The stock market staged a strong recovery during the August 6 session. The main index was in positive territory for most of the trading day and extended its gains towards the close. The VN-Index ended the session up 22 points (1.78%) at 1,210. However, foreign exchange trading was a negative factor, with net selling of nearly VND755 billion across the market.

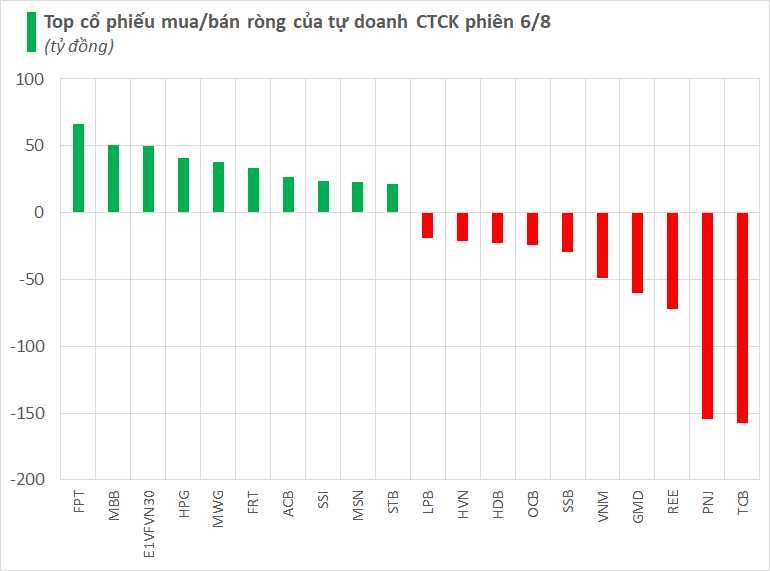

Proprietary trading by securities companies also recorded net selling of VND215 billion across the market.

On the HoSE, proprietary trading by securities companies sold a net VND235 billion, buying VND483 billion on the order-matching channel but selling a net VND718 billion on the negotiation channel.

Specifically, securities companies net sold the most in TCB and PNJ, with VND157 billion and VND155 billion, respectively. REE and GMD were also net sold, with values of VND73 billion and VND60 billion, respectively. Other stocks that were net sold in today’s session included VNM, SSB, OCB, HDB, and others.

On the other hand, securities companies net bought the most in FPT, with a value of VND67 billion. Stocks such as MBB, E1VFVN30, HPG, and MWG were also net bought in the August 6 session.

On HNX, proprietary trading by securities companies bought a net VND20 billion, with PVS being the most net bought at VND13 billion, followed by TNG with over VND5 billion.

On UPCoM, proprietary trading by securities companies bought a slight net, with ACV being the most net bought at nearly VND3 billion, while QTP was net sold at over VND1 billion.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.