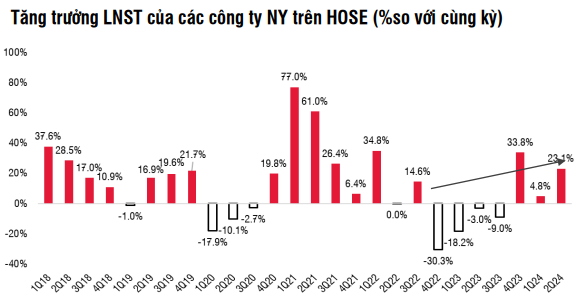

In their recently published strategic report, SSI Research observed that profit growth in the second quarter of 2024 showed improvement, with total profits on HOSE rising by 23.1% year-on-year and 17.5% from the previous quarter.

SSI Research attributes the expansion of profit growth compared to the first quarter of 2024 as a positive factor for the stock market in two key aspects: the circulation of capital between sectors and the increase in the number of leading stocks driving the market, as witnessed in July.

The market experienced heightened volatility in the early sessions of August due to emerging risk factors such as concerns about a US economic recession, as indicated by weak manufacturing and labor market data. The decision by the Bank of Japan (BOJ) to raise interest rates from 0.1% to 0.25% negatively impacted the country’s stock market, leading to a sell-off of risky assets, including stocks, in most global markets, including Vietnam.

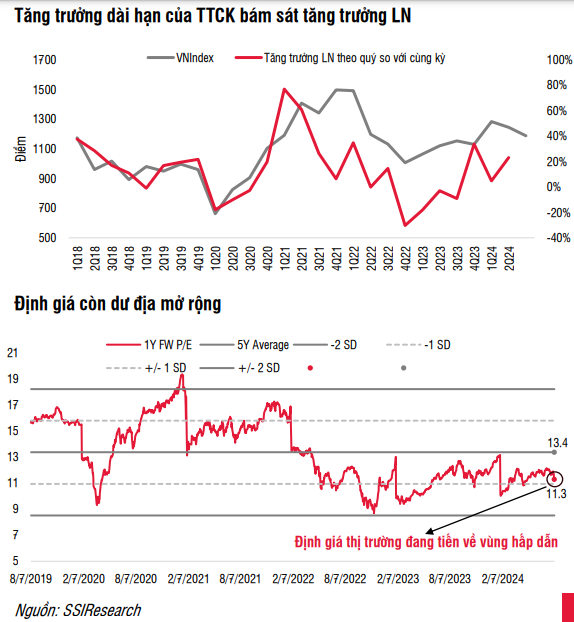

Regarding the Vietnamese stock market, some positive fundamental shifts may have been overlooked due to prevailing psychological factors. The currency risk has been diminishing as the US dollar has weakened, and the quarterly profit recovery trend remains favorable. Moreover, the market’s valuation, at 11.27 times on the estimated one-year P/E ratio, is expected to become more attractive as prices continue to adjust.

Within the “SSI Coverage” list, most stock groups are currently trading at estimated one-year valuations lower than the five-year average, including Consumer, Financial, Industrial, and Real Estate sectors. The exception is the Information Technology group, which has seen expanded valuations recently, supported by robust profit growth and healthy balance sheets.

If the economy maintains its positive trajectory in the latter part of the year, it will provide further support for the growth of listed companies, benefiting the stock market in the long term. However, signs of recession in major economies pose a risk that warrants close monitoring, as it could also impact Vietnam’s recovery process.

From a technical perspective, SSI Research indicates that indicators such as RSI and ADX are in a weak neutral zone on the medium-term charts. However, the ADX’s technical strength is weak, suggesting that while the corrective decline in August exerted significant pressure, the market quickly regained balance.

Consequently, the VN-Index is likely to find support at the medium-term range of 1,145-1,155 points and stage a recovery. Nevertheless, a strong rebound is not expected, and the 1,260-point level may act as a resistance zone during the VN-Index’s recovery.

Given the supportive factors for the stock market, including profit growth recovery and attractive valuations, analysts suggest that investors seek opportunities in sectors and stocks with room for valuation expansion and those that stand to benefit from the economic recovery in the second half of the year. Key sectors to consider are Consumer Goods (Food and Retail) and Industrial Goods & Services (Seaport Transport stocks).

“Excessive volatility driven by psychological factors also presents opportunities for stocks with a history of stable cash dividend payments and robust balance sheets,” the report noted. “Given the new risk variable with unpredictable fluctuations, we recommend a strategy of ‘Accumulating in parts when prices drop sharply’ for the current period.”

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.