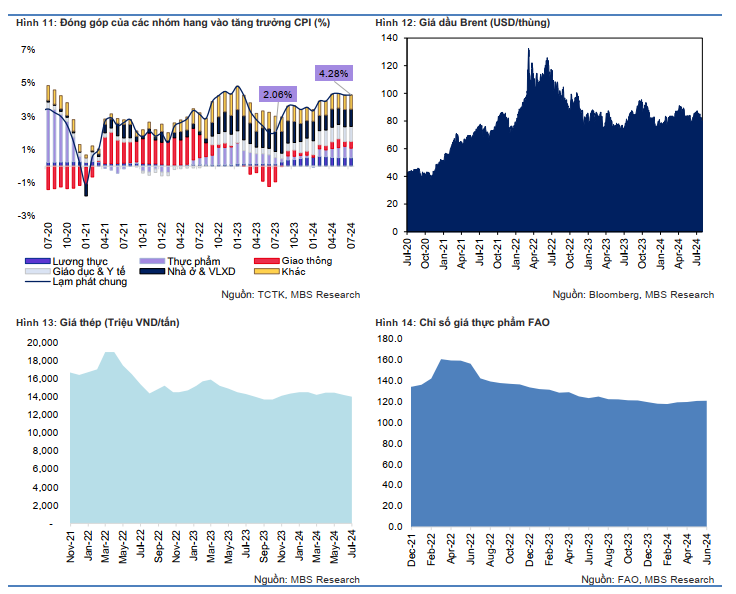

According to MBS, the consumer price index (CPI) in July rose slightly by 0.5% from the previous month and 4.4% from the same period last year. This was influenced by adjusted health insurance rates, which took effect at the beginning of the month, and domestic fuel prices, which rose in line with global tensions.

In July, the food and beverage services group (up 4.3% from the same period last year) contributed the most to the growth of the CPI index, mainly due to a significant increase in food prices, which rose by 14.4% year-on-year. Additionally, the housing and construction materials group also saw a slight increase of 5.6%, attributed to higher electricity rates during the summer peak. Notably, the transportation group increased by 4.4% as domestic fuel prices rose by 5.9% year-on-year, tracking the upward trend in global oil prices. Furthermore, tuition fee hikes in some localities pushed the education index up by 8%. Finally, the health and medical services group rose by 8.13% due to adjusted medical service prices, also contributing to the CPI’s upward trajectory.

The increase in cement and sand prices, in line with rising raw material costs, along with higher rental costs and an 8.6% year-on-year increase in electricity rates due to EVN’s retail price adjustment since last year, drove up the housing and construction materials index by 5.5%. Additionally, the education index continued to rise, increasing by 8.5% year-on-year due to tuition fee hikes in some localities, further contributing to the overall CPI increase. In contrast, the index for the postal and telecommunications group decreased by 1.36% as prices for older-generation phones dropped, tempering the CPI’s growth.

On average, for the first seven months of 2024, CPI increased by 4.12% year-on-year, while core inflation rose by 2.73%. Inflation concerns have been mounting since the beginning of 2024, with the CPI’s growth rate consistently climbing each month, approaching the government’s target of 4.5%.

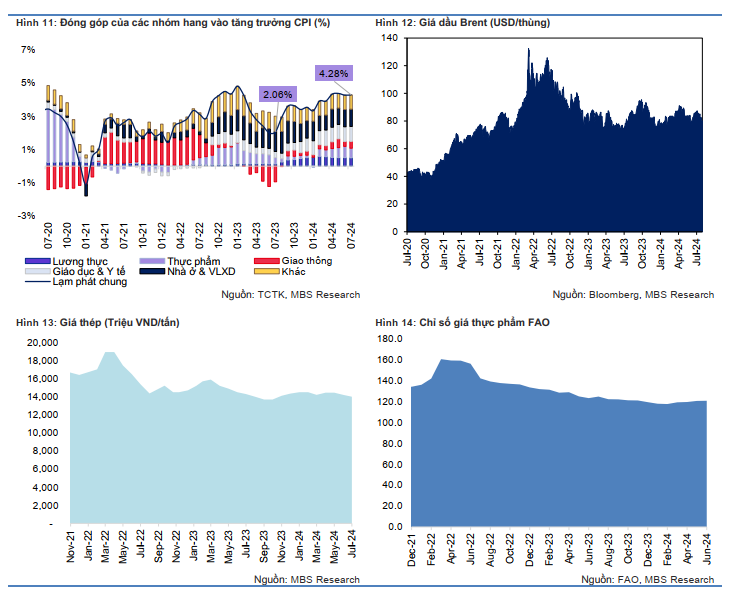

MBS estimates that CPI could rise in the second half of the year, bringing the average CPI for 2024 to 4.3%, close to the government’s target of 4.5%. “Despite subdued domestic consumption, inflation in the second half of 2024 faces risks from the following factors: First, domestic steel and construction material prices are expected to recover to VND 15 million/ton (up 8% year-on-year) in 2024, driven by rising global steel prices and improving demand in Vietnam. Second, the persistent strength of the exchange rate will exert certain pressures on the cost of imported goods. Third, the base salary increase implemented from July 1st may impact domestic inflation. Additionally, we maintain our forecast that oil prices in 2024 will fluctuate within a narrow range around $85/barrel, as OPEC+ has decided to maintain production cuts until the end of Q3 2024, higher than the average price in the second half of 2023″, said the MBS expert.

Source: MBS

|