The VN-Index ended the last trading session of July 2024 on a positive note, regaining the 1,250-point mark. It rose over 6 points, or 0.5%, from the previous month to close at 1,251.51 points. The banking sector played a crucial role in this upward momentum.

According to VietstockFinance data, the banking sector index for July increased by 4% from the previous month to reach 702 points. The sector’s market capitalization also reached a new high.

Source: VietstockFinance

|

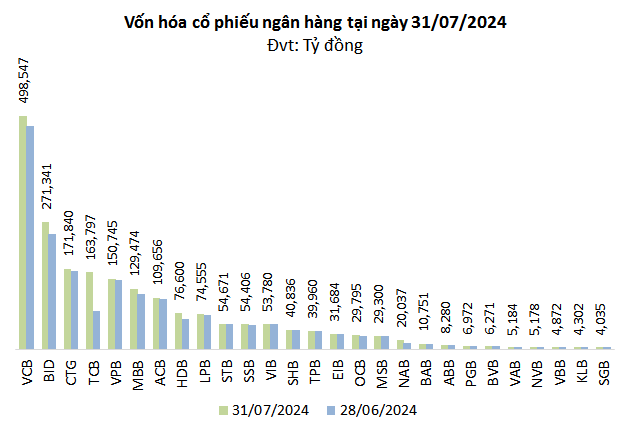

The total market capitalization of banks surged by nearly VND 179 trillion in July, surpassing VND 2.1 million billion (as of July 31, 2024). This represented an increase of almost 10% compared to the end of June.

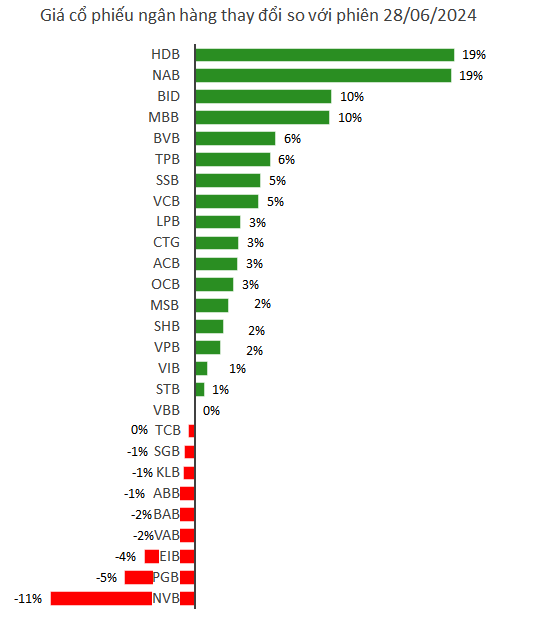

Techcombank (TCB) was the primary driver of the sector’s new peak, as its market capitalization soared by 99% from the previous month to nearly VND 164 trillion. This increase followed the bank’s completion of a 100% bonus share issuance to its shareholders, thereby doubling its circulating shares and charter capital.

Meanwhile, the market capitalization of the three largest state-owned banks, BIDV (BID), Vietcombank (VCB), and VietinBank (CTG), also witnessed growth due to corresponding increases in their share prices. BIDV’s market cap rose by 10%, while Vietcombank and VietinBank saw increases of 5% and 3%, respectively.

On the other hand, due to an 11% decline in its share price, NVB experienced the most significant drop in market capitalization among the banking group, falling to VND 5,178 billion.

Source: VietstockFinance

|

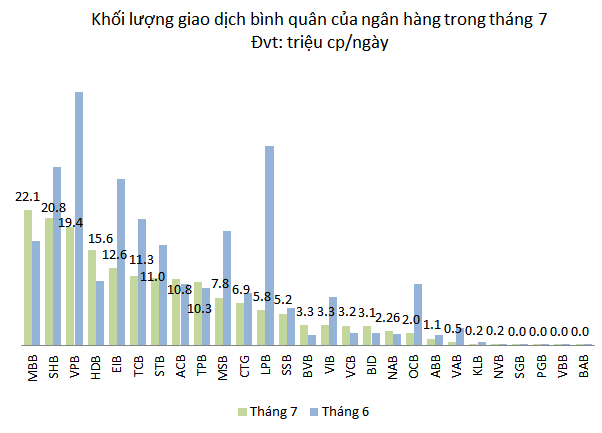

Liquidity in the banking sector took a downturn in July, with approximately 179 million shares traded daily, marking a 36% decrease from June. This corresponded to a reduction of nearly 100 million shares traded per day. Consequently, the trading value also dipped by over 34%, settling at VND 4,042 billion per day.

Source: VietstockFinance

|

The overall sector liquidity witnessed a substantial decline compared to the previous month, mainly due to weakened liquidity in several private banks. These included VAB (down 83%), LPB (down 82%), OCB (down 80%), KLB (down 69%), and both VIB and TPB recording a 58% drop.

Swimming against the tide, SGB witnessed the most significant increase in liquidity among its peers, more than doubling. Additionally, two of the largest banks, VCB and BID, also experienced positive improvements in liquidity, with increases of 60% and 50%, respectively.

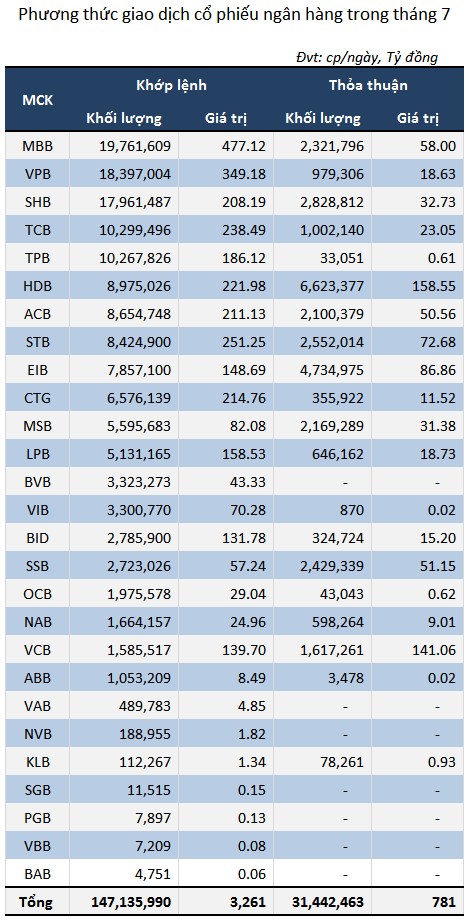

MBB took the top spot in terms of liquidity during this month, with nearly 20 million shares traded daily via matching orders and over 2 million shares traded by negotiation, resulting in an average daily trading volume of more than 22 million shares, a 29% increase from the previous month.

At the other end of the spectrum, BAB witnessed the lowest liquidity, with fewer than 5,000 shares traded per day, a 32% decrease from the previous month. The corresponding trading value barely reached VND 58 million per day.

Source: VietstockFinance

|

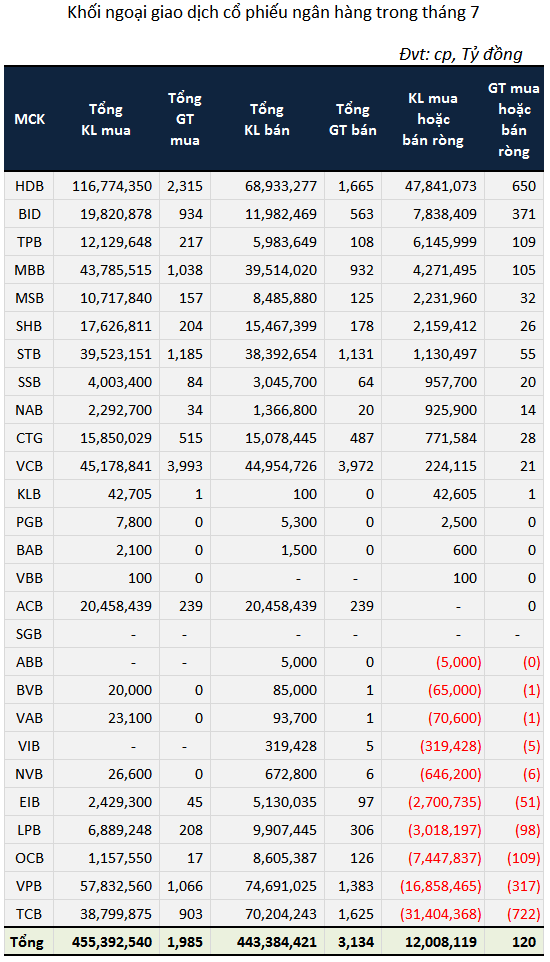

Foreign investors returned to buying banking stocks after five consecutive months of net selling. They net bought over 12 million banking shares, with a corresponding trading value of VND 120 billion.

Source: VietstockFinance

|

Khang Di

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.