Lower P/E Expectations for Full-Year 2024

Vietnam’s stable macroeconomic environment stands out amidst a backdrop of global uncertainties, including disappointing US job numbers, the BoJ’s interest rate hike to 0.25% causing a rapid rise in the Japanese yen, a struggling Chinese economy, underwhelming EU economic data, ongoing military tensions in the Middle East, and a severe crisis in Bangladesh.

In terms of valuation, following the release of Q2 2024 earnings results, the P/E ratio of the VN-Index declined from 14.1x at the end of June to 13.8x at the end of July, lower than the index’s 14.14x average over the past year. P/E expectations for the full-year 2024 are lower due to forecasts of a continued market recovery in the second half.

Large-cap stocks in the VN30 are currently trading at a P/E of 12.58x, significantly lower than the P/E ratios of mid-cap and small-cap stocks in the VNMid (16.73x) and VNSML (17.38x) respectively.

What Scenarios Lie Ahead for the VN-Index in August?

Despite Vietnam’s positive macroeconomic performance, unfavorable global developments have had a significant impact on global stock markets, including Vietnam’s, and are expected to continue to do so in the near future. ABS presents two scenarios for the VN-Index in August:

Scenario 1: In the event that riots and armed conflicts are resolved and do not escalate further, if the VN-Index holds above the 1,166 level, a sideways accumulation structure is likely to form.

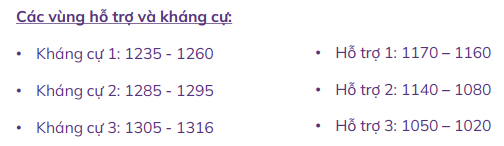

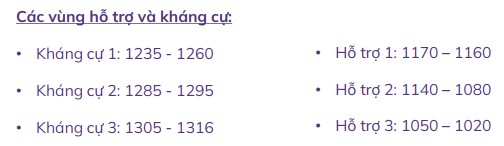

Scenario 2: In the opposite scenario, a downward price adjustment in August is more likely. If the weekly closing price fails to maintain the 1,166 level, the overall market is expected to continue its downward trajectory towards support levels 3 from previous months’ analysis reports, in the range of 1,140 – 1,080. These adjustments could occur with considerable speed and intensity, potentially bringing the market’s trailing 12-month P/E to attractive levels of 12.6x – 11.9x.

Risk Management Takes Center Stage in the Mid-Term

Risk management is a key priority for mid-term investment strategies in August. Caution is advised when trading stocks during technical rebound phases, and careful consideration should be given to specific confirmation signals when assessing support levels for the VN-Index and individual stocks.

During mid-term adjustment phases, investors should temper their profit expectations and adhere to stop-loss disciplines. Support levels 1 and 2 are identified as potential mid-term investment entry points.

Source: ABS August 2024 Strategic Report

|

Huy Khai

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.