Monday, August 5th, will go down in history as one of the darkest Mondays for global stock markets. In Asia, the focus was on the plunge in the Japanese stock market, with the Nikkei 225 index taking a beating, closing 12.4% lower. On the night of August 5th, Vietnam time, the US stock market, the largest in the world, suffered a similar fate with the S&P 500 falling 3%, Dow Jones down 2.6%, and NASDAQ losing 3.4%.

The sea of red across international markets provided the perfect excuse – big enough and uncertain enough – for the Vietnamese stock market to take a tumble, as investor sentiment had already been cautious since the second half of June.

“Recently, the market hasn’t been performing well, and it’s challenging to pick stocks. As a result, investors’ psychology has become discouraged and cautious,” said T.K., a broker with six years of experience at a large securities company, describing his observations of the market over the past two weeks.

“But because of this caution, there hasn’t been a margin squeeze,” T.K. added.

Without forced selling due to margin calls, the decline in the VN-Index on August 5th surprised observers regarding how domestic traders – mostly individuals – fled when shaken by an unexpected earthquake. Even though, anxiety had been observed in the past few weeks.

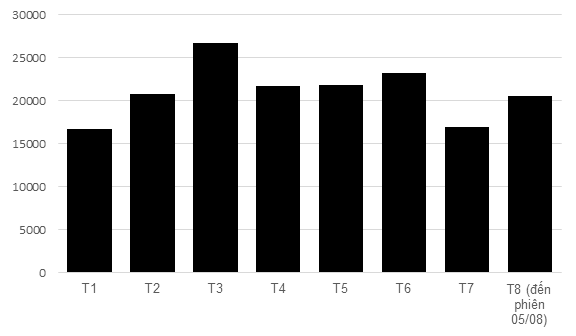

The average daily trading value at HOSE in July was the lowest since the beginning of 2024

|

Billion VND

The average daily trading value in August increased due to two sharp drops in the VN-Index on August 1st and 5th. Source: VietstockFinance

|

The VN-Index fell 48.53 points (-3.92%) on August 5th, plunging to the lows of April this year when the market was still reeling from exchange rate worries and the possibility of the State Bank of Vietnam (SBV) raising its operating interest rates.

Exchange rate pressure – and the potential for the SBV to tighten monetary policy again – was the main driver of the market’s significant volatility in Q4/2023 and Q2/2024.

The backdrop of easing inflation and a potential US economic recession, coupled with the Fed’s changing stance, has eased the pressure on the USD/VND exchange rate. However, the Vietnamese stock market has not breathed a sigh of relief.

Risks in investors’ minds shift from one thing to another: exchange rates, record margin debt at securities companies, foreign net selling, bad debt in banks, and international issues that they may not fully understand. However, the key fact is that the net asset value (NAV) in the portfolios of market participants has been declining in recent days.

Nothing impacts psychology more than fluctuating prices. Even before August 5th, many market participants feared a downturn that they couldn’t even name.

Amid the fog of international macro uncertainty, another critical aspect is the market’s lack of significant fundamental reasons to reverse domestic investors’ expectations.

The Vietnamese economy continues to show progress in its recovery, as evidenced by the latest data on industrial production, exports, tourism, and bank credit movement at the end of June. But this doesn’t seem enough for the stock market, as reflected in the gloomy trend of stocks since mid-June.

A season of unremarkable financial reports is another aspect to consider. Many businesses have demonstrated a recovery in their financial results, in line with expectations, but this carries a different meaning from growth.

The VN-Index has ventured deep into bull market territory, rising nearly 27.5% from the beginning of 2023 to July 10, 2024. Hence, the narrative of business recovery has had a limited impact on the stock market’s movement.

The market fears external risks while struggling to find internal drivers or relying on old ones. It appears that domestic investors are unsure where to turn during a period often characterized as a “transition of expectations.”

But with stock markets, clarity only comes after the fact. Opportunities often hide in uncertainty. At the very least, compared to the vague drivers the market is seeking, a stronger and more expected inflection point is likely a lower stock price.

On August 6th, the Vietnamese stock market saw some relief, but hesitation remained. The VN-Index rose over 10 points as the epicenter of the previous day’s plunge, the Nikkei index, rebounded strongly.

“This morning, when I came to the office, my colleagues and I felt relieved to see the strong rebound in Japanese stocks,” said V.T., an office worker who has been trading stocks for two years.

“Whether Vietnam will recover is uncertain, but at least, we’re less panicked,” he added.

At the close of the August 6th session, the VN-Index extended its gains to 22.2 points.