Aside from investing in business development and contributing to the country’s economic growth and job creation, community engagement and social initiatives, paying taxes is also a significant way for enterprises to demonstrate their commitment to the nation’s progress.

Currently, there are several honorary boards for businesses, but none specifically recognize their tax contributions. In reality, enterprises annually pay taxes that encompass a wide range of fees and duties.

CaféF aims to bridge this gap by creating a list of the top tax-contributing enterprises in the country, starting with PRIVATE 100 – TOP PRIVATE ENTERPRISES WITH THE LARGEST TAX CONTRIBUTION IN VIETNAM. This list will highlight private enterprises with a tax contribution of 100 billion VND or more in the latest fiscal year.

The table below showcases the top 10 private securities companies with the largest tax contributions, which is an extract from the aforementioned list. A similar list for private banks was also published last week.

A consolidated analysis reveals that for the securities sector, the primary taxes paid are corporate income tax and personal income tax (for employees and investors).

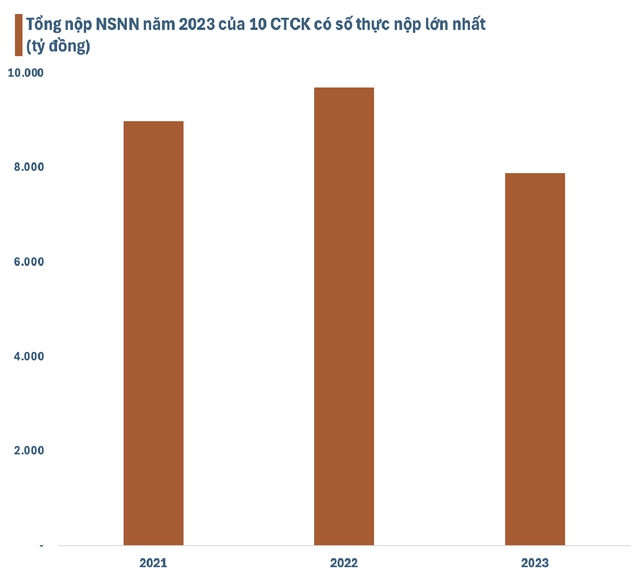

As one of the vital drivers of the economy, securities companies have made, and continue to make, significant contributions to the state budget. Consolidated data from audited consolidated financial statements show that in 2023, the top 10 securities companies contributed a total of nearly VND 7,900 billion to the state budget.

2023 was a year of turmoil for the stock market, and securities companies faced numerous challenges due to unpredictable external factors. However, their agility and prudent business strategies helped them overcome these difficulties and achieve commendable results.

In 2023, the securities companies’ estimated pre-tax profit reached nearly VND 22,000 billion, a 40% increase compared to 2022. Thus, the state budget contributions (including corporate income tax, personal income tax, VAT, and contractor tax) of the top 10 securities companies alone accounted for nearly 36% of the industry’s total profit.

Consolidated data from the 2023 consolidated financial statements reveal that the top 10 securities companies in terms of state budget contributions are VPS, TCBS, SSI, VNDirect, HSC, Vietcap, VPBankS, HDBS, TPS, and ACBS. Notably, the top three companies each contributed over VND 1,000 billion in 2023.

This reflects the securities companies’ dedication to fulfilling their legal and social responsibilities and their commitment to sustainable community development. It also underscores the vital role of securities companies in contributing to the country’s economic and social stability and growth.

By upholding transparency and integrity in their tax payments, securities companies not only build trust with their customers and the community but also enhance their reputation among shareholders. The tax revenues are channeled into the national budget to support critical areas such as education, healthcare, infrastructure, and national defense, ultimately contributing to the country’s socioeconomic development.

In reality, the securities sector is quite unique, with a history spanning almost three decades but only experiencing a boom in the last few years. The influx of new investors since 2020 has transformed the industry, bringing unprecedented vibrancy to the stock market and creating a conducive environment for securities companies to thrive and solidify their position.

Considering Vietnam’s population of nearly 100 million, the number of securities investors is still modest, indicating significant room for growth in the future. Moreover, the securities market is one of the most crucial capital mobilization channels for the economy, alongside bank credit. The role of securities companies will become increasingly vital, especially with Vietnam’s market upgrade from frontier to emerging status.

Thanks to the efforts of regulatory authorities and market members, the upgrade process is progressing positively. A successful market upgrade is expected to usher in a new era for Vietnam’s securities industry, providing a boost for securities companies to achieve breakthrough growth and further enhance their state budget contributions in the future.

According to the Ministry of Finance, personal income tax revenue for the first seven months of 2024 is estimated at approximately VND 114,687 billion, reaching 72% of the estimate and a 15% increase compared to the same period last year. This growth is attributed mainly to taxes on real estate and securities transfers, which increased by 65% and 32%, respectively.

Personal income tax is one of 14 tax items that have achieved over 65% of the annual plan. Some other tax items with considerable progress include lottery tax, reaching VND 32,700 billion, and revenue from the state budget invested in economic organizations, amounting to approximately VND 17,700 billion. Cumulatively, for the first seven months of the year, the total tax revenue managed by the tax industry exceeded VND 1 quadrillion, a nearly 15% increase compared to the same period.

PRIVATE 100 – Top Doanh nghiệp tư nhân nộp ngân sách lớn nhất Việt Nam (PRIVATE 100 – Vietnam’s Top Private Enterprises in Tax Contribution) is a list compiled by CafeF based on publicly available information or verifiable data. It reflects the total actual tax payments made by enterprises, including various taxes and duties. Enterprises with a tax contribution of 100 billion VND or more in the latest fiscal year are eligible for inclusion in this list. Some notable companies in the 2024 list, showcasing their 2023 fiscal year contributions, include ACB, HDBank, LPBank, Masan Group, OCB, PNJ, SHB, SSI, Techcombank, TPBank, Hoa Phat Group, VNG, VPBank, VIB, VietBank, and VPS (listed in alphabetical order)