|

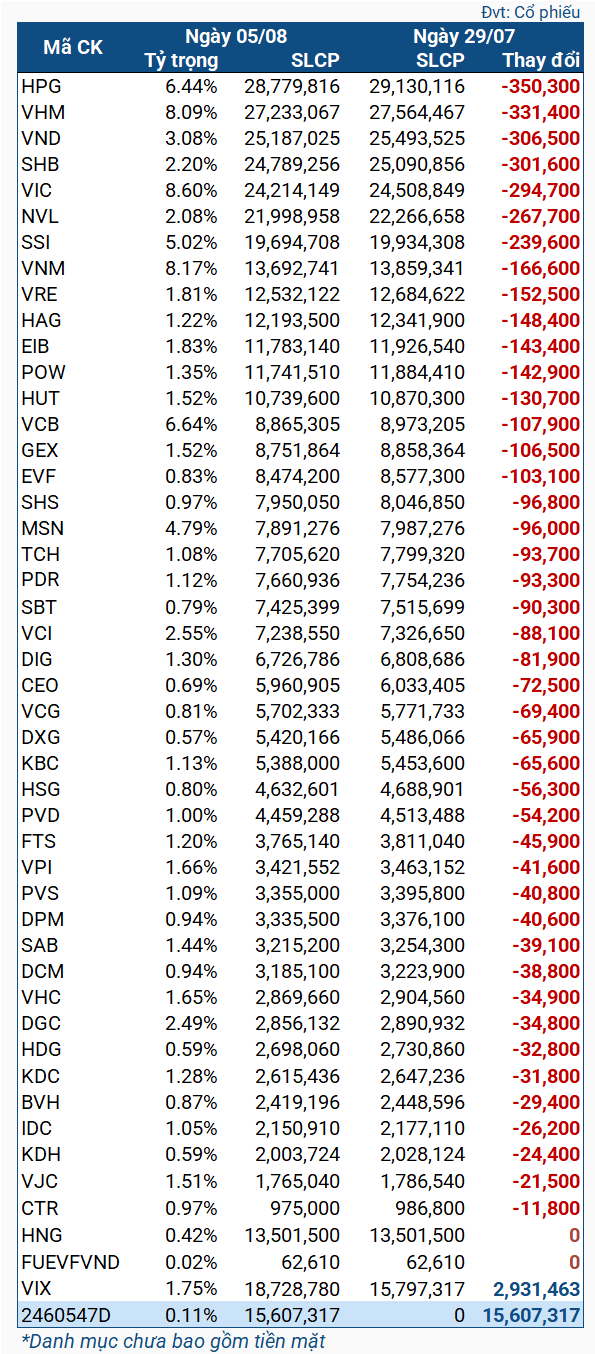

VNM ETF Stock Changes for the Period of 29/07-05/08/2024

|

Almost all the stocks in the VNM ETF portfolio experienced strong net selling, except for HNG and fund certificates FUEVFVND, which remained unchanged. Among them, HPG witnessed the highest net selling volume at 350,300 shares. This was followed by VHM, VND, and SHB, which all experienced net selling of over 300,000 shares, while VIC saw a net sale of nearly 300,000 units.

The only stock that witnessed a positive change was VIX, with an additional 2.9 million shares. However, this was a result of VIX‘s issuance of bonus shares and dividends at a total ratio of 20%. Moreover, the actual increase in shares was lower than the increase in ratio, suggesting that the Fund may have also sold VIX during this period.

Notably, VNM ETF acquired over 15.6 million VIX share subscription rights (2460547D). These rights are part of VIX‘s plan to offer shares to existing shareholders to raise capital. The exercise ratio is 100:95, meaning 1 share corresponds to 1 right, and 100 rights can be used to buy 95 new shares. With these subscription rights, VNM ETF will be able to purchase approximately 14.8 million new VIX shares in the future.

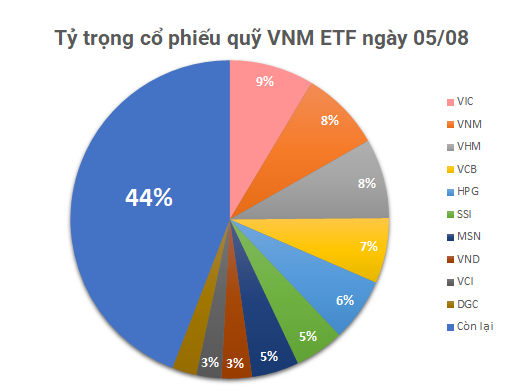

As of August 5, the net asset value of VNM ETF stood at over $462 million, a decrease from the nearly $486 million recorded on July 29. The entire portfolio comprises Vietnamese stocks, with the top weights held by VIC (8.6%), VNM (8.17%), VHM (8.09%), VCB (6.64%), and HPG (6.44%).