBank’s performing loans stood at 55,310 billion VND, a 10.27% increase from the beginning of the year. Loans requiring attention decreased by 14.29% to 534 billion VND, while substandard loans decreased by more than half to 106 billion VND. Meanwhile, doubtful loans increased to 358 billion VND, and loss loans reached 664 billion VND, a 47.23% increase.

KienlongBank’s NPL ratio as of June 30 was 1.98%, slightly higher than the 1.93% at the beginning of the year.

Bac A Commercial Joint Stock Bank (BacABank) reported an 88% increase in net operating income, reaching 324 billion VND. During this period, the bank set aside 132 billion VND for credit risk provisions, 3.4 times higher than the previous year. Pre-tax profit for Q2/2024 exceeded 203 billion VND, a 46% increase compared to the same period last year.

For the first six months of the year, BacABank reported a pre-tax profit of nearly 542 billion VND, a 14% increase year-on-year, achieving 49% of its annual target.

As of June 30, 2024, BacABank’s total assets increased slightly by 1% from the beginning of the year to 154,482 billion VND. While loans to customers increased by 2% to 102,131 billion VND, customer deposits also rose by 1% to 119,743 billion VND.

Notably, the bank’s total NPLs as of the end of Q2/2024 increased by 65% compared to the beginning of the year, reaching 1,513 billion VND. Consequently, the NPL ratio increased from 0.92% at the start of the year to 1.48%.

Other banks with chartered capital below 10 trillion VND, including VietABank, PGBank, SaigonBank, and Baoviet Bank, also faced higher credit risk provisions in the first half of the year compared to the same period last year due to rising NPLs.

VietABank and Baoviet Bank reported modest profit growth, with VietABank achieving 579 billion VND (+9%) and Baoviet Bank reaching 26 billion VND (+3%). On the other hand, PGBank and SaigonBank experienced negative growth, with PGBank’s profit decreasing by 7% to 268 billion VND and SaigonBank’s profit dropping by 9% to 166 billion VND.

Notably, PGBank was the only bank in this group to record a decrease in total NPLs. By the end of Q2/2024, PGBank’s NPLs had decreased by 5% compared to the beginning of the year, reaching 958 billion VND. As a result, the NPL ratio improved from 2.85% at the start of the year to 2.61%.

For the first six months of 2024, PGBank’s net interest income reached 815 billion VND, and its pre-tax profit was 268 billion VND, representing a 20% increase and a 6.6% decrease, respectively, compared to the same period last year. The bank has achieved 48% of its profit plan set at the Annual General Meeting of Shareholders.

Many experts predict that the banking industry will continue to face challenges and see a further divide this year.

Specifically, Dragon Capital Securities Company (VDSC) forecasts that 2024 will be another challenging year for the industry, but some organizations will witness improved profit growth.

Most recently, MBS Research predicted that net interest margins (NIMs) for banks will continue to face downward pressure as lending rates are expected to decrease further, while deposit rates have already risen slightly. Non-interest income remains subdued and is unlikely to recover, relying mainly on fee and debt handling activities.

At the same time, credit risk provisions are expected to continue rising as NPLs showed signs of increasing in Q2. In response, banks will restructure loans and seek ways to support businesses in handling difficult-to-recover NPLs.