Out of the 24 sectors in the VS-SECTOR classification, only four sectors witnessed a decline, including media & entertainment (-1.75%), transportation (-1.65%), hardware (-0.81%), and specialized services (-0.05%).

Among the large number of sectors that are on the rise, several sectors recorded impressive gains of over 2%, including materials, food & beverage and tobacco, healthcare, financial services, and household & personal goods. The most notable gainer was food & essential retail, which surged by more than 13%.

As the market recovers, foreign investors continued to increase their net selling to nearly VND 580 billion, focusing mainly on MWG with a net sell value of over VND 142 billion, far exceeding other stocks such as VPB and FPT. Overall, the broad-based net selling across many stocks overshadowed the net buying of over VND 178 billion in VNM.

Morning Session: Strong bottom-fishing demand, VN-Index recovers over 10 points

The market showed signs of recovery after yesterday’s sharp decline, with the VN-Index gaining 10.22 points to 1,198.29, the HNX adding 0.67 points to 223.38, and UPCoM climbing 0.41 points to 91.20. Moreover, trading volume surged, indicating strong bottom-fishing demand.

At the end of the morning session, the total trading value on the three exchanges reached nearly VND 8.3 trillion, higher than the same period yesterday and slightly above the 5-session average, suggesting that buyers emerged as stock prices became more attractive.

Large-cap stocks made significant contributions to the market’s recovery, with VNM, GVR, GAS, FPT, and VCB among the top performers. VNM led the gains, contributing nearly 1.7 points to the index’s rise, while the top 10 stocks added over 7.1 points in total.

| Top 10 stocks impacting the VN-Index in the morning session of August 6 (as of 11:30 am) |

However, the significant contribution of large-cap stocks to the index’s gains also heightened investors’ concerns, as they hoped for a more balanced recovery across the market.

In terms of sector performance, food & essential retail recorded the strongest gain of over 13%, followed by household & personal goods, which rose nearly 3%. Sectors with high weightage in the index, such as real estate and banking, also posted modest growth.

During today’s upward movement, foreign investors net sold nearly VND 415 billion, with the strongest net selling seen in MWG and SSI, both recording net sell values of nearly VND 70 billion. On the other hand, VNM was net bought for over VND 170 billion, but this lone effort was not enough to offset the overall net selling.

10:40 am: Recovery Faces Challenges

After a strong start, the VN-Index faced multiple challenges, leading to a significant narrowing of its gains, even briefly turning negative.

As of 10:30 am, the VN-Index was up 4.28 points to 1,192.35, while the UPCoM also rose 0.29 points to 91.07. In contrast, the HNX slipped 0.02 points to 222.69.

Trading volume on the VN-Index was also higher than the previous session, with a value of nearly VND 6 trillion. The sharp decline in stock prices over a short period has likely caused panic among some investors, triggering sell-offs, but it has also attracted bottom-fishing activities.

Amid a balanced market, with 295 advancing stocks and 14 limit-up stocks versus 300 declining stocks and 14 limit-down stocks, large-cap stocks played a crucial role in the market’s gains.

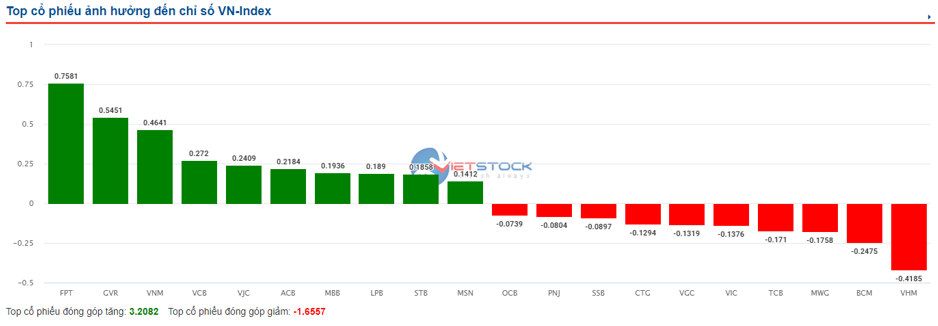

On the VN-Index, the top 10 stocks with the most positive impact on the index, led by FPT, GVR, and VNM, contributed over 3.2 points, doubling the loss of more than 1.6 points caused by the top 10 stocks with the most negative impact.

Source: VietstockFinance

|

Market Open: Regaining Momentum After Sharp Decline

The market sentiment showed signs of stabilization after yesterday’s brutal sell-off, with the VN-Index opening over 12 points higher before easing slightly.

Green dominated the market in the early session, with financial, construction materials, and information technology stocks leading the charge, pushing the VN-Index higher.

FPT was the top contributor to the market’s gains.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.