Joint Stock Company Investment Group I.P.A (HNX: IPA) successfully issued the IPAH2429003 bond lot on August 2, 2024. The bond has a value of VND 1,096 billion with a 5-year term maturing on August 2, 2029.

According to data from HNX, the bond has an issuance interest rate of 9.5%/year, with interest payable every 12 months, and the principal payable at maturity.

This is a “3-no” bond with no conversion, no warrants, and no collateral. The bond has a put option at the request of the issuer or by agreement.

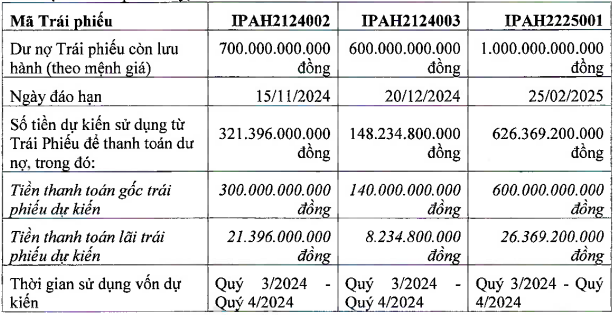

IPA announced that it will use the entire proceeds from this bond (after issuance costs) to restructure the debts of the outstanding bonds IPAH2124002, IPAH2124003, and IPAH2225001 of the Company, expected to be implemented in Q3 – Q4/2024. The bonds will mature sequentially in November – December 2024 and February 2025.

Specifically, IPA will pay VND 300 billion in principal and over VND 21 billion in interest for the IPAH2124002 bond; VND 140 billion in principal and over VND 8 billion in interest for the PAH2124003 bond; and VND 600 billion in principal and over VND 26 billion in interest for the IPAH2225001 bond.

|

Capital Usage Purpose of the Issuance

Source: IPA

|

On August 2, 2024, IPA made its first move by repurchasing VND 140 billion of the IPAH2124003 bond ahead of schedule, thereby reducing the remaining value of the bond to VND 460 billion. It is known that this bond was issued on December 20, 2021, with a term of 3 years maturing on December 20, 2024, and an issuance value of VND 1,000 billion.

The issuance of new bonds to restructure old bonds is not a strange move for IPA. In June and early July 2024, IPA also spent VND 700 billion to buy back two lots of bonds and successfully issued two new lots of bonds with a total value of VND 1,052 billion.

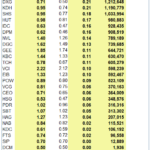

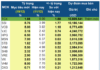

With the above moves, IPA currently has 6 outstanding bonds with a total remaining value of VND 4,308 billion.

|

List of IPA’s Outstanding Bonds

Source: Author’s Compilation

|

In Q2/2024, IPA recorded over VND 163 billion in net revenue, 3.3 times higher than the same period last year. However, net income decreased by 56% to nearly VND 66 billion, mainly due to higher financial expenses.

Another notable point is the negative cash flow of over VND 23 billion in the first 6 months of the year, largely due to the negative cash flow of nearly VND 220 billion from operating activities and the negative cash flow of nearly VND 244 billion from financing activities due to the payment of over VND 1,632 billion in principal debt.

Huy Khai