The Vietnamese stock market opened the week on a disappointing note, with a sea of red dominating the trading session on August 5th. Out of all the stocks, 854 declined, with 84 hitting the daily limit down. The VN-Index once again breached the psychological level of 1,200 points, closing at 1,188.07, a loss of 48.53 points or 3.92%.

In terms of points lost, this was the second time the benchmark index dropped by more than 40 points since the beginning of 2024 (the first being on April 15th, when it fell by nearly 60 points). Trading liquidity on the HoSE improved, with the matching value reaching over 22 trillion VND, a 40% increase compared to the previous session. The absence of foreign capital inflows further weakened the overall market sentiment. During the session, foreign investors net sold over 730 billion VND on the HoSE.

Real estate, banking, securities, steel, oil and gas, and fertilizer stocks all witnessed substantial declines, with numerous stocks even hitting the daily limit down and many seeing no buyers.

The sharp decline wiped off more than 198 trillion VND (approximately 8 billion USD) in market capitalization from the HoSE. As of August 5th, the total market capitalization of the HoSE stood at 4,860 trillion VND.

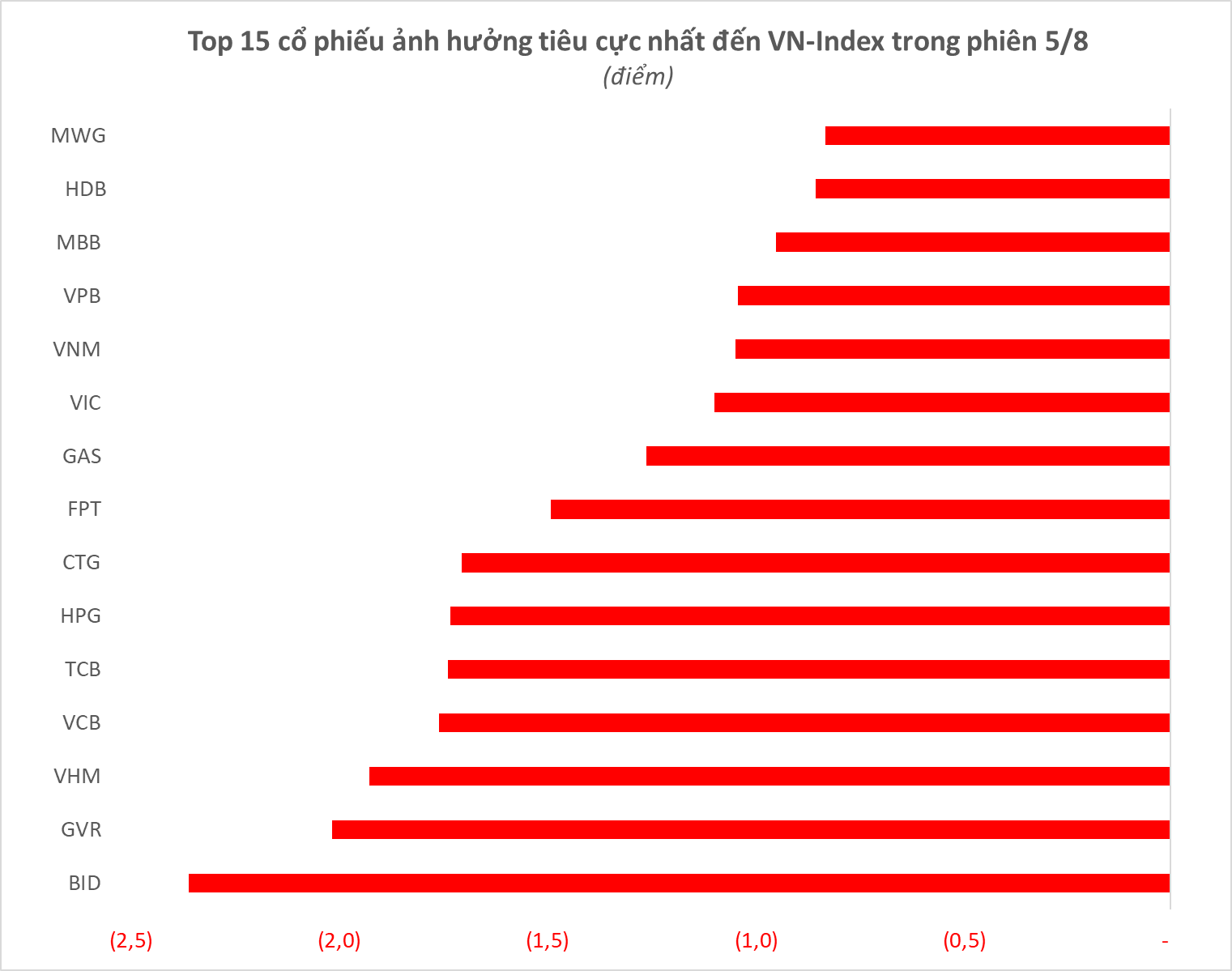

In terms of impact, two large-cap stocks in the VN30 basket, BID and GVR, were the biggest culprits for the VN-Index’s decline, together accounting for a loss of 4.4 points. GVR plunged by its daily limit of 7% to 30,100 VND per share, while BID fell by 3.5% to 46,100 VND per share.

Other VN30 constituents also exerted significant downward pressure on the market, with VHM erasing nearly 2 points from the index as it dropped by over 4% during the session. Major banks such as VCB and TCB witnessed sharp declines, resulting in a loss of nearly 2 points for the index.

The substantial declines across these large-cap stocks, which represent the biggest sectors in the stock market at present, highlight the negative sentiment prevailing in the market. The top 15 stocks that had a negative impact on the VN-Index during this sharp decline also included HPG, CTG, GAS, FPT, VIC, and VNM, among others.

On the flip side, a few stocks managed to stay in the green, including two securities stocks, BSI and FTS, along with some midcap stocks like SVC, HRC, TNC, and COM. However, their gains were negligible compared to the overall downward trend.

According to Mr. Bui Van Huy, Branch Director of DSC Securities, the sharp declines in regional markets significantly influenced the Vietnamese stock market. August 5th witnessed a broad-based sell-off across stock markets in the Asia-Pacific region, with Japan’s Nikkei index closing 4,389.5 points lower, a drop of 13.47%, and South Korea’s Kospi index falling by 234.62 points or 8.77%.

On the domestic front, however, the macroeconomic landscape remains relatively positive, with economic data indicating a strong and steady recovery. This provides an important foundation for the market.

Nevertheless, the second-quarter earnings season has come to an end, and the market is now entering a period of sparse information and a lack of new catalysts. This has made investors more cautious.

Mr. Huy believes that the current situation presents a good opportunity for investors to assess the prospects for corporate profit recovery in the latter part of the year, aligning with a long-term investment mindset. He highlights three key narratives that will have a pervasive impact on the market in the second half of the year: (1) accommodative economic policies, (2) economic recovery momentum, and (3) the potential for an upgrade in Vietnam’s market status. Among these, the economic recovery and the prospect of an upgrade are expected to become more apparent.

Investors are advised to focus on leading stocks with strong fundamentals that stand to benefit from the economic recovery, while avoiding stocks with weak fundamentals for the time being.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”