The Vietnamese stock market experienced a turbulent start to the week, with overwhelming selling pressure across the board. Most industry groups were in the red, with 844 stocks declining, including 127 floor stocks.

At the close of the August 5 session, the VN-Index fell by 48.53 points (-3.92%) to 1,188.07. HoSE’s liquidity improved slightly, with a matching value of VND 21,260 billion. Notably, foreign investors aggressively net sold, with a net selling value of up to VND 749 billion.

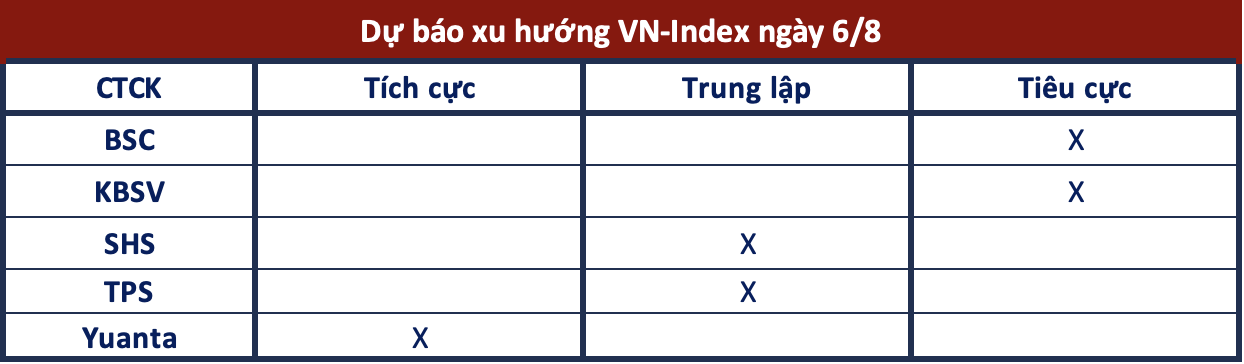

Regarding market forecasts for the upcoming sessions, securities companies have mostly provided mixed assessments:

Continuing downward momentum

BSC Securities: Opening with a large negative gap, the VN-Index traded below the 1,220 threshold and fell sharply to close at 1,188.07, a decrease of nearly 50 points in the August 5 session. In the next trading sessions, the market may continue its downward momentum towards the 1,160 – 1,165 range. Investors are advised to trade cautiously.

Margin call pressure

KBSV Securities: The VN-Index fell sharply and formed a “Marubozu” candle pattern, accompanied by high liquidity, indicating a complete dominance of sellers. Margin call pressure during the session, combined with unfavorable macroeconomic factors, is likely to continue exerting downward pressure on the index.

Short-term recovery to retest 1,200 resistance

SHS Securities: The short-term trend of the VN-Index remains negative, with the failure to hold the strong psychological support area around 1,200, which is also the highest price level of 2018 and the current one-year average price. Currently, with strong selling pressure in the August 5 session, the index is in a short-term oversold condition and may recover to retest the resistance area around 1,200, which is also the current 200-session average price.

Given the current pressure, uncertain global developments, and an increase in short-term forced liquidation, if the recovery attempt to retest the 1,200 area is unsuccessful, the VN-Index may face the risk of further correction towards the 1,150 – 1,170 range in the short term, corresponding to the lowest price level of April 2024 and the current 120-week and 240-week average prices.

Potential for short-term recovery

TPS Securities: The VN-Index formed a strong selling candle with high liquidity. This continues to be a sharp decline, dragging the index below the 1,200 level. This erases the previous session’s recovery effort. In the following sessions, the VN-Index is likely to witness a short-term recovery to retest this resistance area. If bottom-fishing demand does not emerge at this level, the market will retreat to the 1,180 area.

Possible short-term rebound

Yuanta Securities: The market may soon witness a short-term rebound in the next session. With the downward momentum, the VN-Index could also retest the April low with a closing price of 1,175. Additionally, many stocks and indexes have entered the oversold zone, and the projected P/E ratio of the VN-Index has dropped below 11 times, so Yuanta expects the market to rebound soon in the next few sessions.