The VN-Index ended July at 1,251 points, a slight decrease of 0.3%, with average liquidity on the three exchanges down nearly 12% from the previous month. In its latest report, Agriseco Securities observed that the Q2 profit picture was gradually taking shape and showed positive signals with a 25.6% increase over the same period in 2023 and a 12.8% increase over the previous quarter.

After the recent adjustment, positive factors supporting the market in the next phase include the Fed’s likely rate cut at the September meeting, reducing pressure on exchange rates and net outflows of foreign investment. In addition, the macro economy continues to recover, exports are favorable, and policies such as VAT reduction and base salary increase for the public sector can stimulate consumption and are expected to positively support the market in the coming time.

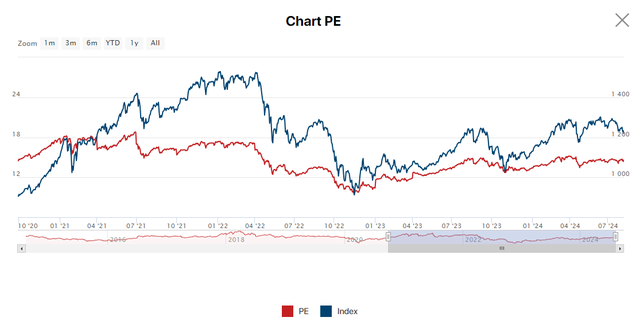

With profit growth in Q2 and positive prospects in the coming quarters, the P/E for 2024 of the VN-Index is estimated at 11.7 times, which is relatively attractive compared to the 13.7 times average of the past five years.

Based on the above analysis, Agriseco Research identifies potential stocks for August, prioritizing companies with expected business results in the second half of 2024 with good growth, reasonable valuation, or belonging to industries that benefit from economic support policies.

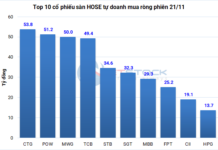

In the steel industry, Agriseco expects Hòa Phát Group (HPG)’s consumption volume to continue to improve, mainly contributed by domestic construction steel. According to the Vietnam Steel Association, the construction industry’s growth in the first six months reached 7.34% over the same period last year, and the real estate market in Q2/2024 continued to show recovery signals with supply tripling and transactions doubling compared to the previous quarter.

In addition, the amended laws, including the Land Law, Housing Law, and Real Estate Business Law, which took effect on August 1, 2024, are expected to increase the real estate supply, thereby increasing domestic construction steel consumption.

Moreover, the gross profit margin is forecast to improve in the coming quarters due to the decrease in raw material input prices. Since the beginning of the year, coking coal and iron ore prices have been on a downward trend due to weak consumption in China. Meanwhile, domestic steel prices have only slightly decreased and are expected to rise again in the second half of 2024 due to real estate market demand, improving profit margins for businesses.

In the retail group, The Gioi Di Dong (MWG) remains on Agriseco’s August recommendation list. The growth highlight is the Bach Hoa Xanh chain, which achieved a record revenue in Q2/2024. In the first six months of 2024, the chain’s revenue reached VND 19,400 billion (+42% year-on-year). Although no new stores were opened continuously, BHX still grew in revenue, indicating that operational efficiency has improved significantly after restructuring.

In June alone, BHX’s average revenue per store reached VND 2.1 billion/store/month, continuing to improve from VND 2.0 billion/store/month in the previous month and setting a record high. As a result, the BHX chain also made a profit in Q2/2024.

For the The Gioi Di Dong chain (including Topzone) and Dien May Xanh, the two chains’ revenue reached nearly VND 44,867 billion, and gross profit reached VND 8,825 billion in the first half, up 7.2% and 30%, respectively, compared to the same period last year. The ICT segment’s gross profit margin improved significantly thanks to the restructuring campaign at the stores. Although the number of stores decreased from the beginning of 2024, with the closure of 22 TGDĐ stores and 97 ĐMX stores, business efficiency soared with revenue and profit growth and improved profit margins.

On the other hand, the analyst team assessed that the drilling rig rental price is expected to continue to increase, supporting the profit margin of PetroVietnam Drilling & Well Services Corporation (PVD) in the second half of the year. Specifically, the market for self-elevating drilling rigs has become scarce as Saudi Aramco decided to reduce the number of self-elevating drilling rigs, leading to a drop in global supply. In addition, the trend of transferring rigs to the Middle East in 2022-2023 also reduced supply in the Asian region. At the same time, escalating geopolitical tensions disrupted exploration and exploitation activities in major producing regions, keeping oil prices high in 2024.

Another driving force comes from the expected boom in exploration and exploitation activities as the global economy recovers. With its position as the leading company in the field of drilling and oil and gas drilling services under the Vietnam National Oil and Gas Group, Agriseco evaluates PVD’s high potential to win bids for major domestic exploration and exploitation projects such as Lac Da Vang and Su Tu Trang, especially Lot B, for which the final decision is expected in Q3/2024.

Recently, PVD also purchased a new well repair equipment package, which will help the company become self-sufficient in equipment and technology and increase its market share in the region.

Another enterprise highly valued by Agriseco Research thanks to positive export market prospects is Phu Tai Joint Stock Company (PTB). With the Fed likely to cut interest rates in September 2024 and demand in the US market recovering, orders for wood and wood products are expected to continue to increase as inventories are at low levels in this market.

Moreover, Phu Tai has increased the capacity of the stone segment at the Dong Nai Quartz Stone Factory. Agriseco believes that this can be considered a proactive move by PTB to anticipate demand recovery and boost exports to the US after its competitors in China were subject to trade remedy taxes. In addition, PTB also plans to supply stone for the Long Thanh Airport project. If successful, it is expected to bring positive growth momentum to the enterprise in the future.

In the industrial real estate group, the IDC Corporation (IDC) is named thanks to the expectation of maintaining positive industrial park leasing activities in the second half of the year. Accordingly, Agriseco Research forecasts that the revenue of this segment will increase positively due to the large area of signed memoranda that have not been recognized in large industrial park projects, and rental prices are expected to increase by 7-10% over the same period.

In addition, the growth momentum also comes from the real estate and electricity segments. In the coming quarters, the real estate segment is expected to continue to recognize the handover of the remaining area of 0.73ha of the Tan An Residential Area project to Aeon Mall and hand over the Osaka Garden project – Bac Chau Giang Urban Area. The electricity segment increased by 9% and is expected to remain stable due to the recovery of hydropower and electricity transmission at the substations.

In the financial group, this securities company mentions Asia Commercial Joint Stock Bank (ACB). The driving factors include positive business results in the first half of 2024, with high credit and deposit growth and improved asset quality. Deposit growth in the first six months reached 6.0%, higher than the system-wide growth rate of about 2.0%. In addition, ACB’s CASA ratio in Q2/2024 improved to 21.6%.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.