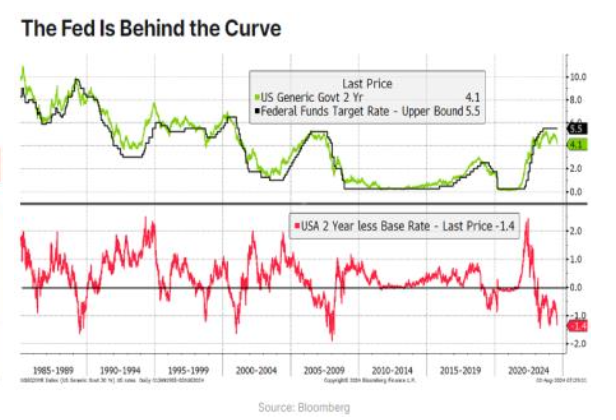

In its recently published July report, SGI Capital emphasizes the negative impact of rising interest rates. The possibility of a weakening US and global economy in the second half of this year, with a potential recession in 2025, is becoming more likely. This marks a shift in the stock market from expecting lower interest rates to being cautious about unemployment rates.

According to SGI Capital, recent selling pressure in the stock market stems from: 1) the growth rate of leading tech companies’ profits has peaked in the first quarter and is expected to fall to 15% by 2025, while valuations have already been too high; and 2) optimistic money flows into global equity funds, which also peaked in July.

Meanwhile, persistently high-interest rates have resulted in 44% of small and medium-sized businesses incurring losses. The yield spread between weak companies and US government bonds is starting to widen again from a low base and will be an early indicator of an upcoming wave of bankruptcies. Yields on US government bonds have fallen sharply, and the market is signaling that the Fed may have been too late in cutting rates to avoid a US recession.

Source: SGI Capital

Additionally, as interest rates rise and the Yen strengthens, speculative carry trade flows reverse. However, deleveraging is often not smooth when there are too many simultaneous loan repayments. As a result, the Japanese stock market experienced two record-breaking sell-off sessions, falling 18% and impacting global stock markets.

Moreover, China’s key economic data, including retail sales and industrial production, are weakening, particularly in consumption. This continues to put downward pressure on key commodities as China offloads its excess supply onto the world, given its record trade surplus. In this economic cycle, China, with its internal issues, will not be able to play the same growth-driving role it did in 2009-2010 if the US and global economies fall into a recession in the coming period.

Potential risks will become more apparent

Domestically, SGI Capital assesses that the macro economy continues to improve, with retail sales, FDI disbursement, industrial production, and exports recovering. Although overall inflation remains high, core inflation has fallen to 2.61%, and with the sharp decline in world oil prices and the USD Index, inflation and exchange rates will no longer pressure the SBV in the coming period.

The fund believes this is an opportune time for monetary policies to remain accommodative to support credit and economic recovery. However, headwinds from the risk of a global recession have started to emerge and could negatively affect the country’s economic growth trajectory in the latter part of this year and into 2025.

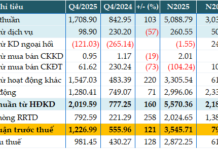

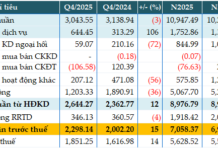

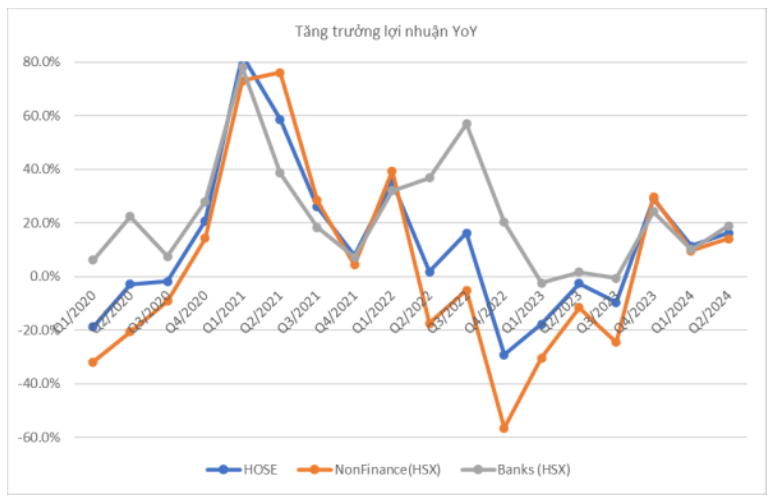

Looking at second-quarter financial results, revenue and profit growth continued to improve compared to the first quarter and the same period in 2023, partly due to a low base effect and partly due to non-core profits from non-financial companies. Stocks with strong financial performance have attracted significant capital inflows, which is reflected in their valuations.

Source: SGI Capital

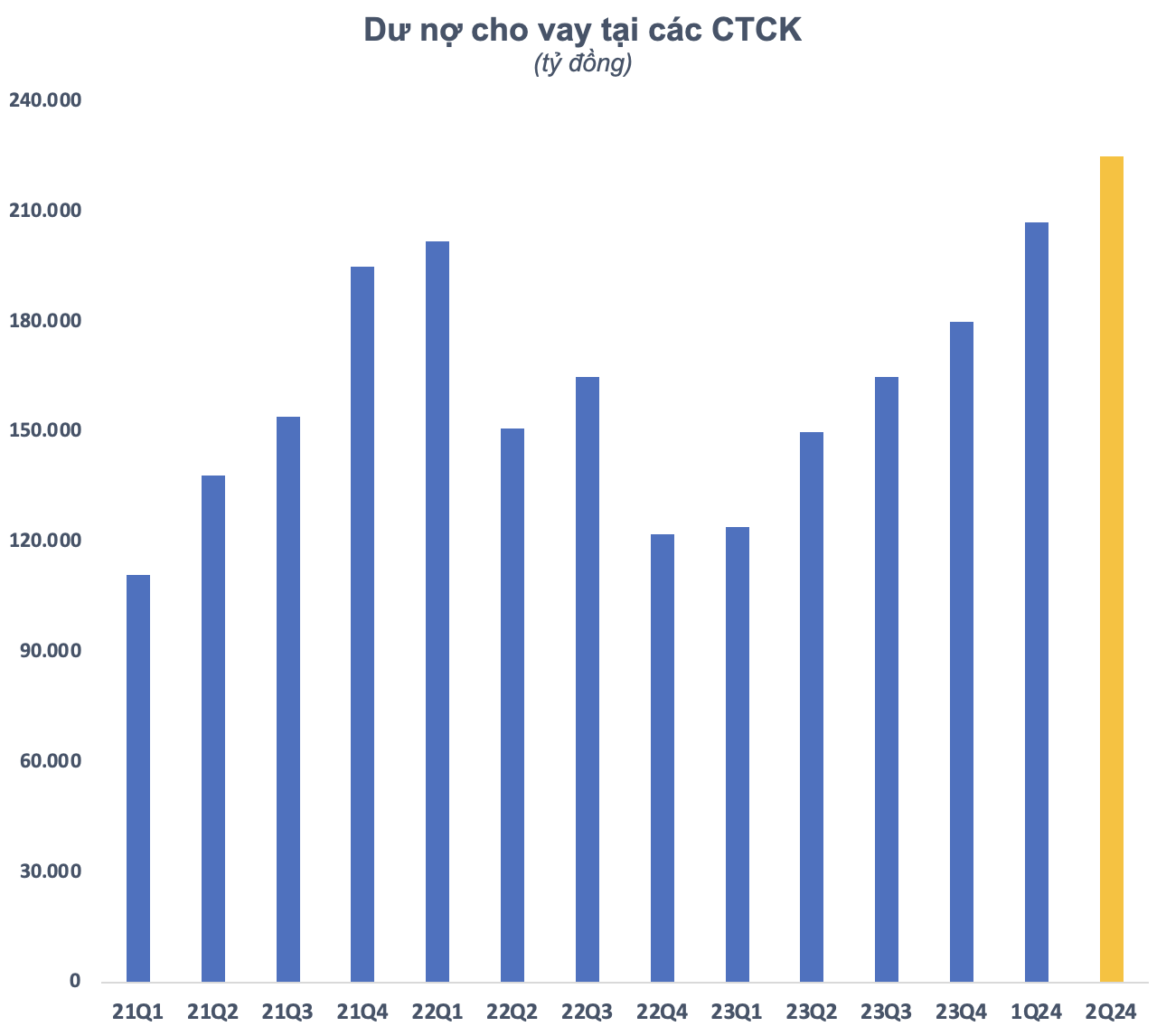

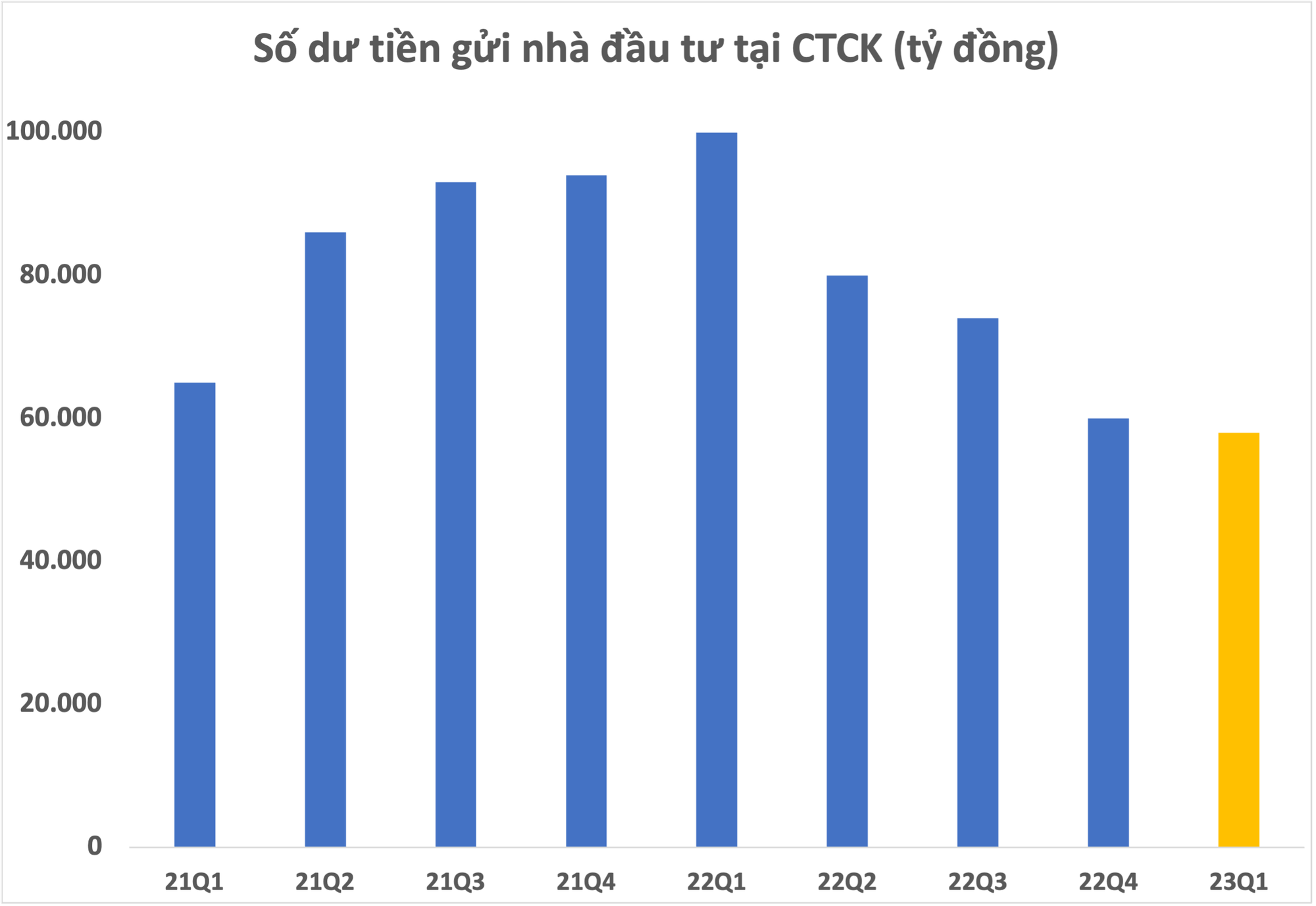

After peaking in the second quarter in terms of liquidity and the ability to attract cheap capital, trading value declined rapidly in July under selling pressure from foreign investors, insider selling, and issuance pressure. Investors’ cash balances decreased while margin loans increased to record levels. SGI Capital believes that a large portion of these margin loans may be borrowed by business owners and shareholders to fund other activities, indicating difficulty in accessing credit and resulting in their acceptance of high-interest rates (11-15% per annum) for short-term brokerage loans.

These margin loans do not guarantee low risk if the cash flow situation of these businesses and individuals remains challenging. A large-scale forced sale of pledged blocks would have a more negative impact on the overall market compared to margin calls for small retail investors. “What happened recently in the Japanese stock market or the Vietnamese stock market in 2022 is a warning when margin rates are high and market trends are unfavorable,” SGI Capital stated.

In the past month, up to 60% of stocks on the three exchanges fell more than 15% from their peaks. All 50 of the most actively traded stocks declined, with half falling more than 20%. This statistic highlights the challenges investors have faced in finding opportunities and avoiding losses recently. August is expected to be another difficult month as foreign capital outflows continue amid unchanged market liquidity.

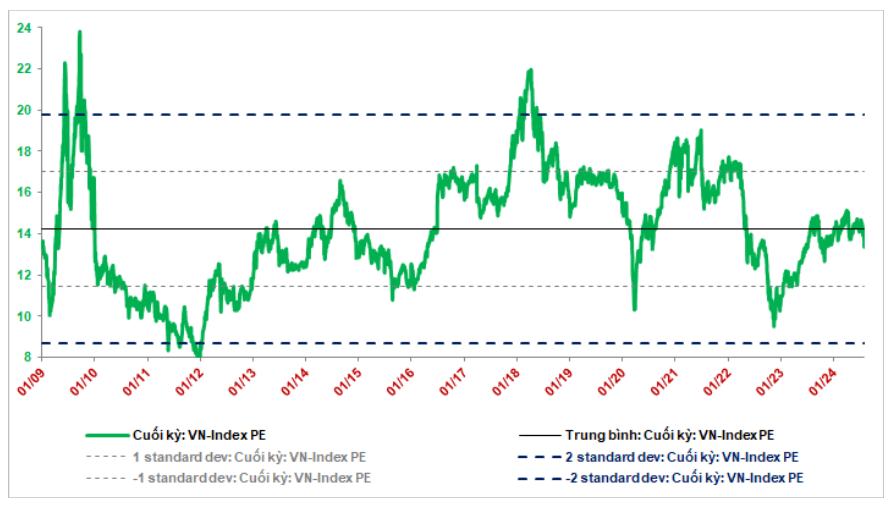

According to SGI Capital, expectations for growth and reasonable valuations are currently supporting market confidence and making future valuations for many stocks more attractive. However, the quality of profits and growth prospects are threatened by the increasing risk of a global recession, necessitating caution and a larger discount for a safety margin when investing.

“Potential risks, both domestic and international, are likely to become more apparent in the coming months, leading to significant capital shifts and creating many opportunities for patient investors,” SGI Capital emphasized.