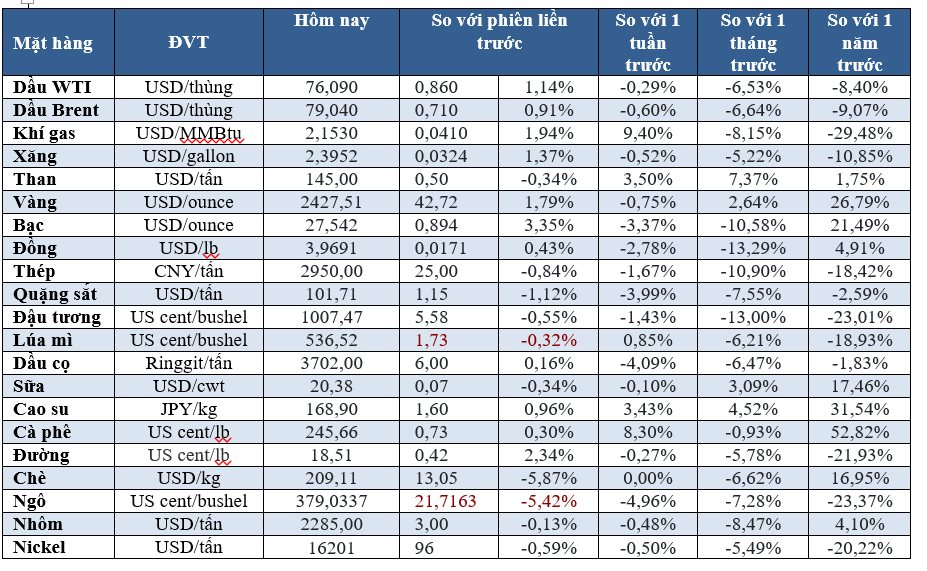

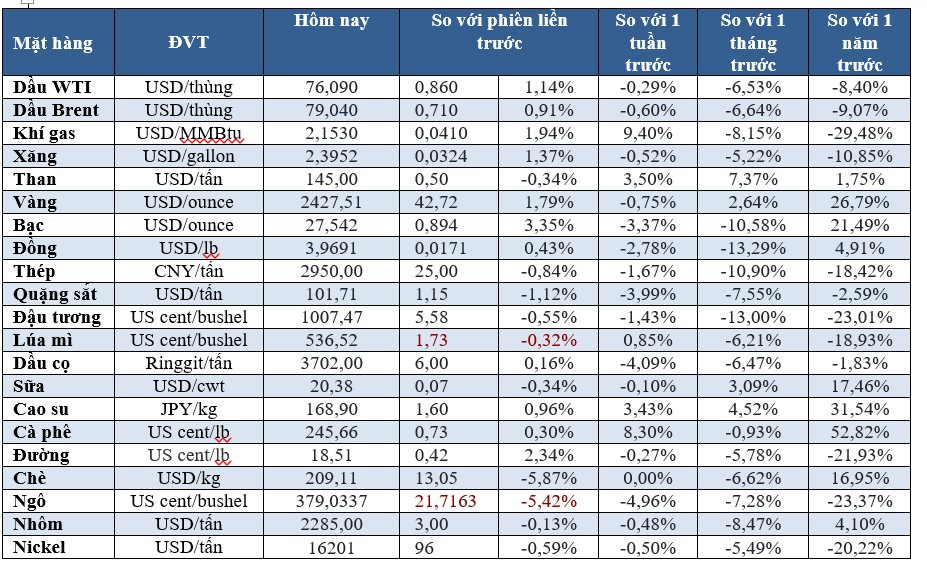

Oil Rises on Easing Demand Concerns, Geopolitical Tensions

Oil prices extended gains for a third session as U.S. jobs data eased concerns about demand for the fuel, and Middle East tensions helped prices recover from eight-month lows hit on Monday.

Brent crude futures rose 83 cents, or 1.06%, to $79.16 a barrel. U.S. West Texas Intermediate (WTI) crude futures climbed 96 cents, or 1.28%, to $76.19.

Oil prices rose after data showed the number of Americans filing new claims for unemployment benefits fell more than expected last week, suggesting worries about a paralyzed labor market had been overblown.

Libya’s National Oil Corporation declared force majeure on shipments of Sharara crude from Tuesday, a statement said, adding that the company had been reducing output at the field due to protests.

Analysts at Citi said Brent was likely to rise towards $80 per barrel.

Gold Rises Over 1% on Safe-haven Demand, Fed Rate Cut Bets

Gold prices rose over 1% on safe-haven demand and growing expectations of a significant interest rate cut by the U.S. Federal Reserve in September.

Spot gold was up 1.8% at $2,423.25 per ounce by 17:58 GMT, snapping a five-day losing streak. U.S. gold futures settled 1.3% higher at $2,463.3.

Brokerages including J.P.Morgan, Citigroup, and Wells Fargo have predicted a 50-basis-point rate cut in September after weak U.S. jobs data last week.

Markets are pricing in a 72% chance of a 50-basis-point cut in September, up from 70% on Monday, according to the CME FedWatch Tool, with an additional reduction expected in December.

U.S. data showed 233,000 new applications for state unemployment benefits last week, below the 240,000 that economists had expected and down from the prior week’s 250,000, easing concerns about a recession in the world’s largest economy.

Silver jumped more than 3.4% to $27.49 per ounce, platinum rose 1.4% to $932.75, and palladium gained 4.1% to $918.75.

Copper Edges Higher on Expected Chinese Demand, Rate Cut Hopes

Copper prices edged higher on expectations of improved demand from top consumer China and a potential interest rate cut by the U.S. Federal Reserve later this year.

Three-month copper on the London Metal Exchange rose 0.3% to $8,794.5 per ton, having earlier slipped to $8,716, near Monday’s two-week low of $8,714.

Factors limiting copper’s recovery include a stronger U.S. dollar, which rose after U.S. weekly jobless claims fell more than expected, easing concerns about an impending recession in the world’s largest economy.

LME copper inventories have nearly tripled in less than three months to 294,750 tons by Wednesday.

On the macro front, traders have raised expectations for a Fed rate cut in 2024, with nearly 105 basis points of easing now priced in by year-end.

A U.S. rate cut could pressure the dollar and make metals cheaper for buyers with other currencies.

On the LME, zinc gained 2.8% to $2,625.5, after touching a three-month low in the previous session due to low inventories. Aluminum fell 0.5% to $2,277 a ton, nickel dropped 0.8% to $16,160, lead inched up 0.1% to $1,968.5, and tin climbed 2% to $30,580.

Singapore Iron Ore Falls Below $100/T on China’s Steel Output Curbs Talks

Singapore iron ore futures fell for a third straight session, slipping below the psychological level of $100 per ton, as talks resumed on China’s steel output restrictions. Specifically, the September iron ore contract fell 2.03% to $99 per ton, touching its lowest since July 31.

The January 2025 iron ore contract on the Dalian Commodity Exchange closed down 3.63% at 729.5 yuan ($106.61) per ton, its weakest finish since April 1. The contract touched its lowest for the day at 727 yuan, the weakest since Aug. 15, 2023.

Beijing said it would continue to manage crude steel output this year but has not yet revealed any necessary details on timing and scale.

The market was also weighed down by increasing supply, with higher July iron ore imports, high port inventories, and surging exports from Brazil.

On the Dalian exchange, coking coal and coke fell 1.75% and 1.82%, respectively.

On the Shanghai Futures Exchange, steel rebar dropped 1.78% to its lowest since April 2020, hot-rolled coil fell 2.04%, wire rod lost 3.17%, and stainless steel declined 0.76%.

Corn, Soybeans Fall on Expectations of Large Supplies

Corn futures on the CBOT fell and soybean futures hit a new low as U.S. farmers rushed to sell old-crop corn and soybeans, flooding the global market with supplies, traders said.

Meanwhile, Chicago wheat futures rose early in the day on new weather threats to European crops but ended slightly lower.

CBOT wheat futures fell 3/4 cent to $5.37-1/2 per bushel. CBOT soybeans fell 10-1/2 cents to $10.08-1/4, and corn dropped 3-3/4 cents to $3.97 per bushel.

Cocoa Plunges as Market Expected to Swing into Surplus

Cocoa prices plunged as favorable weather in West Africa boosted expectations of a global surplus for the 2024/25 season. December New York cocoa fell $304, or 4.3%, to $6,714 per ton. December London cocoa lost 4.3% to £5,264 per ton.

A cocoa surplus of 108,500 tons is forecast for the upcoming season, following a record deficit of 475,000 tons in 2023/24, a Reuters survey of 12 traders and analysts showed.

The shortage in the current season is forcing grinders to draw down stocks, pushing U.S. cocoa bean stocks to their lowest in four years, according to ING.

Coffee Falls

September arabica coffee fell 1 cent, or 0.4%, to $2.453 per lb after touching a one-month high of $2.5175. September robusta coffee lost 1% to $4,436 per ton.

Sugar Prices Jump Over 2%

October raw sugar rose 0.43 cent, or 2.4%, to 18.57 cents per lb. October white sugar gained 2.4% to $526.60 per ton. The price increase was driven by expectations of continued export restrictions by the Indian government and dry weather in Brazil.

A survey conducted by S&P Global Commodity Insights showed average sugar production in the second half of July was 3.6 million tons, down 2.4% from a year earlier.

Japanese Rubber Hits Over 2-Week High on Thai Supply Concerns

Japanese rubber futures rose for a third straight session to their highest in over two weeks, underpinned by supply disruptions in Thailand and higher oil prices, although a stronger yen limited gains. The Osaka Exchange (OSE) rubber contract for January 2025 delivery rose 1.4 yen, or 0.44%, to 321.3 yen ($2.19) per kg, after hitting a session high of 323.6 yen, its strongest since July 22.

The January 2025 rubber contract on the Shanghai Futures Exchange (SHFE) rose 220 yuan, or 1.4%, to 15,905 yuan ($2,216.01) per ton. Natural rubber prices rose as flooding and crop diseases affected production areas, according to Hexun Futures in a note.

Thailand’s Meteorological Department warned of heavy rain in the upper part of the country from July 29 to August 4, causing flooding in some areas.

The September rubber contract on the SICOM exchange in Singapore settled 0.8% higher at 170.3 U.S. cents per kg.

Prices of Key Commodities on August 09, 2024