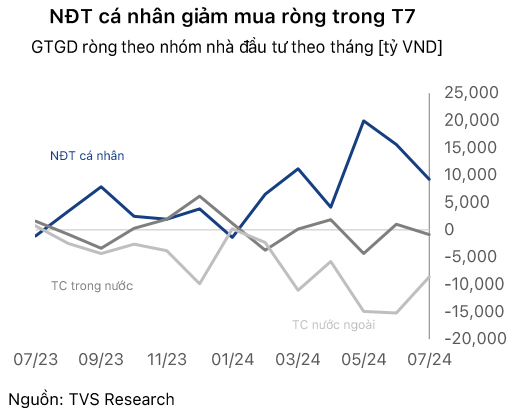

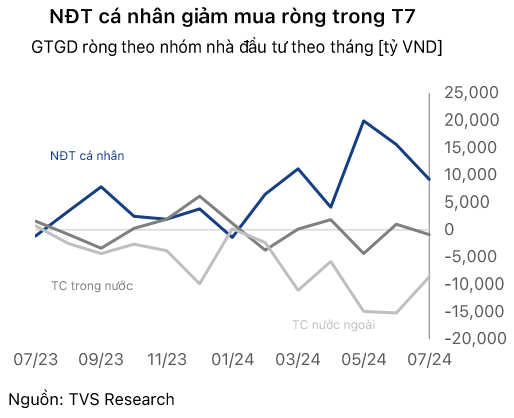

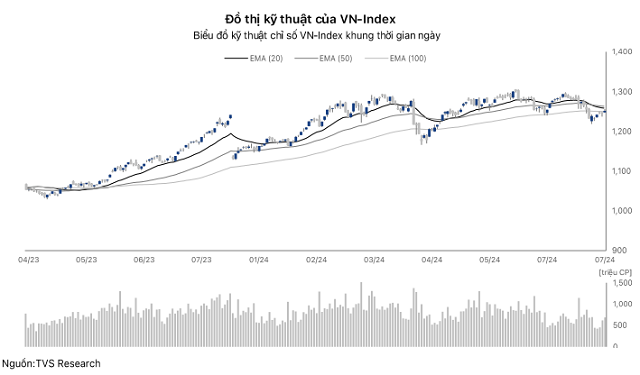

According to TVS Research, the sharp decline in market liquidity in July could be the main factor preventing the market from breaking the 1,300 mark, leading to sideways movement throughout the month. The VN-Index’s upward momentum in early 2024, driven by individual investor inflows, is now waning.

Meanwhile, macroeconomic factors such as economic growth and inflation remain on target, and the USD/VND exchange rate is being effectively managed, positively influencing the market.

However, in August, the analysts assess that the market’s downside risks will increase, mainly due to adverse effects from the macroeconomic situation in major economies and escalating geopolitical tensions in the Middle East.

In terms of valuation, the VN-Index’s P/E, after reflecting the second-quarter earnings of 2024, stands at 13.7 times, a 1.7 percentage point decrease from the previous month, approaching the 5-year average P/E.

TVS Research believes that the current P/E level is unattractive, given the correlation with the expected 20% profit growth for enterprises in 2024 and the potential for declining growth amid a less optimistic global economic outlook.

From a technical analysis perspective, with the significant drop in individual investor inflows, TVS Research suggests that the market currently lacks the necessary support for an upward trend. The VN-Index may continue its downward trajectory, targeting the next support level at 1,200.

Investors are advised to temporarily observe the VN-Index’s movements before making investment decisions.