On a sweltering July afternoon, Mr. Nguyen Thanh Hai waited his turn to test drive BYD’s offerings in Bac Giang, Vietnam. For Mr. Hai, a self-proclaimed car enthusiast, this could be his first electric vehicle, and he was eager to try out the leading Chinese EV brand.

“Two of my relatives bought VinFast cars about a month ago,” said Mr. Hai, in his 70s, to Rest of World. “I could buy a BYD, but my biggest concern is the lack of charging stations.”

BYD officially launched in Vietnam on July 8 after months of anticipation and speculation about how the giant would operate in a market where VinFast has deeply rooted and comprehensive charging infrastructure.

BYD commands nearly half of the Southeast Asian EV market, attracting customers in large markets like Thailand and Malaysia with its competitive pricing and appealing lineup. But Vietnam is a tougher nut to crack, according to Abhik Mukherjee, an automotive analyst at Counterpoint Research.

BYD electric vehicles on display during the opening of a showroom in Hanoi.

“BYD faces significant challenges in penetrating the Vietnamese market, mainly due to VinFast’s near-monopoly on EV charging infrastructure,” he said. “Additionally, long-standing wariness of Chinese products in Vietnam could pose another barrier, influencing consumer perception and acceptance.”

VinFast currently holds a massive charging network with over 150,000 ports exclusively accessible to VinFast vehicles. Before BYD’s launch, VinFast introduced a policy offering free charging for a year at any of these stations.

Other EV manufacturers, including some Chinese brands like Wuling and Haima present in Vietnam, rely on the more limited third-party charging network. There are about 100 such charging points nationwide, Vu Ngoc, a sales manager at a BYD dealership in Bac Giang, told Rest of World.

“Some customers like the car but are concerned about charging,” he said. Customers can use the fast-charging ports at his dealership, as well as dozens of others opened across the country. By the end of the year, BYD plans to have a total of 50 dealerships, all equipped with fast-charging ports.

Customers can also charge their vehicles at home, according to Vo Minh Luc, CEO of BYD Vietnam, who spoke at the product launch event. “You only need to charge your car twice a week,” he said. The company is also offering free mobile chargers and installation to early buyers.

Ngo Ky Lam, a manager at Otosaigon, argued that this doesn’t solve the problem in Vietnam’s crowded cities. “Not many homes have garages to park a car.”

VinFast electric vehicles on the streets of Hanoi in July 2024.

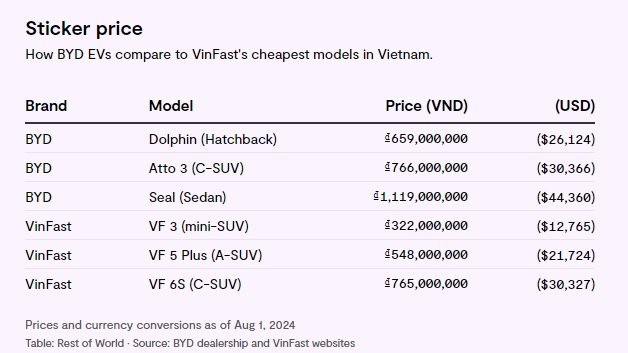

The lack of charging stations is just one of BYD’s challenges in Vietnam. They also have to compete with VinFast on pricing. BYD’s most affordable model, the Dolphin, retails for VND 659 million (over $26,000) – double the price of VinFast’s cheapest offering, the mini SUV VF 3.

On automotive forums on Facebook, the pricing of BYD vehicles hasn’t been well-received. Many users pointed out that BYD’s three models – the Dolphin, Seal, and Atto 3 – are more expensive than in Thailand. For instance, the Dolphin is priced at around $16,000 in Thailand, where BYD has a new factory.

BYD’s pricing compared to VinFast’s three most affordable models in Vietnam.

In Vietnam, BYD’s pricing isn’t competitive yet because the company is currently importing the vehicles from China, said Nguyen Dang Quang, an automotive industry expert. “If they were to import from Thailand, the price could be 30-50% lower.” Southeast Asian imports are tax-free in Vietnam.

For BYD, the company plans to open another factory in Indonesia, the region’s largest automotive market. Vietnam, on the other hand, sold just over 300,000 vehicles last year, far fewer than Thailand or Malaysia. But according to Counterpoint, EV sales in Vietnam surged over 400% in the first quarter of 2024, outpacing regional indices.

Chinese brands are seeking a larger share of this growing market. Wuling is already assembling vehicles in Vietnam, while Chery and BYD also have plans to open factories.

Vinfast electric taxi charging at one of the company’s stations in Hanoi.

Outside of Vietnam, BYD is clearly the leader. The company holds nearly half of the Southeast Asian EV market, while VinFast accounts for less than a fifth. Globally, VinFast delivered nearly 35,000 vehicles last year, while BYD sold over 3 million.

“If you follow online discussions, you’ll see that people who haven’t test-driven a BYD vehicle tend to be biased against it,” said auto expert Vinh Nguyen, who designed the test drive experiences for BYD in Vietnam, to Rest of World. “The feedback on the car’s quality has been very positive from those who have sat in the car and taken it for a spin.”

BYD’s market share compared to select EV competitors in Southeast Asia in Q1 2024.

At the Bac Giang dealership, the test drive event attracted 118 customers over two days, with eight placing orders. Most orders came from Chinese workers, their Vietnamese spouses, or those who had studied or worked in China, Ngoc said.

“BYD will initially face difficulties, but a good product will surely gain the trust of Vietnamese consumers,” Ngoc added, citing the success of Chinese electronics brands like Oppo and Xiaomi in Vietnam.

For Mr. Hai, BYD’s Chinese origins aren’t an issue. “In the past, we drove Chinese cars and trucks,” he said. “They were very good.”

After test-driving two out of the three BYD models, Mr. Hai’s main concerns, besides the lack of charging stations, were the price. “It’s more expensive than other models on the market,” he said of the Dolphin. “I’ll wait and see.”

Source: Rest of World