By the end of May, total credit in the economy had increased by 3.43% compared to the end of 2023. In June, VND 360,000 billion was disbursed, bringing the total credit to nearly VND 14,400 trillion, achieving the 6% growth target in the first half of 2024. This surge in total credit raises hopes for achieving the 15% growth target for the year. However, credit quality remains a factor to be considered. Rapid disbursement of a large amount of credit in a short period may raise concerns about the orientation of credit flow. While strong credit growth can boost the economy, it also poses risks if not tightly controlled.

At the end of July, many banks announced their financial statements for Q2/2024. The data showed that the growth momentum of credit mainly came from listed banks, while non-listed banks had a low growth rate. In the context of the economy needing a strong contribution from the private sector instead of relying on public investment as in 2023, the strategic orientation of each bank becomes particularly important. Banks need to have clear strategies to ensure both sustainable credit quality and growth targets. The differentiation in credit growth among banks in Q2/2024 further reflects the reality of the economy.

Credit growth in June brought many surprises as it only reached 3.43% by the end of May, and by mid-June (June 14, 2024), this figure had reached nearly 3.8%. This implies that in the last two weeks of June, more than VND 270,000 billion must be disbursed to achieve a 6.1% growth rate by the end of the month. According to the financial statements of 27 commercial banks, customer loan balances increased by nearly 8% compared to the beginning of the year. In Q2 alone, the disbursed balance increased by more than VND 590,000 billion, equivalent to a growth rate of 5.76% compared to the end of Q1. With an average growth rate of 6%, listed joint-stock commercial banks are bearing the burden of credit growth for the whole system. Based on the contribution of 70-80% of the total outstanding balance in the economy by this group of banks, it implies that the remaining credit institutions, including finance companies, people’s credit funds, and small banks, have only achieved a credit growth rate of 1-2%.

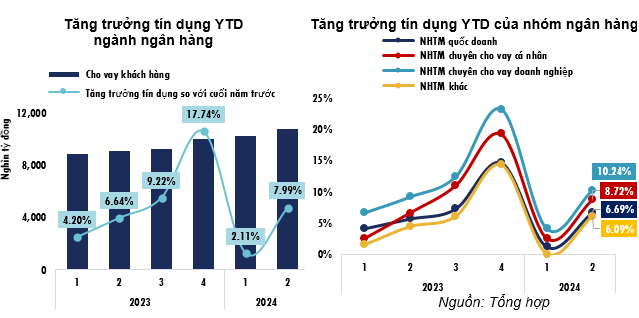

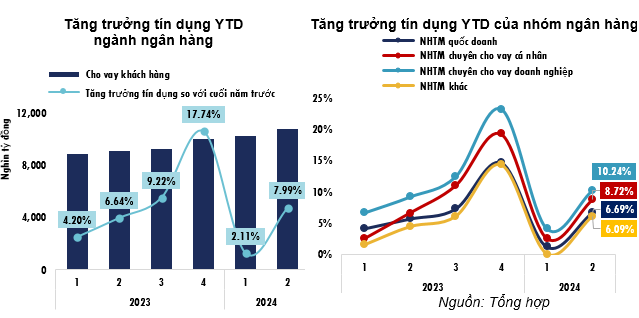

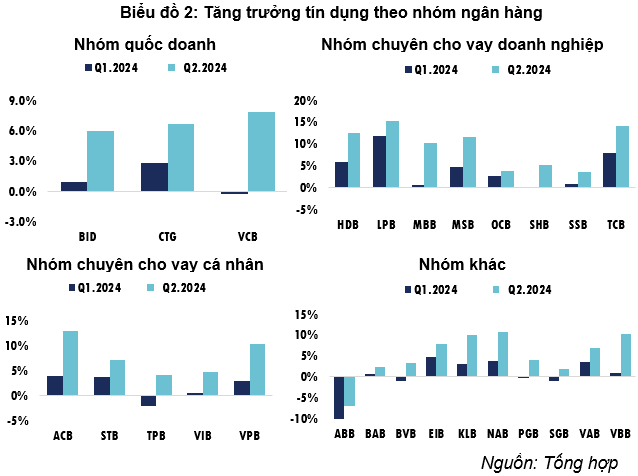

However, there is a significant differentiation among listed joint-stock commercial banks, which is reflected in the credit growth rate in the Q2 financial statements. To further analyze the credit story, we will classify the 27 commercial banks into four main groups based on the scale of assets and the bank’s customer base, including the state-owned group, the business-focused lending group, the personal lending group, and others. The credit situation in 2024 presents a picture quite similar to what happened in 2023, with the business-focused lending group always having a more prominent credit growth rate and becoming the main driver of the entire banking industry.

Considering the macroeconomic situation this year, the manufacturing sector, especially the industrial sector, has recovered strongly, contributing to the overall economic growth with the industrial sector’s GDP growth rate reaching 7.4% in the first half of 2024, and the PMI remaining above the 50-point threshold. Meanwhile, consumption remained weak, with people tending to prioritize savings, and retail sales of goods and services reaching only 8-9%, lower than the 10-12% range when the economy performed well. Given the slowdown in consumption, personal consumer lending activities faced difficulties, forcing banks to adjust their strategies and focus on business lending as in 2023.

|

Chart 1: YTD Credit Growth Performance of the Banking Sector in Q2/2024

|

According to the bank groups, the growth in outstanding balances was more robust in medium-sized and large banks. In the state-owned banks, although they achieved only a 1.18% credit growth rate in Q1, it surged to 6.7% in Q2. The business-focused lending group led with a growth rate of 10.24% compared to the end of 2023, equivalent to nearly VND 164,000 billion of additional credit in Q2. These banks took advantage of opportunities from private sector investment projects and the recovery of production to expand credit. Meanwhile, the personal consumer lending group faced challenges due to the slowdown in consumer credit expansion. However, the shift towards SME and large corporate lending helped this group achieve an impressive 8.72% growth rate. Compared to state-owned banks and large private groups, the other banks had the lowest growth rate, coupled with higher bad debt risks, with the bad debt ratio surging to nearly 5% in Q2, compared to 3.07% in the business-focused lending group.

The differentiation in credit growth reflects the diversity in the loan portfolio and the lending appetite of each bank. In June 2024, banks such as Vietcombank, BIDV, and Vietinbank recorded credit growth rates of 7.82%, 5.92%, and 6.66%, respectively, compared to the end of last year. Vietcombank stood out with the fastest growth rate in outstanding balances in the group, especially considering the decline in Q1; the bank had to achieve an outstanding balance growth rate of more than 8% to make up for it. To achieve rapid credit growth in Q2, Vietcombank adjusted its strategy to focus on FDI and large corporate clients, with wholesale credit increasing by 9.2%, supporting the lower growth rate of retail credit. Notably, in early June, Vietcombank became the lead bank, along with VietinBank and BIDV, to sign a syndicated loan contract worth USD 1.8 billion (approximately VND 42,000 billion) for the first phase of the Long Thanh Airport project.

The business-focused lending group, including Techcombank (TCB), HDBank (HDB), and Loc Phat Bank (LPB), continued its strong growth momentum in Q2. TCB and HDB recorded credit growth rates of 14.16% and 12.46%, respectively, while LPB led the industry with a growth rate of 15.24%. HDB has expanded its construction industry portfolio with a growth rate of 43.5% compared to the end of 2023, but the main driver of the bank came from the wholesale and retail sectors, with a high loan ratio and a growth rate of nearly 28%. Although Techcombank’s real estate loan ratio still accounted for nearly 34% of its portfolio, the bank has diversified its loan portfolio into the industrial, scientific, and construction sectors due to the incomplete recovery of the real estate market, helping it maintain a good growth rate. For LPB, 1/4 of its portfolio is dedicated to the wholesale sector, with a growth rate of over 25%, while the construction sector, accounting for nearly 15% of its portfolio, also showed a growth rate of 15.7% compared to the end of 2023. Other banks in this group, including OCB, SHB, and SSB, had lower-than-average growth rates.

The personal consumer lending group continued to face challenges in credit growth. However, banks like ACB, by shifting their focus to business lending, found more growth opportunities. In the first six months of 2024, ACB recorded a credit growth rate of 12.83% thanks to its strategic adjustment to expand lending to small and medium-sized enterprises, taking advantage of the business market opportunities. VPBank also stood out in the retail banking group with an impressive growth rate of 10.24% compared to the end of 2023. Notably, the main driver of VPBank came from expanding lending to real estate businesses, with the portfolio ratio in this sector increasing to 22.48%, and a credit growth rate of over 22% since the beginning of the year. This transformation has expanded credit opportunities for retail banks amid weak consumption but also poses challenges in risk management and maintaining credit quality in an economy that has not fully recovered.

In contrast to large banks, the remaining banks showed less sustainable credit growth. An Binh Bank was the only bank in the industry with negative growth from the beginning of the year; although Q2 recorded a balance growth rate of 15.04% compared to the previous quarter, it was not enough to offset the 19% decline in Q1. Meanwhile, NAB, KLB, and VBB were the banks with more stable credit growth rates.

Credit growth in Q2 2024 presents a positive picture, with capital mainly flowing into the production sector. However, a portion of the capital is also being invested in non-production sectors, which are inherently high-risk. The differentiation in credit growth reflects the differences in growth potential from the loan portfolios of each bank. Given the slowdown in credit growth in July compared to June, achieving the credit growth target for the year needs to be carefully considered, taking into account the current momentum and the potential for portfolio expansion by banks.

Le Hoai An, CFA – Nguyen Thi Ngoc An, HUB

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.

Factors that can restrain credit growth

In addition to supportive factors, the goal of achieving a 15% credit growth this year may also face some challenges. What are those factors?