|

Many believe that the Vietnamese stock market still has some positive factors that can support a price uptrend in the coming time. Illustration photo: Le Vu

|

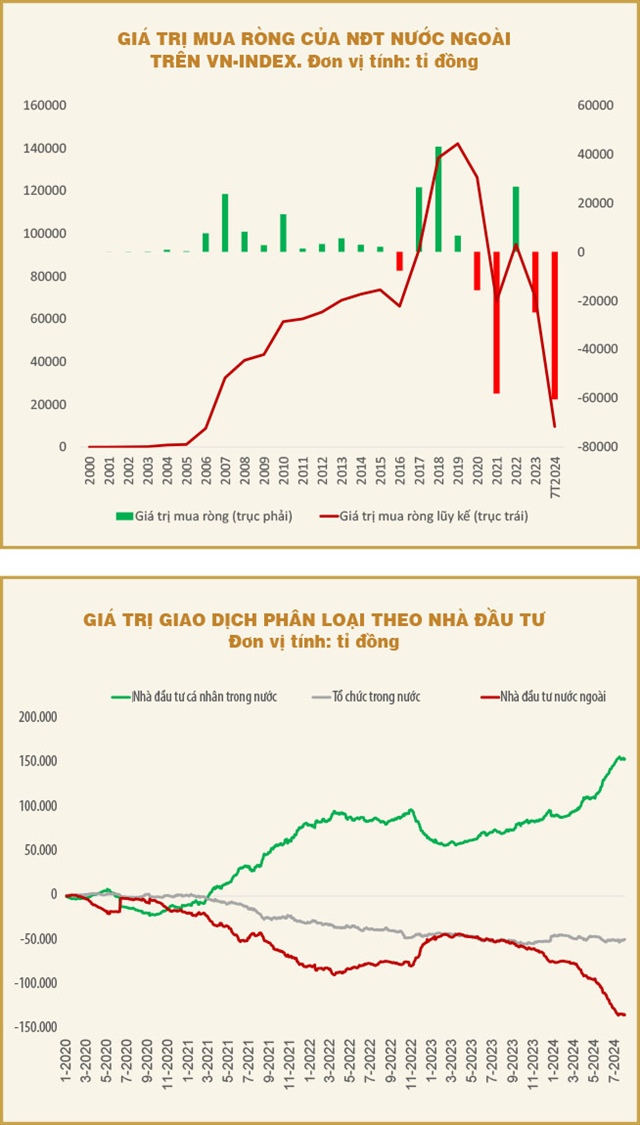

Foreign investors have been net sellers, while individual investors have been the main buying force.

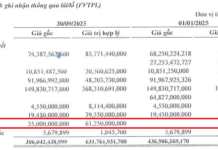

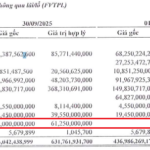

According to data from the beginning of the year to the end of July 2024, foreign investors sold more than VND 60.4 trillion of various securities on the VN-Index, making it the fourth consecutive year of strong net selling (excluding net buying activities in 2022).

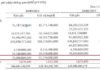

If we look at the cumulative data since the establishment of the Vietnamese stock market until now, foreign investors’ net buying peaked in 2019 at more than VND 142 trillion in principal value (equivalent to approximately USD 6.1 billion). However, by the end of July 2024, this figure had dropped to just over VND 9.6 trillion (equivalent to nearly USD 400 million).

As of the end of July 2024, the ownership ratio of foreign investors was approximately 17.2%, corresponding to a value of over USD 40 billion in market capitalization. If we subtract the remaining principal amount of about USD 400 million, the remaining value is the profit made by foreign investors in the Vietnamese stock market over the years.

It can be said that foreign investors have profited handsomely from the Vietnamese stock market. With their professional knowledge and experience, and by focusing on investing in leading enterprises, this growth is understandable.

|

What’s noteworthy is that in the post-COVID-19 era, the investment trend of foreign investors has completely reversed. They have been net sellers, and the main net buyers are individual investors. What are the reasons behind this situation?

Firstly, the Vietnamese stock market lacks attractive catalysts and does not fully reflect the real economy, making it challenging for foreign investors to invest. The products available to foreign investors are quite limited, and many good companies have reached their foreign ownership limit (room), while the number of attractive newly listed enterprises is decreasing.

Secondly, the delay in upgrading the stock market has also led to the withdrawal of some foreign capital.

Thirdly, the global investment restructuring wave after COVID-19 has caused foreign investors to choose to invest in more stable and sustainable economies to preserve their capital. Additionally, large exchange rate fluctuations have prompted foreign investors to convert their funds into foreign currencies as a precaution against further depreciation of the Vietnamese dong.

It was inevitable for the VN-Index to drop below the 1,200-point threshold.

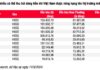

In the context of a fragile global economic recovery, conflicts in many parts of the world, and the risks of recession and expanding wars, the Vietnamese economy has also been affected due to its high level of economic openness. Meanwhile, the investor structure is becoming less stable, with professional foreign investors consistently net selling, while individual investors, mostly newcomers since the post-COVID-19 era, are net buyers.

As the proportion of professional stock investors in the market decreases and the number of individual investors increases, the market becomes imbalanced and lacks sustainable development. Individual investors often have unstable psychology, lack professional analysis skills, and tend to use high financial leverage. This can lead to excitement and panic dominating market fluctuations, resulting in more significant market volatility than necessary. Moreover, individual investors are easily influenced by so-called “driving teams” and may suffer significant losses after market “waves.”

Another factor stems from the lack of diversity and accessibility to various financial products for individual investors. The bond market and fund management market for individual investors have existed for a long time but serve a meager proportion. The lack of supportive tools and accessibility leads individual investors to have few investment choices and inevitably return to the stock market.

What are the reasons for the current decline of the VN-Index (early August 2024)?

In addition to the above reasons, the current decline of the VN-Index is also influenced by a combination of internal and external factors. These factors have accumulated over time, and when coupled with the overreactive nature of individual investors, have resulted in more significant fluctuations than necessary.

Firstly, the net selling activities of foreign investors can be attributed to both subjective and objective reasons. Objectively, there has been a global investment restructuring post-COVID-19, while subjectively, foreign investors are hedging against the Vietnamese dong’s exchange rate fluctuations and other factors.

Secondly, persistently high US interest rates, concerns about a potential US economic slowdown, and the widening Middle East conflict have impacted market sentiment.

Thirdly, Japan’s decision to raise its policy rate to 0.25% significantly impacted the Japanese yen’s exchange rate, affecting global capital investment due to concerns about a potential sell-off of assets by Japanese investors.

Fourthly, rising deposit interest rates and worries about the increase in margin loans in the second quarter of 2024 have also played a role.

Finally, the overreaction of individual investors to every market event is also a consequence of the fragile structure of the Vietnamese stock market.

Despite these challenges, the Vietnamese stock market still has some positive factors that can support an uptrend in the coming time. These include attractive market valuations (P/E ratio of about 12.9 times compared to the average of 14.72 times from 2012 to July 2024), a steadily recovering Vietnamese economy, declining interbank interest rates, and a stable exchange rate. Meanwhile, market interest rates remain low after the recent increase.

Trinh Cao Luong

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.