Upward Trend Faces Challenges

Deep corrective sessions in late July and early August 2024, especially amid a global stock market sell-off, caused the VN-Index to break its upward trend established since October 2023. Maintaining the 1,150 – 1,160 level is considered a challenge for the VN-Index in preserving its mid to long-term upward channel in the coming period.

However, according to ACBS, excluding the possibility of a “recession” in the US economy as the warning signs of an impending recession have only recently begun to increase, the appropriate scenario for the VN-Index in the last six months is to continue fluctuating within the 1,150 – 1,300 range, given Vietnam’s stable macro environment, positive growth, and overall valuation becoming relatively attractive.

VN30 Valuation Remains Attractive

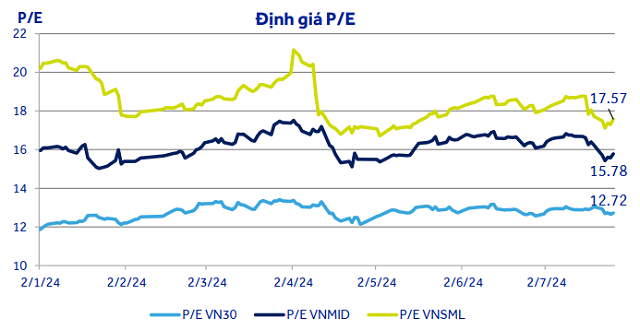

Mid-cap stocks (VNMid) have witnessed the best price increase since the beginning of the year, surging by 19.4%. Meanwhile, large-cap stocks (VN30) have risen by 9.9%, equivalent to the VN-Index, and small-cap stocks (VNSml) have increased by only 4.2%.

Although higher than at the beginning of the year, the P/E valuation of VN30 is still significantly lower than the 2020 – 2024 median of 13.4. In contrast, both VNMid and VNSml are far above their respective medians for the same period (VNMid median is 13.3 and VNSml is 12.2).

Therefore, with profit prospects unlikely to break out in the next 1-2 quarters, a broad-based correction for mid and small-cap stocks is reasonable. Opportunities in the second half of the year will likely favor the VN30 group (with banks making up a large proportion), especially as the Fed cuts interest rates and foreign investment flows potentially return to the market.

Continue to Prioritize Stock Picking

The Fed will commence interest rate cuts in September 2024 and is expected to lower rates three times this year, with a total reduction of over 1%. Both inflation metrics (CPI and PCE) are on a downward trajectory, while the job market has visibly weakened in recent days, making the risk of a US recession a primary concern.

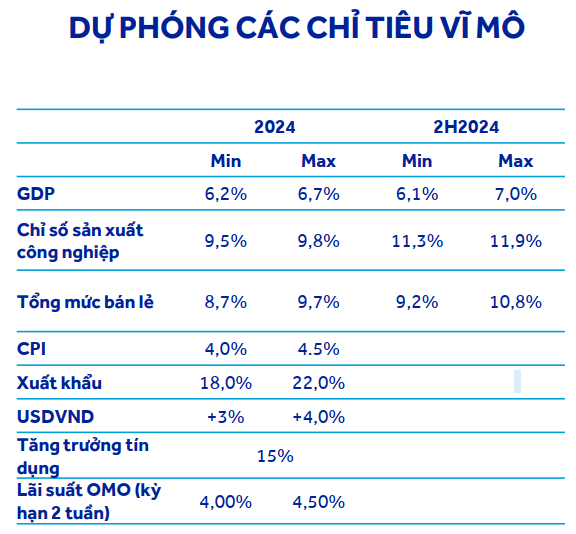

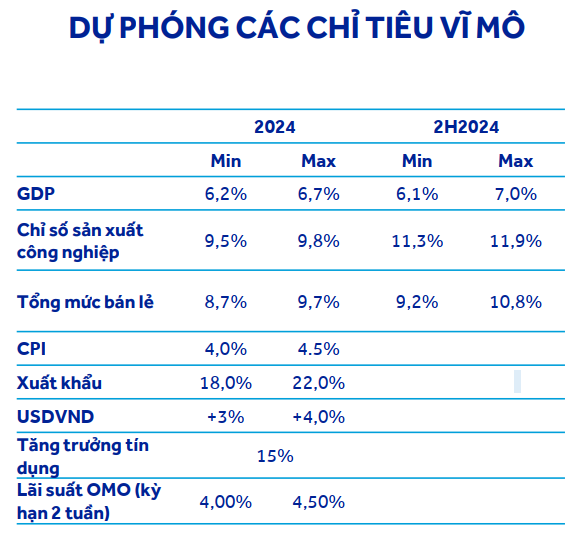

Vietnam’s GDP growth is projected to surpass 6.2% in 2024. The economy is expected to maintain its growth momentum of over 6% in the last six months, driven by industrial production, construction, and exports. However, this growth may decelerate in the fourth quarter if the US and other major export markets face economic recession risks.

Exchange rate pressure is expected to ease towards the year-end. Inflation is likely to remain below 4.5%. Deposit interest rates may rise as credit demand increases, but the increment is projected to be insignificant (less than 0.5%). The net selling status of foreign investors has improved and is likely to continue, although it may still occur in specific stock groups.

Source: ACBS’ 2024 Second Half Investment Strategy Report

|

The investment strategy is to continue prioritizing stock picking, selecting companies with robust profit prospects for 2024 – 2025, healthy finances, and appropriate valuations within sectors benefiting from mid-term tailwinds, including banking, industrial real estate, industrial construction, transportation, technology, and retail.

Source: ACBS’ 2024 Second Half Investment Strategy Report

|

Huy Khai