On August 7, VNM stock hit a 10-month high of 73,800 VND per share. In just two weeks, the shares of Vietnam’s largest dairy company surged by 13%.

What’s noteworthy is the surge in liquidity for this dairy giant. Last week, VNM‘s trading volume consistently surpassed 10 million shares per session, triple the 52-week average of 3.4 million.

| VNM Stock Performance from July to Present |

The primary catalyst behind this rally is Vinamilk‘s impressive second-quarter financial results. The company posted net revenue of 16,656 billion VND, not only surpassing its previous peak in the third quarter of 2021 but also achieving the highest quarterly revenue in its operating history. The 9.5% revenue growth rate in the second quarter of 2024 compared to the same period last year was the highest since early 2022.

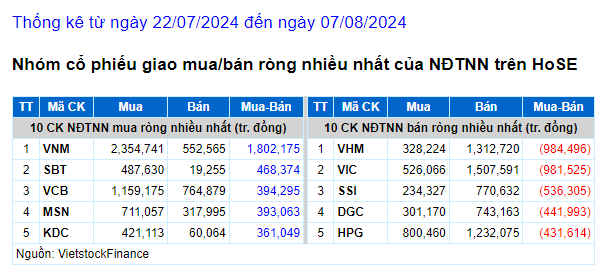

With these positive results, VNM has become the stock most favored by foreign investors in the past two weeks. Since July 22, foreign investors have net bought VNM shares worth 1,600 billion VND, the highest in the market, according to VietstockFinance data.

Who are Vinamilk’s Foreign Shareholders?

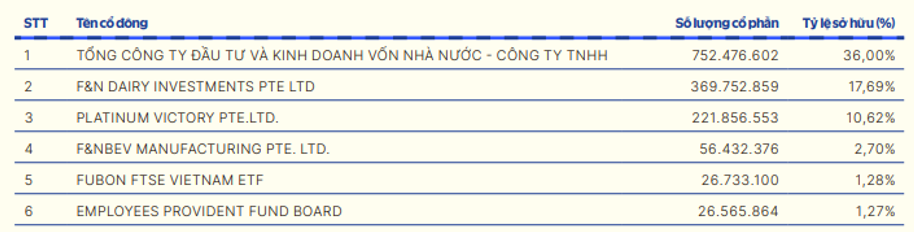

According to the 2023 Annual Report, foreign investors held nearly 54% of Vinamilk’s capital as of December 28, 2023.

Source: Vinamilk Annual Report

|

The top five foreign investors are F&N Dairy Investments PTE, Platinum Victory PTE, F&N Bev Manufacturing PTE, Fubon FTSE Vietnam ETF (Taiwan), and Employees Provident Fund Board (Malaysia), with respective ownership ratios of 17.69%, 10.62%, 2.7%, 1.28%, and 1.27%.

The two most notable names are F&N and Platinum Victory PTE, both familiar faces in Vietnamese stocks.

Top Shareholders at Vinamilk

|

Familiar Giants

Founded in 1883 in Singapore, Fraser and Neave (F&N) is a household name in the history of the beverage and food industry in Southeast Asia. Over 140 years of operation, the group owns diverse businesses such as carbonated drinks, beer, dairy, asset management, and even publishing and printing. F&N currently has a presence in 11 countries with an extensive export network.

In Vietnam, F&N began its investment journey in Vinamilk in 2005 through its subsidiary, F&N Dairy Investments. They have consistently pursued a strategy of increasing ownership, especially during the divestment process of the State Capital Investment Corporation (SCIC).

Currently, F&N, through its subsidiaries F&N Dairy Investments and F&N Bev Manufacturing Pte, holds a total of 20.39% of Vinamilk’s shares, equivalent to over 426 million shares.

As a major shareholder, F&N has two representatives on Vinamilk’s Board of Directors: Mr. Lee Meng Tat (Board member since September 2016) and Mr. Michael Chye Hin Fah (Board member since April 2017). This demonstrates F&N’s long-term commitment and active participation in shaping Vinamilk‘s development strategy.

Another international giant, Platinum Victory, has also accompanied Vinamilk for many years. It is a subsidiary of Jardine Cycle & Carriage (JCC), which is part of a larger conglomerate.

Jardines is no stranger to Vietnamese investors. The group has been present in Vietnam for over 20 years and has made notable investments. One of their most resounding deals was spending 1 billion USD to acquire a 10% stake in Vinamilk in 2017 through Platinum Victory.

In Southeast Asia, JCC considers Vietnam one of its four key markets. Their investment portfolio in Vietnam is diverse, spanning real estate, cement, finance, automobiles, infrastructure, and the food and beverage industry.

Currently, Platinum Victory holds 10.62% of Vinamilk’s shares and remains determined to increase its ownership by consistently registering to buy more VNM shares in recent years.

Among Vinamilk’s major shareholders, the State Capital Investment Corporation (SCIC) maintains its holding at 36%.

Vinamilk’s positive financial results, the confidence of foreign investors, and the stability provided by the state-owned shareholder all contribute to the upward momentum of VNM stock. This not only bodes well for shareholders but also reflects the promising outlook for Vietnam’s dairy industry amid a challenging global economic landscape.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.