The VN-Index plummeted by 48 points, breaching the 1,200 mark after a series of losses in July, amounting to a 0.3% decrease. However, Agriseco Securities predicts several supportive factors for the market as we enter August.

Firstly, the Fed is likely to cut interest rates at its September meeting, easing pressure on exchange rates and mitigating net outflows from foreign investors. Secondly, the macro economy continues to recover, and export activities are promising. Additionally, policies such as VAT reductions and increased base salaries for the public sector are expected to stimulate consumer demand.

The Q2 profit picture is gradually taking shape and showing positive signals, with a 25.6% increase compared to the same period in 2023 and a 12.8% rise from the previous quarter. With profit growth in Q2 and positive prospects for the upcoming quarters, the P/E ratio for 2024 of the VN-Index is estimated at 11.7 times, which is relatively attractive compared to the five-year average of 13.7 times.

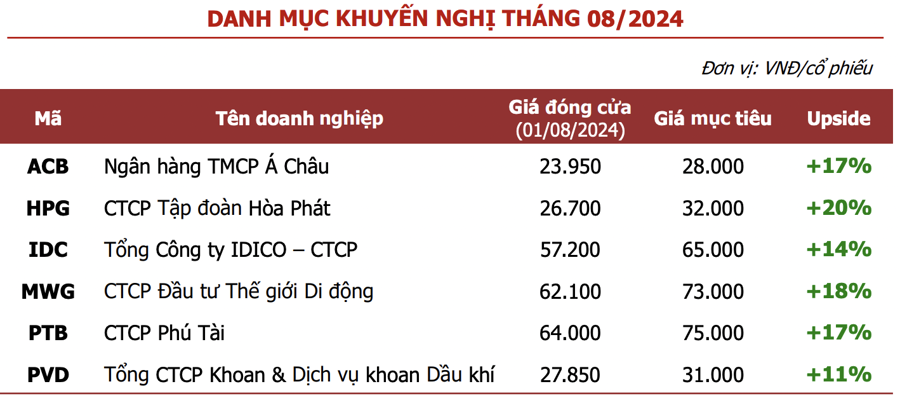

Based on this, Agriseco has selected five potential stocks based on expectations of strong business performance growth in the second half of 2024, reasonable valuations, or belonging to industries that benefit from supportive economic policies.

In the banking sector, ACB is highlighted. ACB reported a 5% increase in pre-tax profit for the first six months of 2024, amounting to VND 10,500 billion, attributed to an 11% rise in NII and a 13% increase in NFI. The high credit growth in the first half of 2024 will positively impact ACB’s NII in the second half, leading to expectations of an improved NIM of 4% for the full year.

Currently, ACB stock is trading at a P/B valuation of 1.4x, which is attractive compared to the five-year average, and the bank boasts a high profitability ratio with a 25% ROE in 2023.

In the steel industry, Agriseco anticipates improved consumption for Hoa Phat Group (HPG), mainly driven by domestic construction steel.

According to the Vietnam Steel Association, the construction sector grew by 7.34% in the first six months compared to the same period last year. Additionally, the Q2/2024 real estate market witnessed a recovery in supply, tripling the previous quarter’s volume, and a 2.4-fold increase in transactions.

Moreover, amended laws, including the Land Law, Housing Law, and Real Estate Business Law, which came into effect on August 1, 2024, are expected to boost the real estate supply, subsequently increasing domestic demand for construction steel.

Furthermore, the gross profit margin is forecasted to improve in the coming quarters due to decreasing input material prices. Since the beginning of the year, coking coal and iron ore prices have been on a downward trend due to weak consumption in China. Meanwhile, domestic steel prices have only slightly decreased and are projected to rise in the second half of 2024 due to real estate market demand, enhancing profit margins for businesses.

In the industrial real estate sector, IDC recorded impressive results in the first six months of 2024, with revenue reaching VND 4,615 billion, a 30% increase, and after-tax profit soaring by 65% to VND 1,381 billion.

The remarkable performance was driven by a nearly sevenfold year-on-year surge in revenue from the real estate segment (VND 369 billion) due to the transfer of 1.45 hectares of land to Aeon Mall. In the upcoming quarters, the real estate segment is expected to continue its growth trajectory with the handover of the remaining 0.73 hectares of the Tan An Residential Area project to Aeon Mall and the completion of the Osaka Garden project in Bac Chau Giang Urban Area. The electricity segment also contributed to IDC’s success, with a 9% increase in revenue, which is projected to remain stable due to improved hydropower generation and electricity transmission at substations.

In the retail sector, MWG stands out with its compelling story of Bach Hoa Xanh, a chain that achieved a record sales figure of VND 2.1 billion per store per month and turned profitable in Q2/2024. Bach Hoa Xanh continues to be a growth driver for the entire company, evident in its 42% increase in revenue to VND 19,400 billion in the first six months of 2024. Despite not continuously opening new stores, Bach Hoa Xanh’s revenue growth demonstrates significant improvements in operational efficiency following its restructuring.

In the export sector, PTB, a wood industry leader, is highlighted. In the first six months of 2024, the export value of wood and wood products exceeded USD 7.15 billion, a 20% increase. In the key market of the US, wood exports reached USD 4.05 billion, a 24% jump. With expectations of a Fed rate cut in September 2024 and a recovering US market, wood orders are anticipated to continue rising as inventories remain low.

Additionally, PTB’s quartz stone business is expected to benefit from increased capacity. In Q4/2023, Phu Tai raised the capacity of its Dong Nai quartz stone factory from 200,000 tons/year to 450,000 tons/year, a strategic move to anticipate PTB’s recovery and boost exports to the US, especially with Chinese competitors facing trade remedy taxes. Furthermore, PTB is also bidding to supply stone for the Long Thanh Airport project, which could provide significant growth momentum if successful.

Lastly, PVD is highlighted in the oil drilling sector. The rental rates for drilling rigs are predicted to remain high, supporting the company’s profit margins in the second half of the year due to several factors. Firstly, there is a scarcity of self-elevating drilling rigs globally, exacerbated by Saudi Aramco’s recent decision to reduce the number of rigs. Additionally, the shift of rigs to the Middle East region during 2022-2023 has contributed to a decrease in supply in the Asian market.

Escalating geopolitical tensions have disrupted exploration and exploitation activities in major production regions, keeping oil prices elevated throughout 2024. As the global economy recovers, exploration and exploitation activities are expected to intensify. Currently, 5 out of 6 PVD rigs have secured contracts through 2025, ensuring stable revenue for the company in the near future.