The Vietnamese stock market, in sync with global equities, has just weathered a turbulent trading session. The VN-Index plummeted by almost 50 points to below 1,200, its lowest level in over three months. This nearly 4% drop marks the second-largest decline for the VN-Index since the start of the year, following a 60-point (-4.7%) plunge on April 15th.

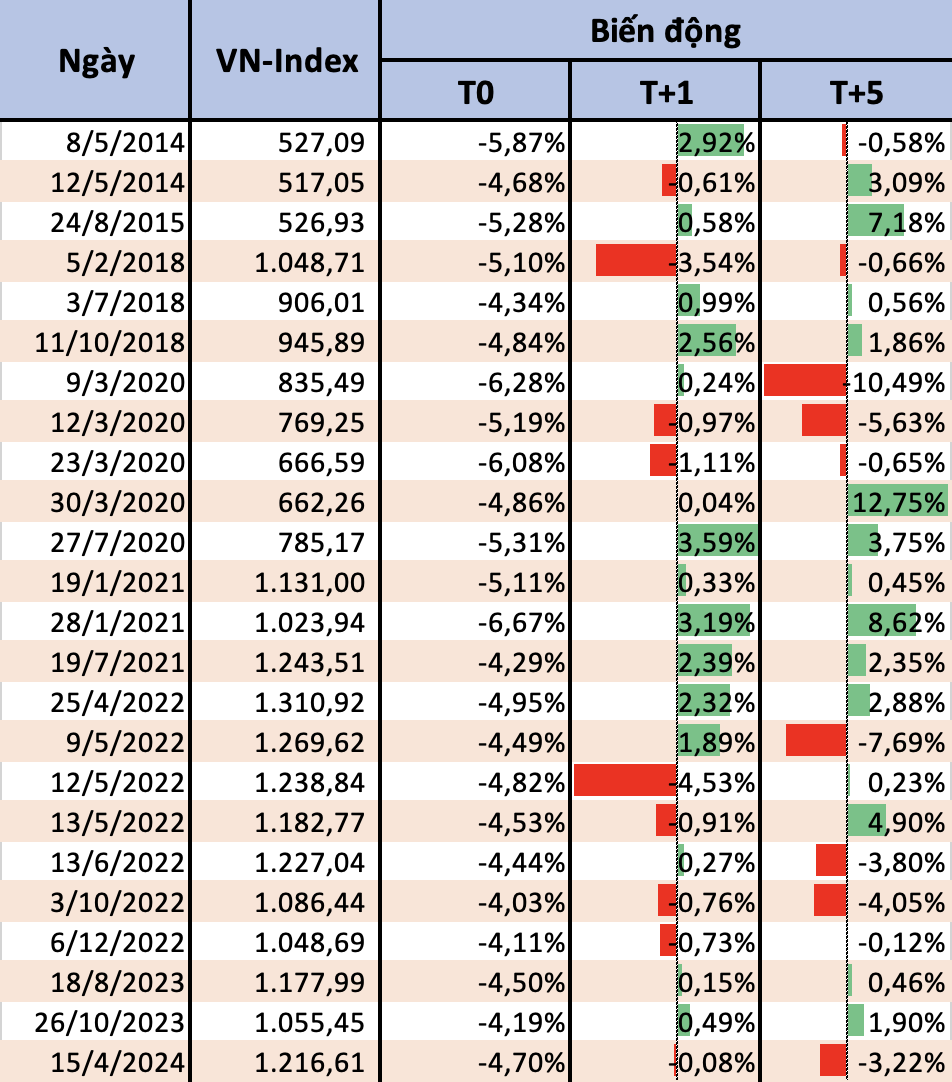

Historically, Vietnamese stocks have experienced numerous volatile sessions, with the VN-Index witnessing even steeper declines than the one on August 5th. Since the HoSE’s trading band reverted to +/-7% at the beginning of 2013, the VN-Index has dropped over 4% in a single session on 24 occasions, mostly concentrated between 2020 and 2022, as COVID-19 cast a dark shadow over global financial markets.

As evident from the chart, Vietnamese stocks tend to rebound swiftly after sharp declines. Statistically, the VN-Index has recovered immediately after such steep drops 15 out of 24 times, equivalent to a 62.5% probability. If we consider a longer time frame, the VN-Index also posted gains during the trading week (5 sessions) following the sharp decline in 14 out of 24 instances.

From 2020 to mid-2022, bolstered by a continuous influx of new investors, the VN-Index demonstrated a robust ability to bounce back after each stumble. During this period, the index often witnessed a strong rebound during the subsequent session and trading week following a sharp decline.

However, the situation changed in the latter half of 2022 as market turbulence intensified. The VN-Index even dropped more than 4% in consecutive sessions on May 12th and 13th, 2022. This trend reversed in 2023, with the VN-Index regaining ground in the immediate session and week following steep declines.

In reality, the market’s recovery pace after recent drops largely depends on their timing. For instance, in the most significant decline so far this year, the VN-Index was hovering around its long-term peak and had just started to undergo a correction. Consequently, the index shed an additional 0.08% in the subsequent session and further plunged by 3.22% in the week after the initial drop.

At present, the market has undergone a considerable adjustment from its latest peak, shedding over 100 points (approximately 8%). Consequently, certain factors, such as profit-taking and margin pressures, might experience some alleviation. Nonetheless, there remain latent risks that are challenging to assess, including geopolitical tensions in the Middle East and Japan’s unexpected policy reversal.

Following the steep decline in Asian stocks on August 5th, particularly in Japan, the sell-off extended to the other side of the globe. US equities plunged into the red, with the Dow Jones, S&P 500, and Nasdaq all suffering substantial losses. Europe also experienced a similar fate, with the FTSE 100 and DAX sinking deeply. These developments inevitably influenced the sentiment of Vietnamese investors.

In summary, historical data serves only as a reference point, as each period carries its own unique context. It is challenging to accurately predict the stock market’s fluctuations in the upcoming sessions. Short-term pressures are undoubtedly imminent. However, there are positive factors that investors can anticipate.

According to Mr. Nguyen The Minh, Director of Yuanta Vietnam Securities Analysis, a review of market valuations reveals that whenever the VN-Index dropped to the 1,200-point mark, the market’s P/E ratio hovered around 10. Historical patterns suggest that a P/E ratio of 10 could indicate a potential market bottom. Furthermore, the fundamental story of enterprises is far more appealing now. While downward pressure persists, the current risks are significantly lower compared to the market’s upside potential.

The Yuanta expert anticipates that the market will reclaim the 1,200-point threshold within a few sessions. Additionally, the current dividend yield stands at approximately 9% annually, while savings deposit rates range from 5.5% to 6%. Investors are currently witnessing an unattractive market and are gripped by fear, leading to herd behavior. However, this situation is expected to change soon, resulting in improved capital inflows.

Sharing a similar viewpoint, Mr. Bui Van Huy, Director of DSC Securities Branch, believes that the market might retest the MA200 level around 1,200 points but will maintain its resilience, as observed last week. While it is challenging to expect heightened market activity, there is no reason for pessimism. The Q2 earnings season has concluded, but it will serve as a valuable reference for forecasting the trajectory of corporate profit recovery in the latter half of the year. Therefore, this presents an opportune moment to adopt a long-term investment mindset.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.