Mixue is a popular drink brand that has been gaining traction in Vietnam, especially among the youth. With its affordable price range of just 25,000 to 35,000 VND per cup of tea and 10,000 VND for a cone of ice cream, it’s no wonder that it has become a go-to choice for young people with average incomes.

Originating from China, Mixue was founded in 1997 by Zhang Hongchao. As of 2023, there are at least 21,581 Mixue stores operating in China and at least 12 other countries in the Asia-Pacific region, according to their website.

Mixue entered the Vietnamese market in 2018, and in less than five years, it has achieved a massive scale that few F&B brands in Vietnam can match. As of April 2023, Mixue announced that it had reached the impressive milestone of 1,000 stores in Vietnam.

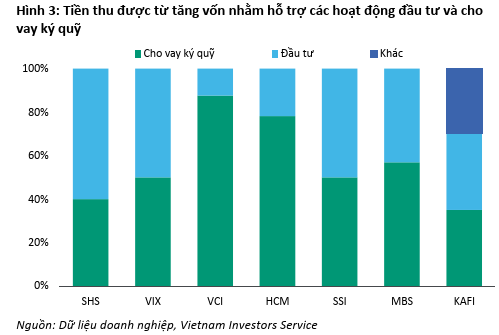

Along with its rapid store expansion, Mixue’s revenue and profit growth have been nothing short of remarkable.

According to Vietdata, Mixue achieved an impressive revenue growth rate in Vietnam in 2023, with a revenue of nearly 1,260 billion VND, a more than 160% increase compared to 2022. This far surpasses the revenue of other brands, which range from just tens to hundreds of billions.

Mixue’s net profit also saw a significant boost, reaching over 200 billion VND, a more than 200% increase compared to the previous year. This puts it far ahead of its competitors, such as Phê La, which earned approximately 50 billion VND, and Koi Thé, which earned nearly 25 billion VND.

When compared to the giants of the coffee chain industry, Mixue’s 2023 revenue is on par with Starbucks (over 1,300 billion VND) and only slightly lower than Phúc Long (1,500 billion VND) and Highlands Coffee (nearly 4,000 billion VND). However, in terms of net profit, Mixue outperforms both Highlands and Starbucks, and its profit is several times higher than that of Phúc Long.

Image source: Vietdata

The growth rate of net profit surpasses that of revenue, indicating that franchise revenue plays a significant role in the company’s financial performance.

The key to Mixue’s rapid expansion across markets lies in its franchise model. By franchising, Mixue avoids incurring high costs associated with store operations, such as rent, which allows the company to maintain relatively high profit margins.

As a result, the tea chain’s revenue primarily comes from franchise fees, management fees, machinery sales, and raw material costs. Thus, Mixue is known more as a raw material supplier than a sophisticated tea retailer.

Instead of seeking prime locations, Mixue strategically targets densely populated streets and smaller towns and cities, taking advantage of relatively affordable rent. This strategy, coupled with franchising, has propelled Mixue to the forefront of the beverage industry in Vietnam in terms of store count.

However, the flip side of this rapid franchising strategy is the high density of stores, with some streets having 2-3 outlets. This has led to intra-brand competition and caused frustration among investors.

Mixue’s discount and promotion policies are a double-edged sword. While they attract customers, they also erode store profits, as evidenced by the backlash from franchise investors. This raises questions about the sustainability and long-term profitability of the franchise model.

With its competitive pricing, Mixue targets students and young adults. In a recent report on the F&B industry by Cốc Cốc, based on data from over 30 million users and a survey of 1,999 respondents nationwide, Mixue ranked first among coffee and tea chains, outperforming established brands like Highlands Coffee and Phúc Long.

Mixue was the top choice among respondents aged under 18 and 18-24, with a preference rate of 36% and 44%, respectively.

Additionally, according to Momentum Works, the Mixue brand has become the fourth-largest F&B chain in the world.

It is also worth noting that Mixue is the first Chinese brand to break into the Top 5 largest F&B chains, which were previously dominated by American brands. If it maintains its current pace, Mixue could surpass McDonald’s within the next one to two years.