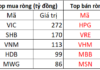

Interbank rates remain high, surpassing the 4% threshold across all tenors

In July, the State Bank of Vietnam (SBV) flexibly utilized both the OMO and bill issuance channels to stabilize system liquidity. Notably, the amount of money injected through the OMO channel this month was five times higher than the previous month.

As of the end of July, the net money injected into the system was estimated at VND 416.4 trillion with a tenor of 7 days and an interest rate of 4.5%, including VND 236.1 trillion in matured bills. MBS estimated that about VND 81.6 trillion in bills would continue to mature in August. Also, in July, the SBV maintained bill issuance with a total value of about VND 196.1 trillion with a tenor of 14 days and an interest rate of 4.5%.

The interbank market rates remained above 4% across all tenors during the month. On July 09, the overnight rate surged to 4.9% – the highest since the end of May – signaling a liquidity shortage in the system after strong net withdrawals by the SBV in the past two months. In addition, credit growth as of June 30 reached 6%, also impacting the upward trend of interbank rates. By the end of the month, thanks to the SBV’s intervention efforts, the overnight rate fell to 4.3%, while interest rates for tenors from one week to one month fluctuated between 4.5-4.6%.

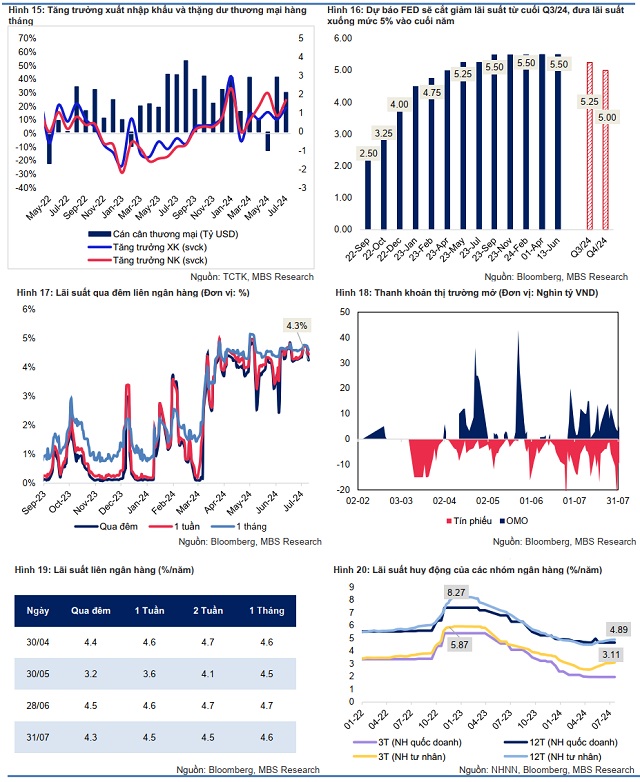

Deposit rates are on an upward trend

According to MBS, as of July 31, a total of 20 banks (including 5 large banks: MBB, VPB, ACB, Sacombank, and BIDV) have adjusted their deposit rates, with increases ranging from 0.1-0.7%. Some banks’ rates have even surpassed the 6%/year mark, while credit growth is increasing threefold compared to capital mobilization. This has prompted banks to aggressively increase deposit rates to enhance the competitiveness of savings channels compared to other investment channels in the market. Following VietinBank, BIDV is the second state-owned joint-stock commercial bank to adjust savings rates. Specifically, the interest rate for online deposits with a tenor of 24-36 months was increased by 0.1%/year.

Deposit rates are expected to rise slightly by 50 basis points in the second half of 2024

MBS believes that credit demand will continue to show a stronger upward trend from mid-2024 as production and investment accelerate in the final months of the year.

In the first seven months of the year, the industrial production index (IIP) increased by 11.2% year-on-year, and the Purchasing Managers’ Index (PMI) reached 54.7 in July. Public and private investment rose by 2.3% and 6.7%, respectively, in the same period.

“We forecast that the 12-month deposit rates of large commercial banks may increase slightly by 50 basis points, returning to the range of 5.2-5.5% by the end of 2024. However, lending rates will remain at the current level as authorities and commercial banks are striving to support businesses’ access to capital,” said the MBS expert.

Source: MBS

|

Khang Di

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.