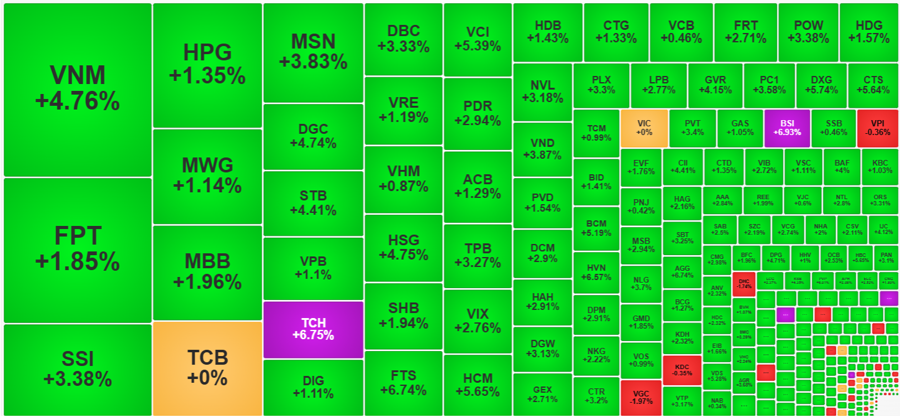

The afternoon rally was boosted by the strong performance of Asian stocks, with the Nikkei 225 index surging 10.24%. As sellers began to withdraw their orders, the buying side quickly gained momentum. The VN-Index closed with a gain of 1.87%, or 22.21 points, recovering about half of the previous day’s loss. However, many stocks showed stronger recovery, even outperforming the index.

The highlight of the afternoon session was the liquidity. The HoSE floor only matched an additional 6,980 billion VND, a slight increase of 2% compared to the morning session, but the VN-Index gained another 12 points. The breadth at the end of the morning session was 272 gainers and 123 losers, while at the close, it stood at 383 gainers and 58 losers. There were 51 stocks that gained more than 2% in the morning session, and this number increased to 164 by the close.

The contrast between liquidity and the extent of price increases suggests a clear supply restriction. The buying pressure pushing prices up did not encounter significant selling pressure, resulting in a modest increase in liquidity. This was partly evident during the morning pullback when the VN-Index briefly fell below the reference level. If investors wanted to cut losses, that would have been the most vulnerable phase psychologically.

Another notable difference in the afternoon was that the blue-chip stocks were no longer the best performers. The midcap and small-cap stocks took center stage. This is understandable because when the blue-chip stocks provide support, and the VN-Index recovers strongly, and global stock markets turn optimistic, speculative money will flow more vigorously. The Smallcap index rose 1.93% in the afternoon, while the Midcap index gained 2.69%. In contrast, liquidity in the VN30 basket decreased by 15% from the morning session, and the index only added about 0.83%, closing 1.68% higher than the reference price.

Six stocks on the HoSE closed at the ceiling price: BSI, ACC, HNG, DLG, TCH, and LDG. Additionally, 50 other stocks rose by more than 4%, including only four in the VN30 basket: BCM, which climbed 5.19%; VNM, up 4.76%; STB, gaining 4.41%; and GVR, increasing by 4.15%. A host of mid-cap stocks also showed strong gains, including AGG, FTS, HVN, VIP, PVP, PPC, DXG, HBC, HCM, CTS, VCI, and VDS.

Securities stocks shone today after a sharp decline in the previous session. A declining market inevitably impacts the business opportunities of securities companies, and the reverse is also true. In this group, only two stocks closed in the red: PSI and VFS. In contrast, 20 other stocks rose by more than 3%.

Overall, in a context of global market recovery, the stocks that failed to rebound today are noteworthy. However, there weren’t many, as only 58 stocks on the HoSE were left behind, and most of them had modest trading volumes. QCG declined by 4.71% with a liquidity of 10.6 billion VND; HVH fell by 2.05% with a volume of 13.1 billion VND; VGC dropped by 1.97% with a turnover of 58.7 billion VND; DHC decreased by 1.74% with a volume of 23.4 billion VND; VPI slipped by 0.36% with a turnover of 62 billion VND, and KDC fell by 0.35% with a volume of 46.3 billion VND were the most notable.

The VN-Index recovered 22.21 points today, regaining about half of yesterday’s loss. The index also climbed back above the psychological level of 1200 points. Liquidity on the HoSE floor decreased by 35% compared to yesterday, reaching over 13,843 billion VND. However, this level is not considered too low because selling sessions like yesterday always have very high liquidity. The most fearful investors have likely already exited the market.