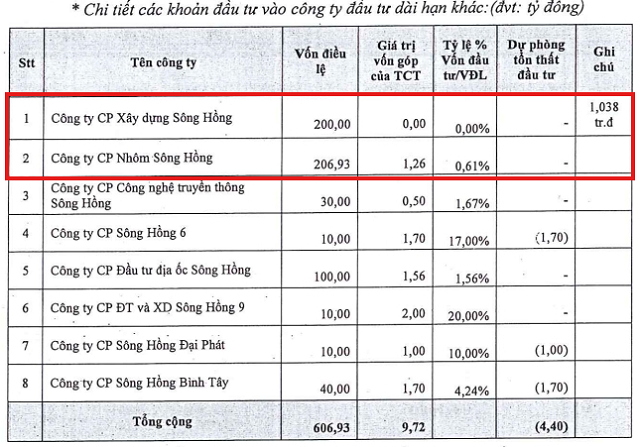

SHG has announced its plans to divest its holdings in several companies as part of its business restructuring strategy. Specifically, the company will sell 100,000 shares of the Shalumi Hong River Aluminum Group (HNX: NSH) and 91 shares of Hong River Construction (HNX: ICG) through matching orders on the exchange. As of the market close on August 5, the market prices of NSH and ICG stood at VND 4,700 per share and VND 7,800 per share, respectively, with SHG expected to receive nearly VND 471 million from the sale.

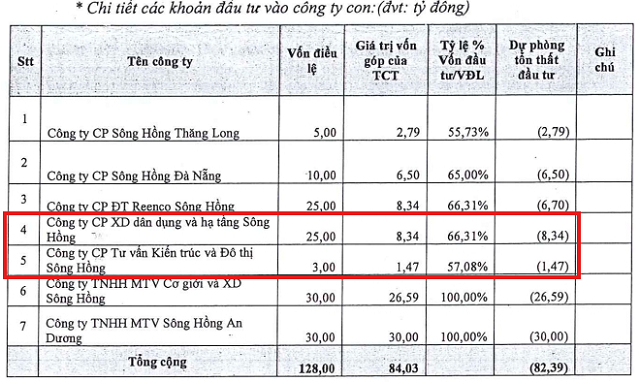

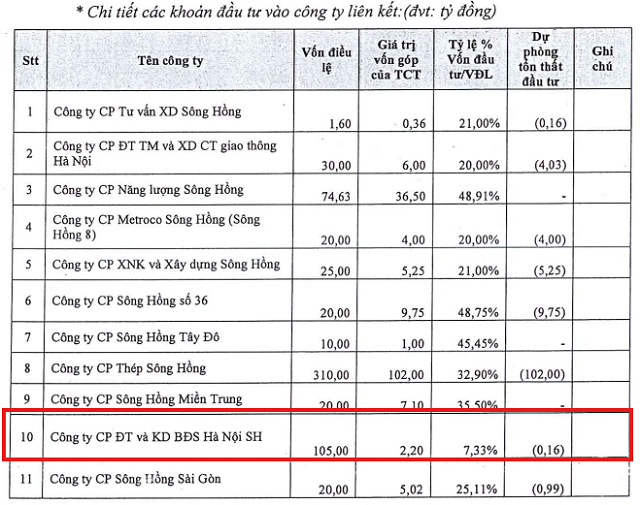

The company will also divest its investments in unlisted companies through private agreements. The divestment price will be agreed upon but will not be lower than SHG’s book value (after offsetting financial investment loss provisions). Specifically, SHG will divest 834,000 shares (66.31%) of Civil and Infrastructure Construction of Hong River; 147,000 shares (57.08%) of Urban Consulting and Construction of Hong River (formerly Hong River Architecture and Urban Consulting); and 220,000 shares (7.33%) of Hanoi Hong River Real Estate (formerly Hanoi Hong River Real Estate Investment and Trading). SHG has already made provisions for losses on most of its investments in these companies.

Source: SHG

|

SHG’s CEO presented the proposed divestment to the Board of Directors in late May. However, the Board members requested additional explanations and supporting documents related to the shares offered and the operating performance of the divested entities. As of now, the explanations have been provided.

Earlier this year, SHG’s Board also approved the divestment of its entire stake in several companies, including 35.5% in Hong River Central, 1.56% in Hong River Real Estate Investment, and 1.67% in Grassland Technology and Investment (formerly Hong River Media and Communications Technology).

SHG’s divestment move is in line with the company’s business restructuring plan for the period 2024-2025, which was approved at the Extraordinary General Meeting of Shareholders in 2024. According to the company’s leadership, the restructuring plan is necessary to eliminate bad debts after the completion of state capital divestment. The majority of SHG’s subsidiaries and associated companies are incurring losses, carrying significant debts, and facing challenges in generating cash flow after the divestment.

The divestment aims to clear the debts of these companies and will not impact SHG’s financial statements. The company is working with the management of these entities to facilitate the buyback of SHG’s stake and proactively handle their respective debts.

During the 2024-2025 period, SHG will focus on divesting its investments while simultaneously settling receivables/payables (if any) or initiating bankruptcy proceedings (if eligible) in cases where divestment is not possible. The company also intends to restructure its debt by converting payables into equity, increase its charter capital to facilitate investment projects, mergers and acquisitions, and establish new enterprises. Additionally, the parent company will focus on real estate investment and will no longer directly engage in construction contracting.

SHG is also in discussions with banks to release machinery and equipment from mortgage and lease them out, as well as to optimize the utilization of the 70 An Duong land plot to generate revenue for sustaining its operations.

In the upcoming period, SHG plans to increase its charter capital from VND 270 billion to approximately VND 770-820 billion in phases, aligning with the progress and roadmap of its restructuring plan and the financial requirements of its investment projects. SHG estimates a capital need of approximately VND 200 billion for the Hong River Tower multi-functional complex project and VND 300-350 billion for restructuring its payable debts.

In 2023, SHG recorded a net loss of VND 70 billion, continuing its streak of unprofitable years over the past decade. The company’s revenue stood at VND 9 billion, while interest expenses amounted to VND 64 billion.

As of the end of 2023, the accumulated loss reached over VND 1,300 billion, resulting in negative equity of VND 1,000 billion. This situation is largely attributed to the losses incurred by its subsidiaries, their significant loss of solvency, lack of business opportunities, and cessation of operations in recent years. Some investment projects have been stalled due to insufficient financial resources and failure to meet the owner’s equity requirements as per regulations.

| SHG’s Financial Performance for the period 2011-2023 |

Tu Kinh

Overcoming Challenges in Dealing with Bad Debts

In the newly passed Revised Securities Law, securities companies (SCs) no longer have the privilege to hold collateral. Therefore, SCs need to recognize that debt collection is their responsibility, and they should be extremely strict in assessing borrowers, ensuring compliance with principles, procedures, and conditions before granting loans.