An expert has opined that concentrating capital in real estate, as in the previous period, will not create added value, jobs, and prosperity for a nation, commensurate with the capital poured into this field.

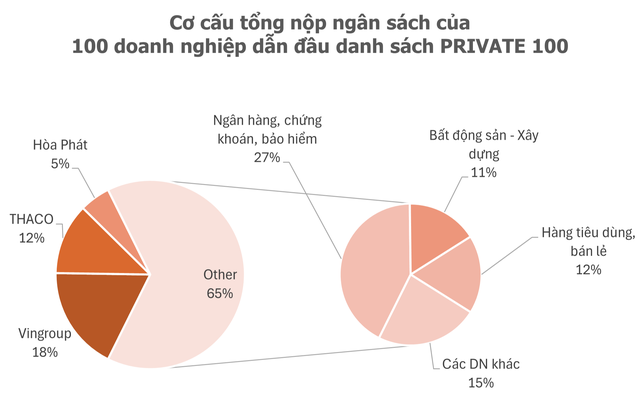

– According to PRIVATE 100 – the list of private enterprises with the largest budget contributions in Vietnam in 2023, with a minimum actual contribution of 100 billion VND compiled by CafeF, banking, real estate, and steel are the industries with the most significant contributions from enterprises. The list is topped by private banks. The securities sector has three leading enterprises with contributions of over 1,000 billion VND. The technology sector also has two representatives contributing over 1,000 billion VND, namely FPT and VNG. What is your assessment of the contribution of the private enterprise sector to the state budget?

In the early stages of economic integration, starting from Vietnam’s accession to the WTO, large-scale joint-stock companies with significant budget contributions were mostly state-owned enterprises that had undergone equitization, such as Vinamilk and Vietcombank. However, in the last 15 years, we have witnessed the development of many large-scale joint-stock companies from the growth of private enterprises. The private sector is growing and making significant contributions to the economy. This is entirely in line with our country’s orientation towards a market economy.

In the past three years alone, the contribution of the private enterprise sector to the state budget has been substantial. In Vietnam, small and medium-sized enterprises currently account for a large proportion in terms of quantity and labor force. However, this group is estimated to contribute only about 30% of tax revenue. In contrast, large enterprises contribute up to 70%. This is not unusual, as large economies like Japan, Korea, and the US also have similar situations.

Among the contributors to the state budget, the banking and real estate sectors account for the largest proportion. This is understandable, given the large capitalization of these two industries on the stock exchanges. Following them are enterprises in the industrial sector, such as steel, automobile, and consumer goods.

A bright spot in terms of budget contribution is the securities enterprises. In recent years, along with the development of the stock market, with trading sessions reaching a value of up to 30,000 billion VND, securities companies have had a strong growth momentum. However, it should be clarified that many securities companies mainly engage in lending, and their revenue does not come primarily from transaction-based fees. Nonetheless, the contribution of these companies to the state budget also demonstrates the growing scale of Vietnam’s securities system.

Regarding the contribution of the technology sector to the state budget, FPT and VNG are currently the leading enterprises. These companies derive revenue from both domestic and foreign operations. FPT, in particular, is a technology corporation that has achieved growth in both breadth and depth.

– Specifically, regarding the banking sector, what is your assessment of the contribution and rise of private banks in the past period, with notable names such as Techcombank and VPBank?

Many Vietnamese private banks have developed well in terms of breadth and depth by investing in technology to build data systems and create quality products and services. Nowadays, people are becoming accustomed to using banking services through smartphone applications. Thanks to smart banking applications and their strong development in Vietnam, payment transactions have become more convenient.

As mentioned earlier, the significant contribution of private banks to the state budget is understandable, given their large capitalization on the stock market. Vietnam’s market economy has grown strongly in the past period. From 2012 until now, Vietnam’s GDP has almost doubled. The expansion and growth of banks are inevitable consequences of this economic growth. They have good strategies and wise choices of partners, leading to remarkable development.

However, in reality, some private commercial banks in Vietnam are not solely engaged in lending and services, as in the US. They also take on the role of investment banks and financial companies. Many commercial banks have evolved into financial groups with diverse ecosystems, which helps them achieve a large scale but also entails certain risks.

– Could you elaborate on the differences between the private banking systems in the US and Vietnam?

The US private banking system is more diverse, with various forms, including a distinction between commercial banks and investment banks. Commercial banks can also be specialized by industry or by region. In Vietnam, commercial banks operate as both commercial and investment banks and have a nationwide presence, unlike some small US banks that focus on specific regions. This is the first difference.

Secondly, Vietnam’s banking system operates under a market mechanism with state control. Vietnamese commercial banks do not merely engage in monetary business under a market mechanism but also work towards macroeconomic objectives in finance to ensure the safety of the financial and banking system and align with economic development in each period, especially the Big 4 banks.

Therefore, private banks in Vietnam are subject to control and management in terms of capital mobilization, credit growth, and other regulations. Even the leadership personnel of banks, such as the Chairman and General Director, must be approved by the State Bank of Vietnam.

One notable feature is that despite the existence of bankruptcy laws, the state still provides support to prevent losses for depositors when a commercial bank encounters difficulties and faces the risk of bankruptcy. For example, in the case of SCB, even if there is an incident, depositors still have faith in state protection, despite the existence of the Bankruptcy Law. Moreover, if a commercial bank faces a liquidity crisis, the Big 4 banks must provide assistance to ensure liquidity for depositors.

In contrast, private banks in the US operate purely under a competitive market mechanism. As a result, bank failures are quite common in the US. Depositors in failed banks usually have to accept their losses.

In Vietnam, private banks are also managed as public joint-stock companies. The state does not allow the dominance of individuals or specific organizations but ensures that banks operate as true public entities. Therefore, the state regulates the ownership ratio of organizations and individuals to ensure that commercial banks operate with a Board of Directors. This distinction is necessary. The state, specifically the State Bank of Vietnam, needs to ensure the supervision of the private commercial banking system.

– What makes you believe that the management of private banks by the State Bank of Vietnam is necessary?

The reality proves that thanks to the supervision and management of the State Bank of Vietnam, Vietnam’s economy and financial and banking system have remained resilient and overcome challenges during three difficult periods: 1997-1998, 2008-2012, and most recently, 2020-2022.

For instance, in 2008, the financial crisis led to the collapse of many banks worldwide and in Southeast Asian countries. However, Vietnam only faced difficulties. The banking system stood firm thanks to the state’s management and direction.

In 2022, when banks competed to increase savings interest rates, lending rates also soared. Looking back at the news during that time, many experts worried about the collapse of the banking system as inflation and interest rates rose sharply. But the resolute handling of the State Bank of Vietnam during that period ensured the stability of the financial and banking system and the economy.

Another example is the case of SCB, where the State Bank of Vietnam promptly intervened, supervised the quality of lending, and prevented a collapse that could have impacted the entire system.

Of course, on the other hand, private banks are “tied” in credit growth as they have a certain credit limit set by the State Bank of Vietnam. Private banks also cannot significantly increase deposit interest rates compared to the average. This prevents unhealthy competition, as seen in 2022.

Moreover, in Vietnam, each bank determines the risk separately for each customer group and industry and does not apply a uniform approach to all groups. Some banks are willing to accept risks to lend. But this lending is also controlled by the State Bank of Vietnam to ensure the safety of the financial and banking system.

– What are the most pressing issues facing banks at the moment?

The capital mechanism remains the most significant issue. Secondly, it is essential to recognize that commercial banks are inherently involved in monetary business related to micro and macro aspects. The micro aspect pertains to enterprises, while the macro aspect concerns the global and domestic economic situation. Therefore, banks need leaders with strong financial knowledge, preferably graduates of reputable universities, rather than just those skilled in business management. These leaders should have a solid foundation in finance and economics and practical experience.

Consequently, the mechanism for selecting bank leaders is crucial to preventing situations where the operators are “insiders” of the “bank owners,” lacking the knowledge and capacity to manage and causing risks to the system.

Currently, banks in Vietnam are aware of their significant responsibility to support capital for production and business sectors, especially during challenging periods. However, most banks are joint-stock companies that face pressure from shareholders regarding profitability. This leads some banks to focus on credit growth and pour capital into the real estate sector to seek short-term profits without long-term strategies aligned with Vietnam’s competitive production and business sectors and sustainable development. When the real estate market declines, as we have witnessed, non-performing loans emerge, and the bank’s development does not lead to sustainability.

– In reality, some opinions suggest that banks’ lending to the real estate sector should be limited. What is your view on this?

It must be affirmed that in the past period, real estate and banking were like “twin brothers.” Looking back at previous stages, when banks grew stronger, the real estate market thrived, and when the real estate market encountered difficulties, commercial banks also faced challenges.

There were two notable periods that highlighted the development of banks linked to real estate. The first was from 2006 to 2010, when the real estate market was vibrant, and the commercial banking system began to develop. Then, when the real estate market faced a crisis in 2011-2012, the banking industry struggled.

In 2014, when the real estate market recovered, banks also gradually grew and expanded their scale.

In fact, in the past period, without the capital of commercial banks, there would be no large real estate companies. And without real estate projects, banks would find it difficult to achieve rapid credit growth and easily deploy capital in the billions to a single customer… Therefore, the collapse of the real estate market in 2011-2012 was partly due to the responsibility of banks. This is why some banks had to undergo restructuring.

In 2022, the two-way impact of banks and real estate was similar. However, the state has managed the situation much better this time.

Additionally, lending to the real estate sector is more straightforward for banks. Assessing, analyzing, and recovering capital through real estate collateral is more reassuring than lending to the production and business sector, which involves diverse industries and requires more effort and expertise in appraisal and management.

– So, the lending of commercial banks to the real estate sector does not affect the sustainable development of the financial system?

Commercial banks cannot solely focus on lending to the real estate sector. Some commercial banks that have ventured deeply into this field have encountered difficulties when the real estate market has faced crises. The common impact can affect the entire banking system.

If banks only lend to the real estate sector, we will not develop production and business sectors, leading to a lack of goods, consumer goods, and services and a failure to generate GDP. The capital cycle in real estate is also very slow, taking 3-5 years. In contrast, investing in production and business can result in shorter cycles of 3-6 months. Developing production and business sectors creates value through a growth spiral, leading to a nation’s prosperity.

No nation can prosper by heavily lending to the real estate sector, which only benefits a small group. Currently, the Vietnamese government is gradually doing an excellent job of channeling capital towards production and business sectors. Regarding the real estate sector, with the synchronization of the legal system, this market is also gradually stabilizing.

— Thank you for your insights!

PRIVATE 100 – Top Private Enterprises with the Largest Budget Contributions in Vietnam is a list compiled by CafeF based on publicly available sources or verifiable data, reflecting the actual budget contributions of enterprises, including taxes, fees, and other mandatory payments. Enterprises with budget contributions of at least 100 billion VND in the latest fiscal year are eligible for inclusion in the list. Some notable enterprises in the 2024 list, reflecting the actual contributions of the 2023 fiscal year, include ACB, DOJI, HDBank, LPBank, Masan Group, OCB, PNJ, SHB, SSI, Techcombank, TPBank, Hoa Phat Group, VNG, VPBank, VIB, VietBank, and VPS… (listed in alphabetical order)

In 2023, GELEX earns nearly 1,400 billion VND

In the face of macroeconomic pressures over the past year, GELEX Corporation has implemented flexible strategies to maintain stability and strive for sustainable growth.