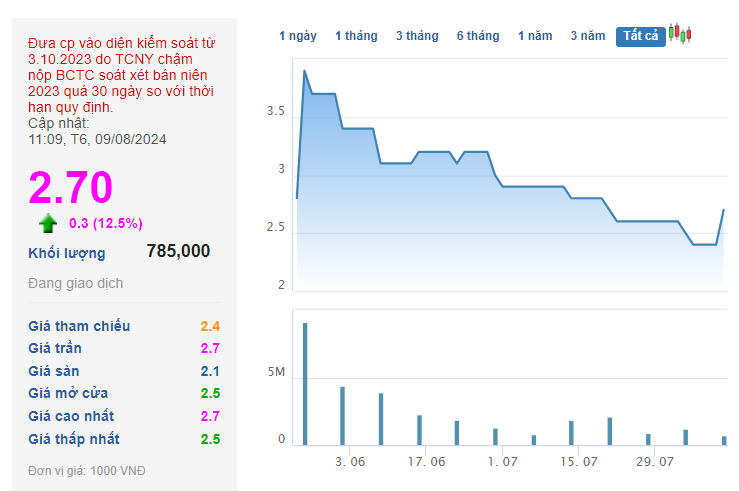

The trading session on August 9 witnessed a sharp rally in steel stocks, with the most notable being POM of Pomina Steel Joint Stock Company (POM ticker). Share prices surged to the daily limit of 12.5%, reaching VND 2,700 per share, with a buying queue of nearly 800,000 units at the ceiling price.

This positive momentum in the stock followed Pomina’s announcement regarding its development strategy and comprehensive restructuring plan.

Firstly, concerning the strategic partnership with Nansei Steel Company (Japan), Pomina officially signed a strategic cooperation agreement with Nansei in late July 2024. As per the agreement, Nansei will provide sufficient raw materials for Pomina 2 to operate at maximum capacity starting from September 2024, meeting the growing market demand.

This collaboration optimizes the supply chain and enhances production efficiency by integrating from raw materials to the market. The strategic cooperation marks a significant turning point in the development journey of both companies.

Secondly, Pomina also signed an MOU with a large and professional investor, aiming to restart the blast furnace project in early 2025 to capture the expected recovery in public investment and real estate projects in 2025.

The company has not yet disclosed the identity of this new investor.

It is known that Pomina implemented the blast furnace project and commenced production in February 2021. Pomina 3 factory transitioned from an EAF furnace to a blast furnace, resulting in a 42.6% increase in net revenue and a 1.5-fold rise in after-tax profit compared to the previous year. However, with the downturn in the steel market since early 2022, the company had to announce the suspension of blast furnace operations from September 23, 2022, and terminate labor contracts with some employees due to challenging business conditions.

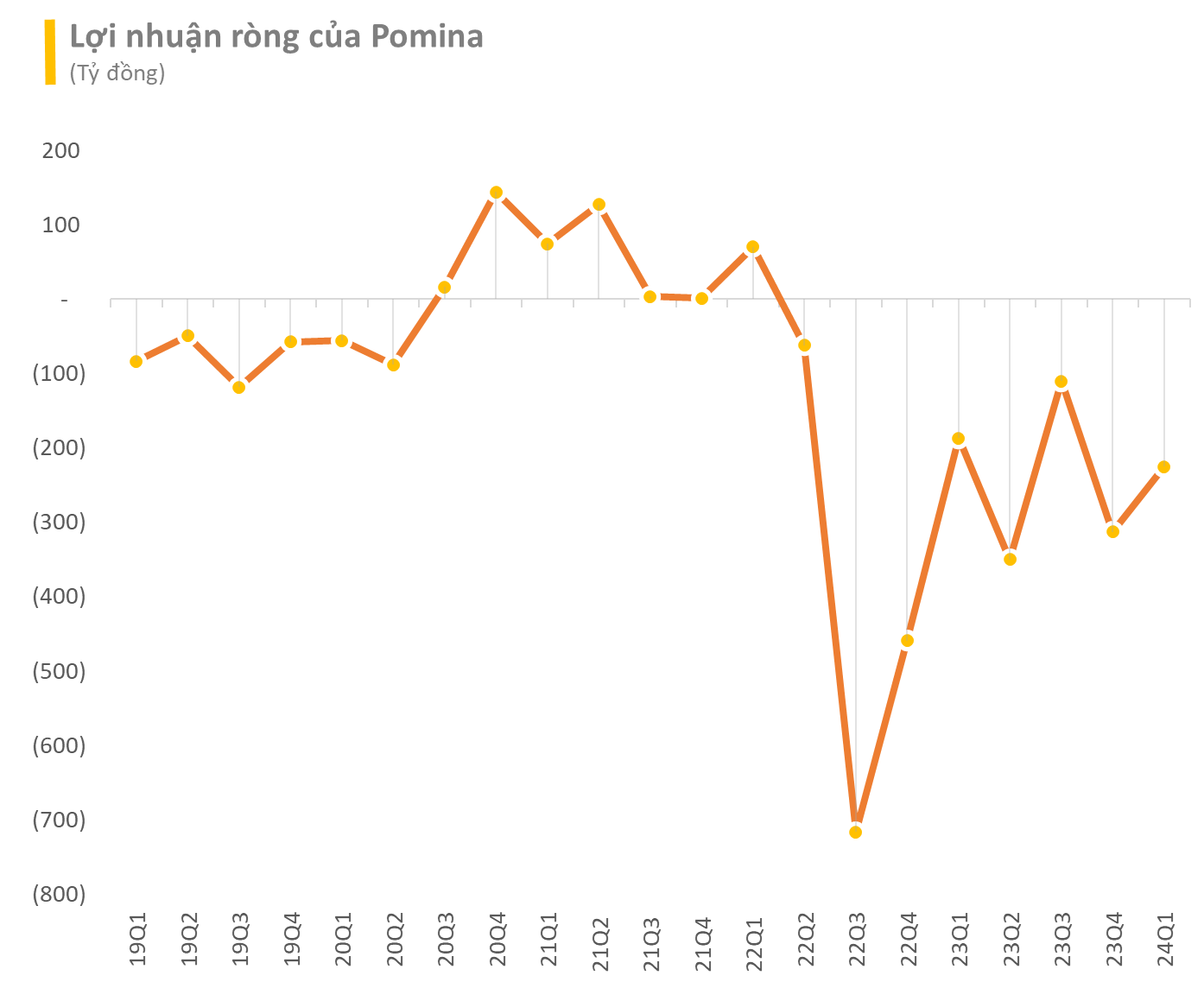

Given the cyclical nature of the steel industry, Pomina’s financial performance has been volatile. In the past, Pomina Steel enjoyed prosperous periods with profits ranging from VND 400-700 billion. However, after the boom cycle, the company’s profits declined significantly, even resulting in losses.

In the first quarter of 2024, Pomina recorded a 71% year-on-year decrease in revenue, amounting to VND 471 billion, and a loss after tax of VND 225 billion, compared to a loss of VND 187 billion in the same period last year. This marked the eighth consecutive quarterly loss for Pomina since the second quarter of 2022. As of March 31, 2024, Pomina’s accumulated loss reached VND 1,697 billion, equivalent to 61% of its charter capital.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)