The Vietnamese stock market recently experienced a sharp decline, mirroring the downward trend seen in regional equity markets. The VN-Index plummeted by 48.53 points (-3.92%) to 1,188.07 points, marking its biggest drop since mid-April 2024. This downward momentum pushed the index to its lowest level in over three months.

This was the tenth time the VN-Index fell below the 1,200 mark since it first crossed this threshold in early April 2018. Historically, the VN-Index has only briefly remained above the 1,200 level. The longest period it sustained this level was from April 2021 to mid-May 2022, while most other instances were measured in weeks.

On the other hand, the VN-Index has often lingered below the 1,200 mark for extended periods, sometimes lasting several months or even years. The longest stretch was from its first official breach of 1,200 in early April 2018 to early April 2021, a full three years before “stock scholars” in Vietnam witnessed this level again.

While the VN-Index’s oscillation around the 1,200 mark has become a familiar story for Vietnamese stock investors in recent years, the recent acceleration of declines may have come as a shock. Geopolitical tensions in the Middle East and Japan’s unexpected policy reversal could have contributed to the market’s psychological impact. However, the extent of their influence on Vietnam’s stock market still needs further assessment.

Selling pressure may intensify in the short term due to margin calls, but the market outlook for the second half of the year remains optimistic. According to Mr. Bui Van Huy, Branch Director of DSC Securities, three major narratives will impact the market for the remainder of the year: (1) relaxed economic policies, (2) economic recovery momentum, and (3) the story of upgrading. Among these, the economic recovery momentum and the prospect of upgrading will become more apparent.

Investors are advised to focus on leading, high-quality stocks to capitalize on profit recovery momentum. Sectors that stand to benefit from the economic rebound include banking, financial services, consumer goods, construction materials, basic resources, and retail. It is recommended to avoid fundamentally weak stocks at this time.

Sharing this view, Mr. Tran Truong Manh Hieu, Head of KIS Securities’ Analysis Division, believes that money is still in the market, waiting for an appropriate time to reinvest. “The possibility of money shifting from the stock market to other investment channels is very low. After a hot period, the gold market has not seen significant movements, real estate has not yet recovered, and deposit interest rates remain low, making these channels less attractive for large sums of money from the stock market”, he added.

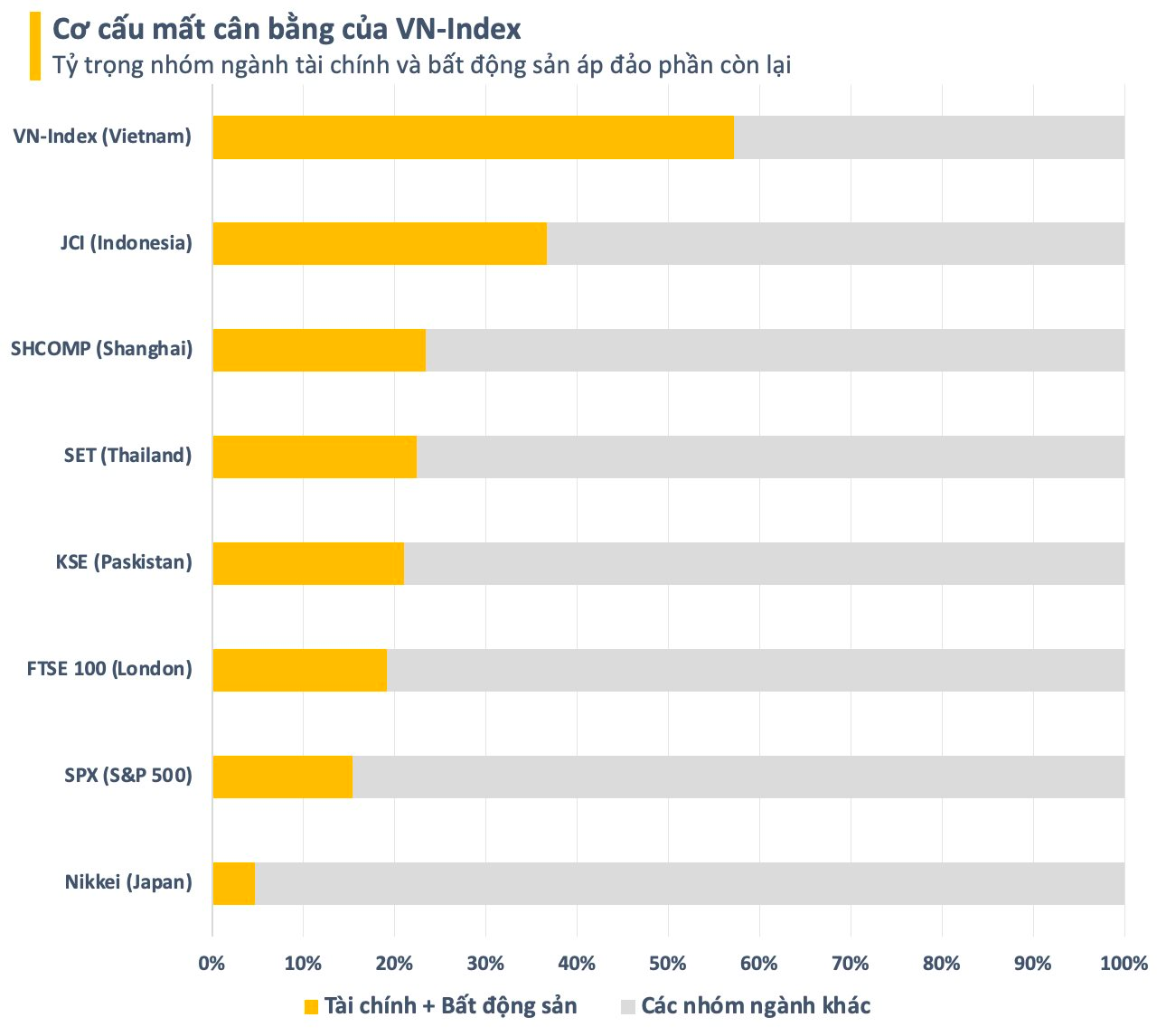

While the outlook is optimistic, it is challenging to expect the VN-Index to break out of the “vicious cycle” around the 1,200-point mark due to the increasing market polarization. The market structure is undergoing a certain shift towards greater sectoral diversity. However, the financial and real estate sectors still dominate, and this situation is expected to persist in the short term. These two sectors are assessed to have knots that cannot be untied in the short term, related to the real estate market.

This dynamic hinders the market’s long-term upward momentum. “Hot” sectors like technology, telecommunications, retail, healthcare, and energy still account for a modest proportion. Additionally, representative stocks from these sectors have already experienced robust gains earlier and require time for valuations to return to more balanced levels.