In a surprising turn of events, Vingroup’s VHM announced a bold move to purchase 370 million treasury shares. This news sent stocks in the group soaring, with VHM itself surging to the daily limit of 6.9%. The real estate sector saw the biggest gains, up 2.53%, while other Vingroup stocks also made significant moves: VRE rose 5.88% and VIC climbed 2.54%. This positive momentum was the main driver behind the VN-Index’s advance of 5.60 points towards the 1,215 level.

As the session progressed, the market breadth turned increasingly positive, with 228 gainers outnumbering 182 losers. In addition to real estate, other sectors that contributed to the upbeat sentiment included oil and gas, up 2.28%, and steel and information technology, both edging higher by approximately 1%. On the flip side, banks and securities weighed on the index, with TCB, VPB, BID, CTG, TPB, and SSB being the biggest detractors.

Liquidity remained subdued, with the total matched transaction value on the three exchanges reaching VND 15,700 billion. Foreign investors offloaded Vietnamese shares aggressively, recording net sell orders of VND 1,387.2 billion on the market and VND 1,352.0 billion in matched transactions. Their top buys were in the food and beverage and information technology sectors, including VNM, FPT, FRT, GVR, DPM, VCI, BCM, GAS, BWE, and HSG.

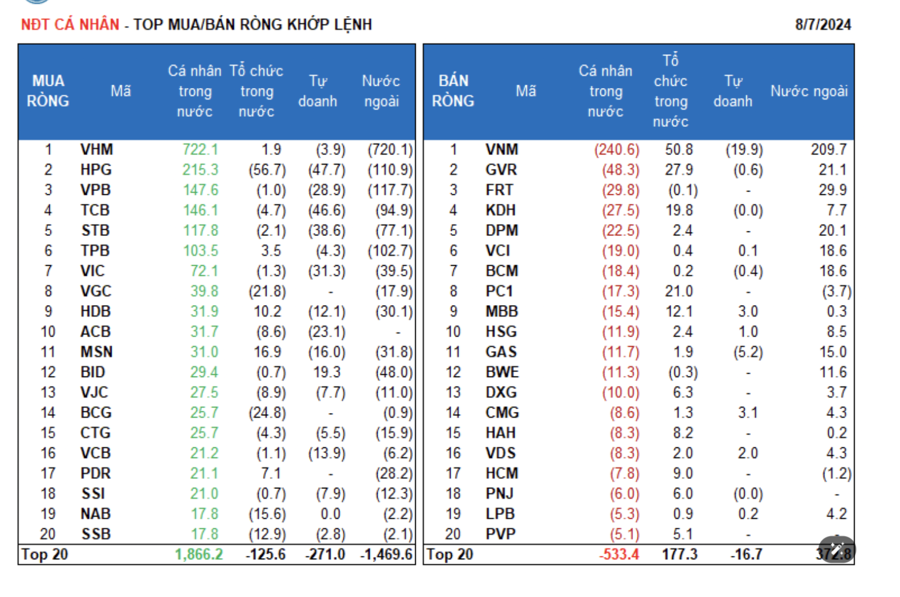

On the selling side, foreign investors focused on the real estate sector, offloading VHM, VPB, HPG, TPB, TCB, STB, BID, VIC, and E1VFVN30. Meanwhile, individual investors bought a net VND 756.6 billion worth of shares, with matched transactions amounting to VND 1,623.3 billion. They bought real estate stocks heavily, with their top picks being VHM, HPG, VPB, TCB, STB, TPB, VIC, VGC, HDB, and ACB.

Institutional investors were net buyers to the tune of VND 921.0 billion, with matched transactions contributing VND 88.2 billion to this figure. In terms of sector allocation, they favored food and beverage stocks, scooping up VNM, GVR, E1VFVN30, MWG, PC1, KDH, MSN, MBB, HDB, and TCH. On the selling side, they offloaded HPG, BCG, VGC, NAB, SSB, PVD, HHV, TDM, VJC, and BAF.

Over-the-counter transactions totaled VND 2,782.6 billion, a slight increase of 1.7% from the previous session, accounting for 17.7% of the overall trading value. A notable deal involved EIB, with 50 million shares worth VND 975 billion changing hands between domestic institutions (buyers) and individuals (sellers). Additionally, there were block trades among domestic individuals involving MSN (over 4.8 million shares worth more than VND 355 billion) and VHM (over 5.8 million shares worth over VND 204 billion).

Sector-wise, cash flow allocation increased in real estate, driven by the surge in VHM, as well as in oil and gas production, rubber and plastics, and petroleum distribution. In contrast, it decreased in most other sectors, including banks, food and beverage, securities, steel, retail, and construction.

Looking at market capitalization segments, large-cap VN30 stocks attracted more cash flow in matched transactions, while mid-cap VNMID and small-cap VNSML stocks witnessed outflows.