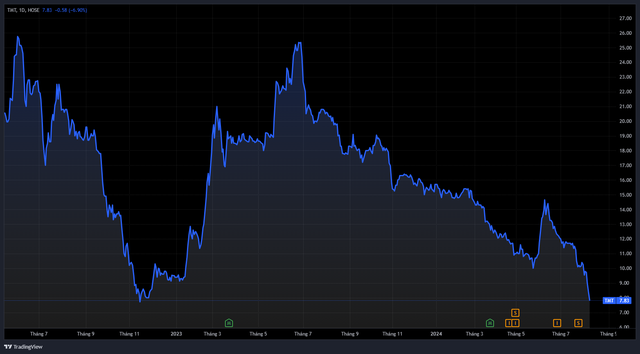

Noted in the morning session of August 7, shares of TMT Motor Joint Stock Company (TMT Motor) continued to fall to the maximum extent, “white on the buying side” for the third session in a row, thereby stopping at VND 7,830/share. This is the lowest market price in nearly 2 years, since November 2022.

Previously, TMT shares had a phase of accelerating nearly 50% from the end of May to mid-June 2024, but suddenly “turned head” and slid from then until now.

In a related development, the Wuling Mini EV car sold by TMT has been discounted at many dealerships recently. Typically, a dealer in Hung Yen is offering the Wuling Mini EV with a big discount. Specifically, the 120 km and 170 km Advanced versions of this mini electric car are reduced by VND 58 million and VND 48 million, respectively. After applying the incentive, the selling price of the Mini EV LV2 120km is reduced from VND 255 million to VND 197 million. The LV2 170 km version is reduced to VND 231 million.

In the Southern region, the distributor has made adjustments to help the Wuling Mini EV set the lowest price since its launch. Currently, the Wuling Mini EV Lv1 120 km (Standard 1 version) is offered at a price of VND 189 million, which is VND 50 million lower than the listed price (VND 239 million). Because this is the discount policy of each dealer, it is not the same everywhere.

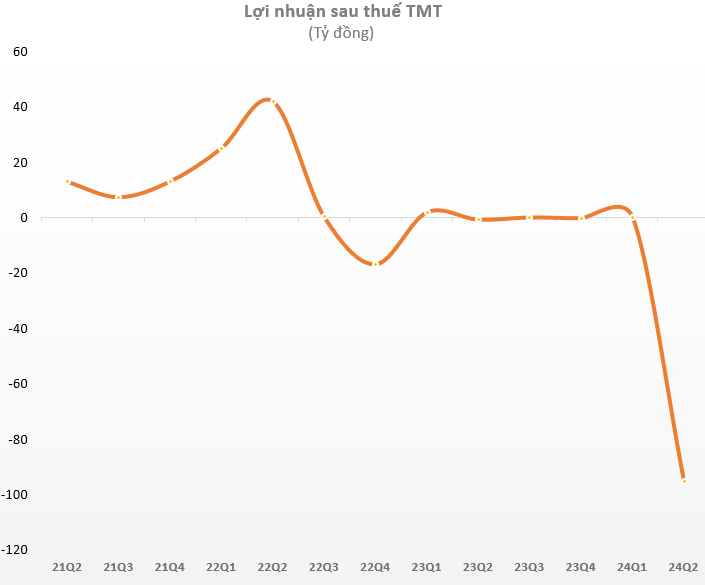

On the other hand, TMT Motor’s business results in the second quarter of 2024 were not as expected, which also caused the share price to “fluctuate”. TMT reported net revenue of VND 814 billion, unchanged from the same period last year. The increase in cost of goods sold by 11% caused the company to lose VND 49 billion in gross profit, while in the same period it still made a gross profit of VND 52 billion. After deducting expenses, TMT Motors reported a post-tax loss of VND 95 billion, while in the same period it made a profit of more than VND 2 billion. This is also the heaviest loss quarter in the operation history of this enterprise.

For the first 6 months of the year, TMT recorded net revenue of VND 1,321 billion, down 13.4% over the same period. After-tax profit recorded a loss of nearly VND 100 billion, while in the same period it still made a profit of over VND 1.4 billion.

According to a explanation from the enterprise, the reason for the decrease in after-tax profit is mainly that in 2024, the economic situation was difficult, the real estate and public investment sectors decreased strongly, the risk of inflation increased, causing the consumption of automobiles to decrease deeply, while enterprises producing and trading in automobiles such as TMT continuously reduced selling prices to clear inventory.

As of June 30, TMT Motors’ total assets reached VND 1,501 billion, a decrease of VND 668 billion, or 31%, compared to the beginning of the year. Cash and cash equivalents reached VND 6 billion, a sharp decrease compared to the beginning of the year. The value of inventories as of the end of the second quarter was VND 853 billion, a decrease of VND 554 billion compared to the beginning of the year.

TMT Motors’ total liabilities were VND 1,163 billion, a decrease of more than 33% compared to the beginning of the year. Of which, loan debt decreased by 55% to VND 571 billion. Owner’s equity was VND 339 billion, of which accumulated loss was VND 46 billion.

Selling electric cars with “loss”, difficult to complete the plan for 2024

According to our research, TMT Motors, formerly known as Transportation Equipment Trading and Production Joint Stock Company, is mainly engaged in the manufacturing, assembly, and trading of automobiles and their parts. TMT Motors has long been known for its famous truck products such as Cuu Long, Tata, and Howo, as well as Sinotruk tractor trucks with large payloads.

The company gained attention when it entered the electric vehicle market by manufacturing, assembling, and distributing the Wuling Hongguang MiniEV in Vietnam. The Wuling Mini EV is a popular small-sized electric car in China, holding the title of “world’s best-selling small electric car” for four consecutive years, from 2020 to 2023.

Despite offering affordable electric cars, TMT Motor’s sales performance fell short of expectations. Last year, the company only sold a mere 591 units of the Wuling HongGuang MiniEV, equivalent to just 11% of its initial sales target of 5,525 units.

Facing a lackluster performance in the previous year, TMT Motor set a more modest target for 2024, aiming for a total sales volume of just 1,016 electric vehicles. Although this figure represents a 71% increase compared to the actual sales in the previous year, it is still a very low number.

Regarding the 2024 business targets, TMT Motors aims for a net revenue of VND 2,645 billion and a post-tax profit of over VND 38.5 billion, an increase of 1% and 475%, respectively, compared to the previous year. Given the dismal performance in the first half, the company will face significant challenges in achieving its annual profit target.