The stability of external information flows helped the domestic market recover positively today. While the VNI rebounded moderately, many stocks made a very impressive recovery, not only regaining yesterday’s loss but also rising higher, as if there was no sell-off on August 5th. This development reinforces the opportunity for bottom-forming in many codes as their strength was proven when the market was at its most panicked.

The rebound range after each violent sell-off like yesterday is usually a signal to gauge strength. However, at this point, we should not only look at the index. In the deep decline on August 5th, stocks that were not heavily affected, with low selling pressure (reflected in liquidity and price volatility), and did not lose their accumulation base are likely to see an early bounce. Smart money will focus on these strong stocks as the risk is the lowest.

Technical indicators often reflect this strength belatedly and require waiting for multiple “confirming” signals. Short-term supply and demand reflect sentimental reactions, so if there are changes, psychology will change first. This morning’s rebound in international stock markets increased the chances of a domestic market recovery. What remains to be seen is the change in perspective of buyers and sellers.

The market’s recovery with low liquidity can be seen as an uncertain signal, which is true but not sufficient. Daily liquidity is the result of buy and sell orders matching in price and volume available at each price level, so liquidity needs to consider both factors. Opening the market today, we saw a reflection of the positive new developments from abroad, but soon after, a downward slide appeared, and the VNI even turned red. Early gains or rebounds after a sell-off are often seen as opportunities to cut losses or restructure portfolios at attractive prices. Low liquidity during the initial downward slide indicates that not many people exited their positions.

The afternoon rally throughout the remaining time also had low liquidity, but the buyers were clearly actively pushing prices higher, sweeping through the sell orders. If the selling resistance was thin, liquidity couldn’t have increased much. The price range expansion indicates the strength of the buying pressure (hundreds of stocks rose over 2% and intraday volatility of 3-5%). Therefore, low liquidity is due to sellers withdrawing their orders or raising their asking prices even higher.

Generally, with the significant influence of the prevailing information flow, any reduction in selling pressure is positive. The market touches the bottom in a downtrend because loosely held stocks are traded out, or the point of supply and demand balance is reached. Violent sessions like yesterday tend to push liquidity to very high levels as too many panicked investors want out. After selling, they will feel relieved. Today’s matching volume of about 14.9k billion on the two exchanges is not necessarily low because, excluding yesterday’s session, the average of the last 10 sessions was also only 15.6k billion/day.

Currently, looking at the market through the lens of the VNI, there are still many uncertainties, but the index does not always represent individual stocks. Supply and demand for specific stocks vary. If, during the decline since the beginning of August (4 sessions), stocks have not been heavily affected by the VNI’s movements and their accumulation base has been maintained, the risk is low. These are the codes that can be accumulated, regardless of how the VNI twitches in the coming sessions. Additionally, low selling volume during intraday price declines is also positive.

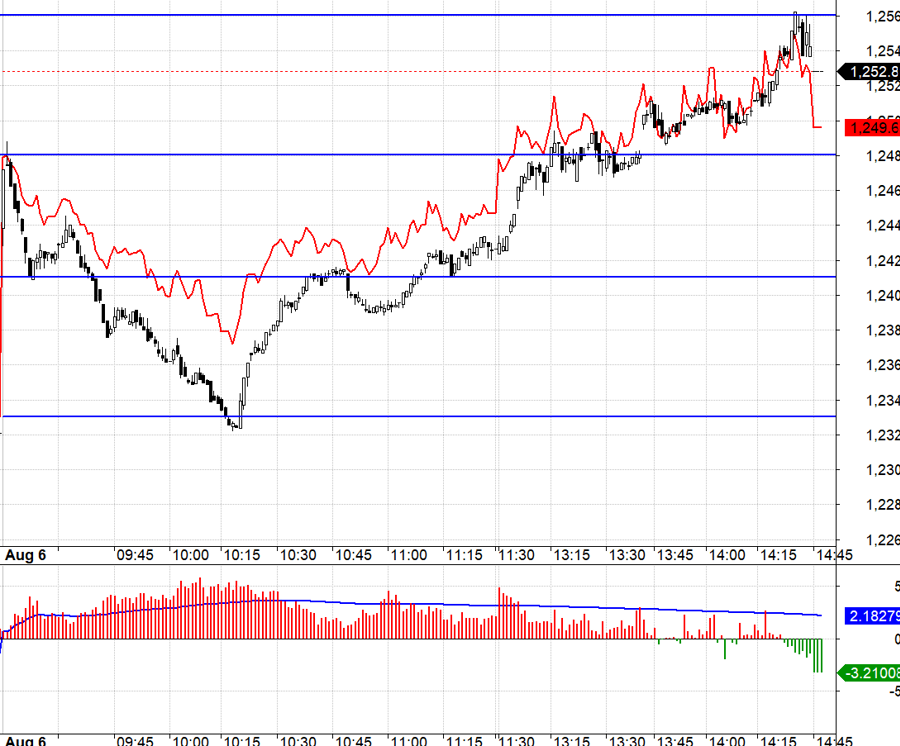

Today’s derivatives market was quite confident in the recovery of the underlying market, especially when Asian markets rebounded before the trading session. VN30 opened with a sharp rise to 1248.xx, then slid through 1241.xx to exactly 1233.xx. This move could have been Shorted when the index broke below 1241.xx, as the range from 1241.xx to 1233.xx is quite wide, but the expanding basis in this situation is a disadvantage. After a decline like yesterday’s, it’s a sign of strength rather than irrationality. Moreover, the high F1 liquidity indicates an increase in position accumulation. The downward slide in the underlying market also didn’t see much selling pressure despite the lengthy duration.

VN30 turned upwards from 1233.xx without a clear Long setup, with a wide basis of 4-5 points, and there’s no guarantee that VN30 will successfully retest 1241.xx. The best Long entry point is when the index crosses above 1241.xx.

Today’s rebound session shows that the market is highly dependent on subjective perceptions of external information. If international markets weaken tonight, it is likely that the market will cool down tomorrow. However, this is not a deciding factor, as many stocks are sending positive buying signals. The strategy is to be flexible with Long/Short positions in derivatives.

VN30 closed today at 1252.81. Tomorrow’s nearest resistances are 1256; 1261; 1271; 1276; 1290. Supports are 1248; 1241; 1233; 1226.

“Blog Chứng Khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, assessments, and investment strategies are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for issues arising from the investment opinions and strategies presented in this blog.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.